Mewbourne Oil Lawsuit

Post on: 14 Июнь, 2015 No Comment

Current Investigations

Posts tagged Mewbourne Oil lawsuit

Update on Securities Fraud Investigation into Mewbourne Oil Investments

The White Law Group continues to look into potential FINRA arbitration claims involving Mewbourne Oil and Mewbourne Energy Partners.

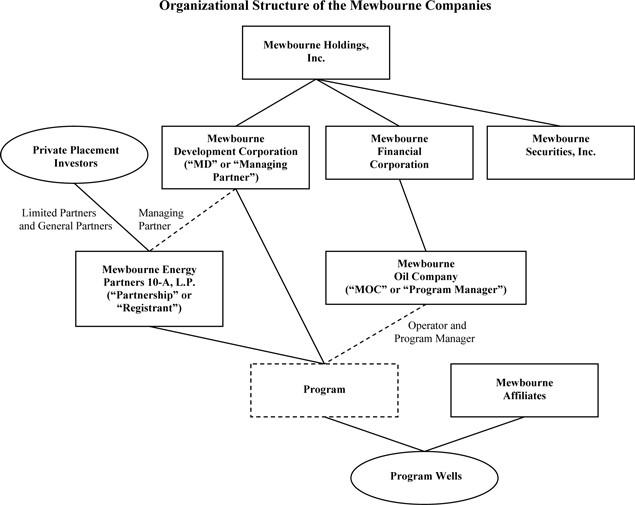

Mewbourne Holdings Inc is the parent company of both Mewbourne Development Corporation and Mewbourne Oil Company. According to their website, Mewbourne Oil is an independent oil and gas producer established in 1965.

Mewbourne Oil, based in Tyler, Texas, is the acting general partner for multiple Mewbourne Energy Partners general and limited partnerships offerings. Based on online reports, it appears that in 2007 Mewbourne Energy began offering private placements to raise capital.

Oil and gas private placements are high-risk investments, and often more complex than traditional investments. FINRA registered broker-dealers are obligated to make recommendations to clients that are consistent with the clients’ risk tolerance, investment objectives, and financial situation.

However, private placements (like limited partnership oil and gas offerings) are sold with less regulation and oversight than other investments. and are not always required to register with the Securities and Exchange Commission.

Private placements (like the limited partnership oil and gas offerings offered by Mewbourne), in most cases, are suitable only for sophisticated investors with a high net worth. These types of securities lack liquidity and investors in these investments must be able to risk total loss of their investment.

In addition to the high risk and lack of oversight, private placements often offer extremely high commission fees to the broker-dealer. According to the Mewbourne Energy Partners 07-A form S-1, the broker-dealer that sells this offering will earn an estimated 8% in commission. Such high commission rates often result in the unscrupulous broker-dealers pushing these types of investments onto clients regardless of whether the investment is suitable for them in light of their specific investment experience and objectives.

The White Law Group is investigating potential FINRA arbitration claims involving the following Mewbourne investments (among others):

Mewbourne Energy Partners 06-A LP

Mewbourne Energy Partners 07-A LP

Mewbourne Energy Partners 08-A LP

Mewbourne Energy Partners 09-A LP

Mewbourne Energy Partners 10-A LP

Mewbourne Energy Partners 11-A LP

Mewbourne Energy Partners 12-A LP

If you have suffered losses in a Mewbourne Energy Partners or Mewbourne Oil investment and would like to discuss your litigation options, please call the securities attorneys of The White Law Group at 312-238-9650 for a free consultation.

The White Law Group is a national securities fraud, securities arbitration, and investor protection law firm with offices in Chicago, Illinois and Boca Raton, Florida.

www.whitesecuritieslaw.com

Recovery of Mewbourne Oil Investment Losses

Have you suffered losses in Mewbourne Oil or Mewbourne Energy Partners? If so, the securities attorneys of The White Law Group may be able to help you recover your losses through FINRA arbitration.

According to its Form 10-Q SEC filing, Mewbourne Energy Partners is a Tyler, Texas based oil and gas development company. In order to raise capital for its offerings, Mewbourne Energy Partners has offered “private placements” to the public, which were then offered and sold by certain FINRA registered broker-dealers. The private placement offering, consisting of limited and general partner interests, began May 1, 2007 as a part of the Mewbourne Energy Partners 07 Drilling Program and concluded August 13, 2007 with total investor contributions of $70,000,000 originally being sold to accredited investors, of which $65,710,000 were sold to accredited investors as general partner interests and $4,290,000 were sold to accredited investors as limited partner interests.

Private placements like the one offered by Mewbourne Oil are often riskier and more complicated than traditional investments, and are only suitable for high net worth, sophisticated investors. Notwithstanding the risks of investing in private placements, brokerage firms continue to push this type of investment because of the high commissions associated with their sale and creation (commissions on private placements are often between 7-10%, 4-5 times higher than most investment products sold by financial advisors).

The White Law Group continues to investigate the liability that FINRA registered brokerage firms may have for improperly selling high-risk private placements, like Mewbourne Oil, to their clients.

To speak with a securities attorney regarding your investment in Mewbourne Oil, please call The White Law Group at 312/238-9650 for a free consultation.

The White Law Group is a national securities fraud, securities arbitration and investor protection law firm with offices in Chicago, Illinois and Boca Raton, Florida.

www.whitesecuritieslaw.com .