Minimum volatility ETFs Fidelity Investments

Post on: 23 Апрель, 2015 No Comment

Volatility of the S&P 500 ® Index (as measured by index movements of +/–2% on a given trading day) has risen dramatically over the past decade compared with historical averages. From 1973 to 1982, the S&P 500 experienced fewer than 100 trading days of a 2% move in either direction. 1

If you are looking for potential ways to manage or take advantage of market volatility, there are a number of strategies that may help protect your portfolio. In addition to diversification, one investment choice that might be worth considering is a minimum-volatility fund.

How to manage volatility

Diversification is a tried-and-true portfolio management technique. While neither diversification nor asset allocation ensures a profit or guarantees against a loss, both can be effective ways to manage long-term fluctuations in the market. Other investors may simply prefer to wait out market volatility—a buy-and-hold approach. Buy-and-hold and diversification strategies feature many of the investment characteristics that may help alleviate the impact of a market downturn.

More active investors may want to consider other approaches. One such strategy is to implement tactical rebalancing. This is a dynamic asset allocation strategy that involves adjusting portfolio allocations to more or less risky investments, depending on how the market is performing and the expectations for volatility.

During periods of expected heightened market volatility, you may want to consider reducing exposure to riskier investments. Alternatively, when volatility is expected to be lower, the portfolio may be adjusted to include riskier investments that also align with your risk and return objectives.

“Min vol”

Yet another active investing product is a relatively new type of exchange-traded fund (ETF) known as minimum volatility, or “min vol.”

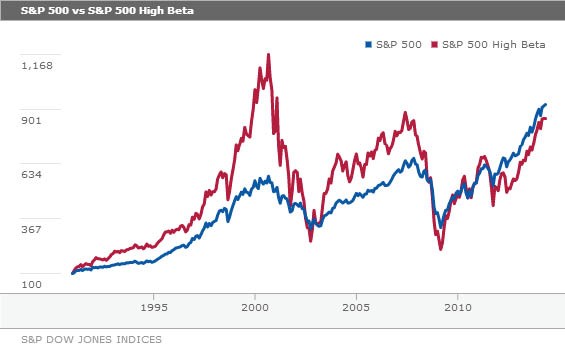

A min vol ETF attempts to reduce exposure to volatility by tracking indices that aim to provide lower-risk alternatives. For example, a min vol ETF might exhibit less risk during market turbulence compared with a broadly diversified index such as the S&P 500. Some min vol ETFs accomplish this objective by purchasing securities that exhibit relatively low volatility and concentration risk. 2

Of course, a min vol ETF does not eliminate risk exposure to volatility, and may not prevent a loss in the event of a downturn. Low volatility funds may underperform when the broad market is doing well, and they can experience declines during sharp corrections. However, the expectation for a min vol ETF investor is that any potential losses during a market decline might be smaller relative to other securities that may have more risk exposure to volatility. As a result, a less risky portfolio could recover more quickly than the broad market in the event of a downturn when stocks recover.

Additionally, min vol ETFs can be used to lower overall portfolio risk. For instance, if your portfolio consists largely of cyclical stocks, a min vol ETF might diversify away some risk exposure in the event that the market becomes volatile.

Moreover, these types of funds might not only be considered in advance of a potential weak market. Many min vol ETFs tend to be skewed toward more defensive sectors, such as consumer staples and health care, and so they might perform well when those segments of the market are expected to do well—within the framework of the business cycle. Of course, the nature of how low vol funds are constructed can mean investors who rely too heavily on them could end up with portfolios that are concentrated in large-cap defensive stocks and light on small-cap growth stocks.

Minimum volatility ETFs

If you own U.S. stocks and are concerned about a market decline, you may want to consider researching min vol ETFs, the largest of which by net assets are the PowerShares S&P 500 Low Volatility ETF ( SPLV ) and iShares MSCI USA Minimum Volatility ETF ( USMV ). Fidelity offers USMV commission free.

If you have global investments and are concerned about some of the volatility risks that have emerged out of China, Europe, and other parts of the world, there are also non-U.S. min vol ETFs. The largest non-U.S. min vol ETFs by net assets are iShares MSCI Emerging Markets Minimum Volatility Index Fund ( EEMV ) and iShares MSCI All Country World Minimum Volatility ETF ( ACWV ). Fidelity offers EEMV commission free.

Other volatility management possibilities

There are several other ways that investors may be able to weather an increase in volatility. Bonds, for example, tend to be less volatile than stocks. When the stock market is expected to be more volatile, investors may want to consider increasing their bond allocation. It is worth noting that the bond market is not immune to volatility.

High-yielding stocks are another opportunity that investors can explore. The income component of high-yielding stocks tends to make these investments less volatile than more cyclical stocks, which have lower or no dividend yield. Additionally, there are several options strategies, including the strangle. which can be used to take advantage of expected market volatility.

Investing implications

Whether you take a more passive approach, or want to actively implement strategies that seek to reduce your exposure to market volatility, there are a number of ways to position your portfolio. Even though stocks are in the midst of a multiyear rally, and recently reached new all-time highs, it is never a bad time to consider positioning your portfolio for protection against volatility.

Learn more

- Learn more about the commission-free Fidelity iShares ® offer .

- Use Portfolio Review to see whether your investment mix is in line with your long-term goals.

- Research stock, bond, and commodity ETFs .