Maximum Retirement Contributions

Post on: 23 Июнь, 2015 No Comment

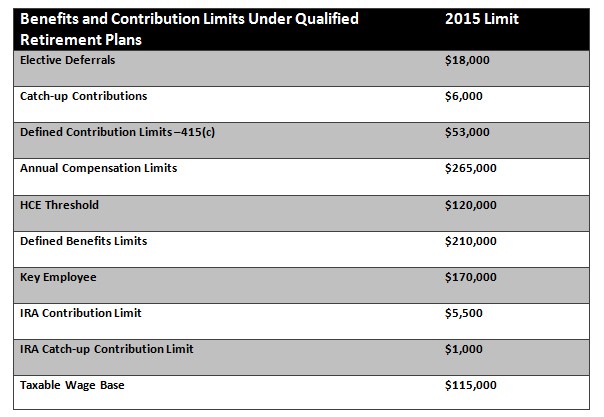

401(k), 403(b), 457(b), Roth 401(k) and Roth 403(b)

$17,500

** Note that employer matching or profit-sharing contributions do not count against these limits. Some 401(k) plans also allow for after-tax deferrals that do not count against the $18,000 limit (for 2015).

If you participate in one or more governmental 457(b) plans, you can contribute a combined total of $18,000 to such plans in 2015. You do not need to combine this deferral limit with other plan types. Deferrals to all other employer plans (SIMPLE, 401(k) and 403(b)) must be combined.

To make it even easier for you to put more money toward retirement, the government allows people age 50 and over to make additional catch-up contributions every year.

Maximizing your contributions can pay off

Is it worth making maximum contributions? Absolutely. Lets say that you contribute $1,200 to an IRA every year over a 10-year period. 1 With an annual, compounded return of 6%, your savings would total $16,766. On the other hand, if you contribute $5,500 to an IRA annually, and keep the other factors the same, you would end up with $76,844. Thats over four times as much money, representing an increase of $60,078. The numbers are even more impressive for workplace plans, such as the 401(k) and 403(b), which have higher contribution limits.

Maximizing your IRA 10 Years

This chart assumes that contribution limits remain the same over time.

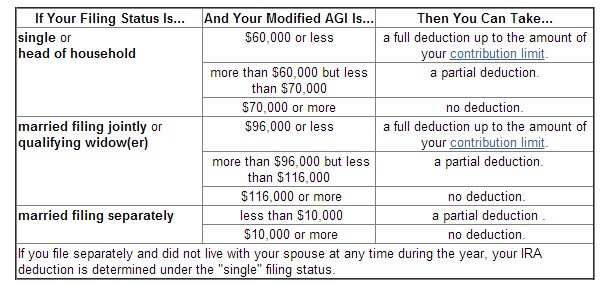

Making non-deductible IRA or Roth IRA contributions

You can make maximum contributions to both an employer plan such as a 401(k) and an IRA in the same year, assuming you have earned income and you otherwise qualify. Although you may not qualify to deduct your IRA contribution from your taxes and nondeductible contributions require special administrative steps your savings will still grow tax-deferred. Still, its generally only a good idea to fund a non-deductible IRA if your income is too high to allow you to make a Roth IRA contribution. That’s because distributions from a Roth IRA are generally tax-free (rather than just tax-deferred).

Many people will need more than an employer plan and IRA savings to live in retirement

To the extent that you can afford to save additional after-tax dollars after you have maxed out your tax-advantaged options, you can do so in other types of investments. An Ameriprise financial advisor can help you determine what types of savings or investments are appropriate for your situation.

1 Assumes that investor is under age 50 or is not making catch-up contributions during the 10-year contribution period.

Ameriprise Financial Services, Inc. Member FINRA and SIPC.