Market Timing Strategy of Buying Stock

Post on: 11 Май, 2015 No Comment

If you ask around long enough, you are bound to hear just about every conceivable system possible used for playing the stock market. Some people just point to the history books and contend that the market has averaged growth of around 11 percent a year when you go back 4 decades therefore, it makes sense to buy the stock and hold it. Eventually, buy and hold stock strategists contend, you cannot help but make money on your investment. Others try to pick value stocks which happen to be performing poorly today but which should be able to turn things around in the near future and thus greatly raise stock prices. Market timing is still another stock buying strategy which looks at a number of complex factors when purchasing equities.

Market Timing Fundamentals

Many people do not have the ability to be patient for years at a time without touching their money. For people not looking to sit on their stocks as advised in the standard buy and hold strategy, market timing is a good option to consider! This is because market timing strategies for buying stocks do not advocate buying stock and just sitting on it for year after year. Indeed, market timing investors do not wait out the lows and sell only when prices are sufficiently high to make a decent return on investment they avoid the lows altogether and only aim to sell when prices are at their peak.

At the heart of the market timing strategy for buying stocks is a deeply-held belief that stock prices are predictable. Going even further, those who believe in market timing also assert that trends in the broader markets can be applied to more specific ones, and specific stocks, in order to accurately predict price fluctuations. A large amount of analysis and research is used to predict market fluctuations and the prices of specific stocks. Two primary forms of analysis, fundamental and technical, are favorites of market timing strategists and are used together in many cases to help predict the prices of specific stocks.

Fundamental analysis essentially concentrates on all information and processes fundamental to the operation of a specific business. This includes any financial statements pertaining to earnings and other accounting variables. Other variables factored into when conducting fundamental analysis include: competitors and percentage of available market; management; debt structure; asset allocation; sales; growth potential; and earnings. While fundamental analysis may not be the only form used, many investors make use of at least some fundamental analysis before making stock purchases.

Technical analysis does not look at the management team, market, or any other subjective matter. Instead, this method of analysis tends to prefer looking at historical prices for stocks of specific companies and uses that data in conjunction with other variables of buying in order to make a decision. The end result is to be able to predict future patterns of prices on specific stocks. However, no proof has been provided illustrating any link between historical prices and how they perform in the future. While the market timing strategy does not make exclusive use of one method, a mixture of both or one or the other investment strategy is used to predict future stock prices.

Pros of Market Timing Stock Strategy

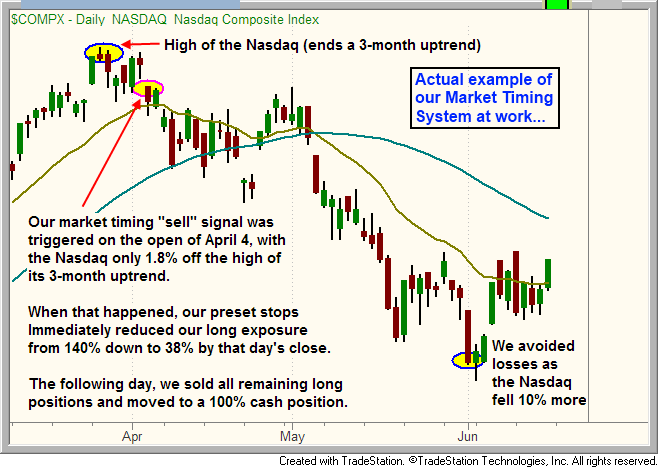

There are certainly a large number of investors who swear by the market timing strategy for buying stocks. Such people tend to be big fans of technical analysis which seeks to draw correlations between current market conditions and those which affected historical stock prices. It is not uncommon for a great deal of spreadsheets, charts, and graphs being generated when trying to employ market timing as strategy for purchasing stocks. All of these are generated in order to identify any potential trends in the market that may indicate a significant shift in share prices. However, aside from looking very busy and investing a lot of effort, there are a few pros to this investment approach for stocks.

Cons of Market Timing Stock Strategy

The most fundamental problem with the market timing stock strategy is that it remains pure fantasy, at least according to most investment experts. After all, if anyone truly could predict the rise and fall of stock prices with any degree of certainty, then we would all be billionaires because such a strategy could be documented and replicated. But even Warren Buffet does not ascribe to this approach and neither do most investment professionals. There are almost an unlimited number of market and world variables that may ultimately affect stock prices.

Another big negative with the market timing strategy is the fact that it generally involves a large number of transactions, especially when compared to the buy and hold method. Buying and selling all those stocks requires commissions which can start to take a larger and larger chunk of profits especially when the market doesnt react in the way you predicted. In order to really be effective, a market strategy tends to require a larger capital investment. This allows the investor to purchase a larger number of stocks and thus not need to make as large of a return on the sale price in order to still make a profit.

The differences between bid and asking price can also eat into the profits of a struggling market timing investor also known as the bid/ask spread. An investor may bid a price for a certain stock and be told that it is available, but by the time the actual transaction is made the asking price actually charged by the exchanges may be higher. Again, the difference may seem insignificant but it can make a large difference between a good and a bad day in the life of a market timer.

Although market timing is an approach that millions of investors pursue every day on exchanges around the world, the truth is that it tends to carry more risk than reward. With the erosion of profits due to transaction fees and the bid/ask spread, market timing tends to require larger investments of capital in order to be worthwhile. While no investment strategy for buying stocks has proven to be risk-free and a sure thing, there are other options that tend to be safer investment alternatives.