Millennials Save For Retirement Earlier Than Baby Boomers Survey Finds

Post on: 8 Июнь, 2015 No Comment

Follow Comments Following Comments Unfollow Comments

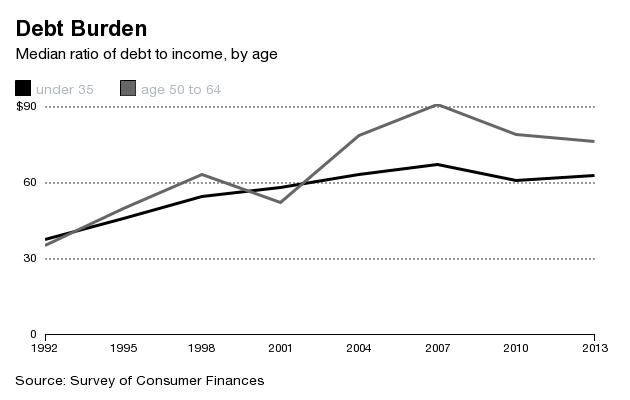

All of those reports encouraging Millennials to start saving for retirement as soon as possible may be paying off, literally. According to the 15th Annual Transamerica Retirement Survey. performed by the nonprofit Transamerica Center for Retirement Studies, Millennials are an “emerging generation of retirement super savers,” with 74% starting to save for retirement at an “unprecedented” median age of 22, or 5 years sooner than Gen Xers and a staggering 13 years sooner than Baby Boomers.

The survey focused on the retirement habits and trends of Baby Boomers, Gen X and Millennials who are currently working full- or part-time in a for-profit company of 10 or more people.

There were stark differences between the habits of the older and younger generations. Despite entering the workforce in the midst of the Great Recession, Millennials are “much more likely” to be recovered from its economic impact than older generations and 68% are confident they will be able to retire comfortably.

This may stem from more open discussions about saving and retirement options.

“Millennial workers are focused on retirement in a big way. Our research found that three out of four are already discussing saving, investing, and planning for retirement with family and friends,” said Catherine Collinson, president of TCRS, in a press release. “In fact, Millennials are twice as likely to frequently discuss retirement compared to their parents’ generation.”

Additionally, the vast majority of Millennial workers, 81%, are concerned that Social Security will not be there for them when they retire. Instead, Gen Y is investing in employer-sponsored 401(k) or similar plan, and the majority of those participating in these plans are using some form of professionally managed account.

Generation X boosts a similar statistic, with 83% concerned about Social Security, while 67% of Baby Boomers are as concerned, according to the survey.

Unsurprisingly, mobile accessibility to retirement planning tools was a major boon for Millennials: 71% of Millennials participating in the 401(k) or similar plans mentioned above found mobile apps helpful.

The survey did find that more Millennials should create a written, long-term strategy for retirement – only 10% of those who estimated their savings needs in retirement said they had used some type of retirement calculator or worksheet. In other words, while Gen Y is saving at unprecedented levels, it needs to start looking at the bigger picture.