MarketRiders Joins Vanguard Schwab and Fidelity to Lower Costs for Retirement Investors

Post on: 18 Апрель, 2015 No Comment

Online Portfolio Manager Offers Diversified Portfolios That Utilize Commission Free ETFs

DANVILLE, CA—(Marketwire — August 5, 2010) — MarketRiders, Inc. (www.marketriders.com ), an online investment services company, today announces the release of version 3.0 of its easy-to use portfolio management service that allows anyone to join the Exchange Traded Fund (ETF) revolution using strategies previously only available to elite investors and large endowments. With the new release, MarketRiders now provides custom portfolios for Schwab, Fidelity and Vanguard clients built around the brokerages’ recently announced commission-free ETF offerings.

By offering these custom portfolios, MarketRiders joins with Vanguard, Schwab and Fidelity to disrupt the lock mutual funds and financial advisors have held on retirement investors. With their commission-free trades and low expense ratios, these ETFs give investors the fundamental ingredients for diversified, low cost portfolios. MarketRiders’ online software uses these ETFs to create appropriate portfolios based on an investor’s age, risk tolerance and other criteria. The resulting all-ETF portfolios have fees that are lowered by as much as 90 percent as compared to portfolios of actively managed mutual funds. After 20 years, these low fee ETF portfolios can be worth as much as 40 percent more than high fee mutual fund portfolios.

ETFs offer retirement investors the lowest cost building blocks for a globally diversified portfolio and free ETF trades motivate investors to swap their expensive mutual funds for ETFs. Using our MarketRiders online portfolio manager with these ETFs, investors now have all the pieces they need for an unbeatable investment solution — all without expensive mutual funds and an advisor tacking on another 1-2 percent in fees, said Mitch Tuchman, CEO, MarketRiders.

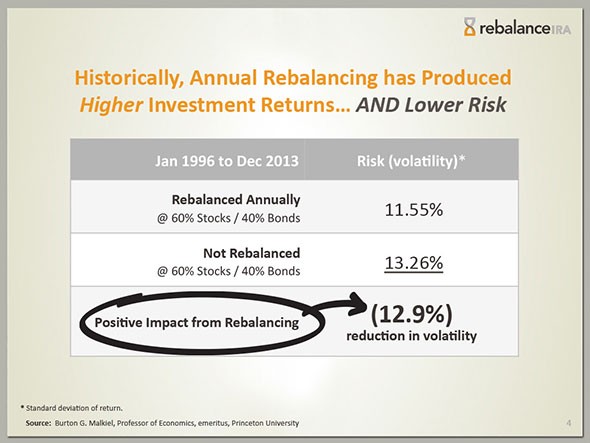

With just a few mouse clicks within the MarketRiders online software, investors can easily create an ETF portfolio. MarketRiders sends alerts with specifics when it is time to rebalance the portfolio. Until now, commission costs associated with rebalancing an ETF portfolio several times per year could cost up to $500 — expenses now eliminated if an investor takes advantage of the new commission-free core ETFs from Vanguard, Fidelity and Schwab. With low cost ETFs and no commission costs, investors may easily follow the investment strategies employed by the world’s most elite endowments and wealthy families.

The online software, which launched fifteen months ago, today manages more than $500 million in over 5000 customer portfolios — what Tuchman refers to as assets out of management. Other new features in the MarketRiders 3.0 release include a free innovative mutual fund/ETF converter tool that analyzes mutual fund fees and recommends lower cost ETF options, information on portfolio dividend payout history, simplified data management procedures and the addition of a number of new model portfolios for Vanguard, Fidelity, and Schwab customers as well as celebrity portfolios like Bob Pisani’s CNBC all ETF portfolios.

About the Commission-Free ETF Portfolios

Portfolios for each firm may include:

Schwab:

U.S. Large-Cap — SCHX

Foreign Developed Equity — SCHF