Mexico ETFs

Post on: 2 Июнь, 2015 No Comment

List of Mexico ETFs

You can opt-out at any time.

There are quite a few reasons to consider investments that target Mexico. You may feel that the country is an emerging market and therefore the economy is a strong investment opportunity. Or maybe you want to diversify your international exposure or even your portfolio in general. Or perhaps you want to hedge some Mexican assets or hedge against any commodity or currency risk you have in that region. Whatever, your reason for targeting Mexico as an investment opportunity, you should consider Mexican ETFs.

Instead of trying to corner the market on Mexico company stocks, or battling the price of a Mexico market index basket, you can gain instant exposure to Mexico securities (or short the same securities), buy selling or buying a Mexico ETF.

Mexico ETFs are pre-packaged min-portfolios of Mexico company stocks compiled in one asset. One transaction gives you immediate exposure to the Mexico market. Not only will this help control commissions and brokerage fees, but you also gain the many benefits of ETFs such as the tax advantages .

So if all of this is music to your investing ears, then consider exchange traded funds with a sole focus on the country of Mexico.

All the stocks in the funds on this list are either located in Mexico or conduct the majority of their business within the country. The only exception is the Mexican Peso ETF, which focuses on currency instead. And as you will see, you have some inverse and leveraged ETF options as well…

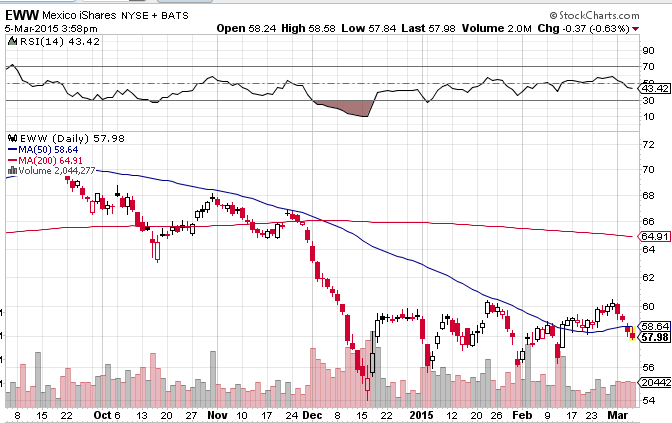

This fund from iShares tracks the MSCI Mexico Investable Market Index and includes Mexican companies such as Walmart de Mexico, America Movil SAB, and Fomento Economico Mexica. The top sectors represented in the ETF are Consumer Staples and Discretionary, Telecommunications, and Materials.

SMK — UltraShort MSCI Mexico Investment ProShares ETF

This fund tracks the MSCI Mexico Investable Market Index, but seeks a 2x leveraged return as well as an inverse performance to the underlying index. So as the index rises or falls on a daily basis, SMK moves in the opposite direction and seeks twice the return.

In order to accomplish its investing goals, the fund uses derivatives such as swaps as well as some cash assets. But some of the holdings in the underlying index are Grupo Mexico, Grupo Elektra, and America Movil. The sectors represented are Consumer Staples and Discretionary, Telecommunications, Materials, Financials, Industrials and Healthcare.

UMX — Ultra MSCI Mexico Investable Market

UMX has all of the same characteristics as its partner-in-crime, SMK, the only difference being that UMX is not an inverse ETF. So SMK and UMX movie in opposite directions, but both seek a 2x leveraged return on the MSCI Mexico Investable Market Index.

FXM — CurrencyShares Mexican Peso Trust ETF

This currency ETF from CurrencyShares targets the price of the Mexican Peso, which is the national currency of Mexico and the currency of the accounts of the Bank of Mexico. The Mexican Peso is the 14th-most-traded currency in the world and is traded under the ticker MXN on currency exchanges.

MEXS – Global X Mexico Small-Cap ETF

Before its closing at the end of 2011, this fund tracked the Solactive Mexico Small-Cap Index. Unfortunately due to lack of interest, the funds has been delisted. However, if a suitable replacement comes along that tracks Mexican small-cap companies, I will update this listing.

And make sure you check back to see if any other funds are added or removed to this list as I will update it when things change. Also, before making any trade, be sure to consult your broker, your advisor or a financial professional.

Research each fund individually, know how each fund works, and keep an eye on how they react to different market conditions. In other words, as with any investment, conduct due diligence. No investment is risk-free, so make sure you are aware of the pro’s and cons of any investment or in this case…Mexico ETF.