Maximum 401k Contribution for 2014

Post on: 26 Май, 2015 No Comment

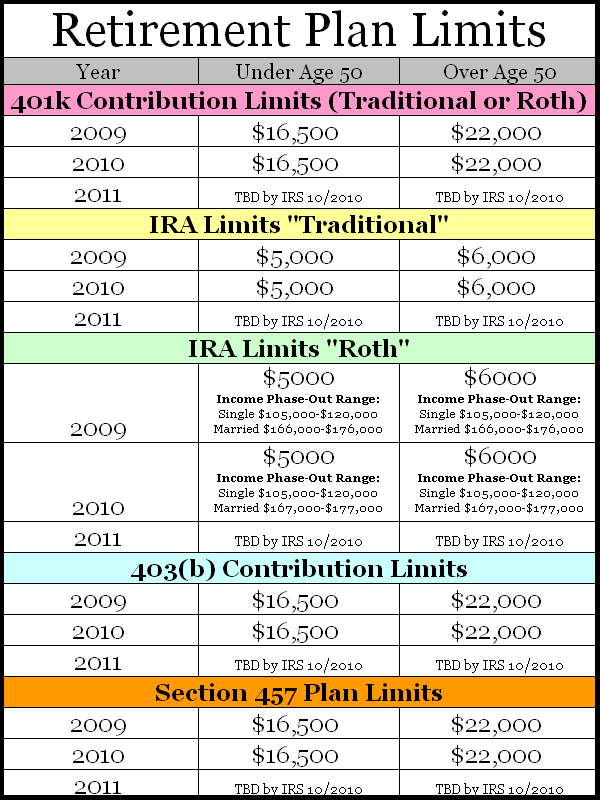

Each year the Internal Revenue Service sets the maximum amount of contributions a person can make toward their 401k plan. On Thursday October 31, the IRS announced that the contribution limit will remain unchanged for 2014, here. The amount maximum contribution amount will be $17,500, the same as 2013 maximum 401k contribution limit. The IRS stated that this decision was due to the Consumer Price Index. The consumer price index measures inflation and according to the IRS there was not a big enough increase to change the maximum 401k contribution for 2014.

2014 401k Catch Up Contribution

Individuals that are age 50 or older are able to contribute $23,000 for the year of 2014. This particular amount includes an additional catch-up contribution of $5,500, added to the $17,500 for the total of $23,000. The same holds true for Roth 401K’s, 457 B plans, and 403 B plans .

The maximum 401k contribution for 2014 of $17,500 will include all 401k accounts. This is very important for individuals that have more than one job or for individuals that change jobs during the year. The $17,500 contribution cap is not per job but per person. Individuals that have more than one job or who change jobs during the year will probably need to keep track of their 401k contributions.

Individuals with a SIMPLE 401k plan, have a different maximum contribution amount for 2014. Their amount is slightly lower at $12,000. This amount is the same from 2013.

Usually an employer is able to track its employee’s 401k contributions. But when an individual has more than employer during a certain year, it is the employee’s responsibility to know how much they have collectively contributed. This will help to prevent the person from exceeded the annual amount for 401k contributions.

Maximize your 401k Contributions for 2014

Planning can be done for individuals wanting to contribute the maximum amount to their 401k. A monthly or bi-weekly installment plan can be calculated by these individuals. An installment plan can help an individual to evenly plan out their 401k contributions. This will allow the amount of monies to be evenly distributed throughout the year and for you to contribute the desired amount with ease.

Understanding the maximum contribution amount is very important. Contributing beyond the maximum amount can lead in receiving a financial penalty. Though maximum contribution amounts have been set for 2014, they may be adjusted in the future to accommodate the cost of living.

Maxed out 401K Contributions, What to do Next?

If you have maxed out your 401k contribution and you are looking for what to do next there are many options. Have you opened a Roth IRA yet, if not you are missing out. Roth IRAs are a great investment vehicle and can easily be started by individuals through brokerages such as TradeKing, check out my review of TradeKing here. There are also things to consider like 529 plans if you have children.

So where are you investing your money?