Market Rises To A Neutral

Post on: 18 Июль, 2015 No Comment

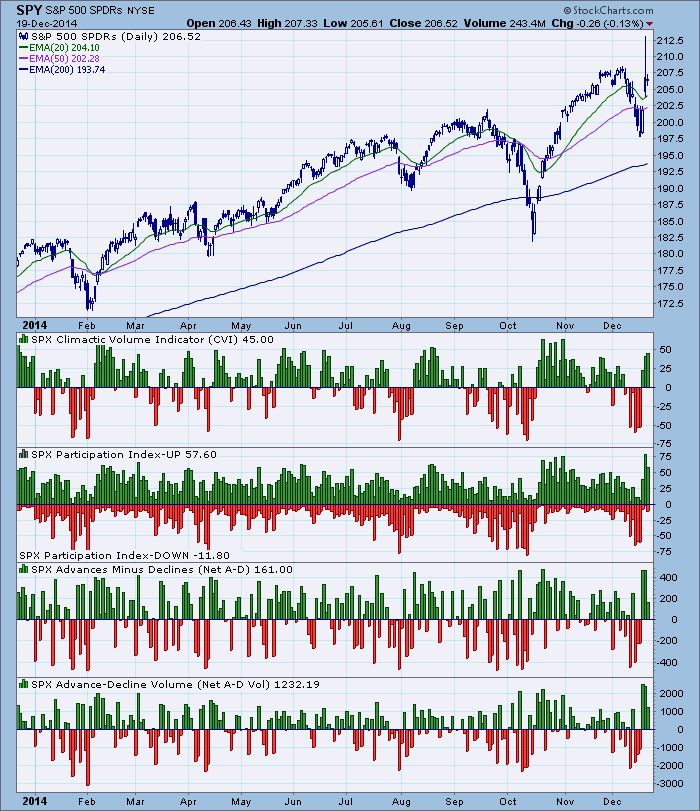

Market increases with heavier volume. “Black

Gold” prices drop as Gulf comes back online.

Fed’s may increase interest rates twice this

year. Take a look at the charts. Get the latest

This is A.J. on Wednesday, September 7th with your

Trading Trainer web log. We are your home of

market insights for the serious option trader.

This web log will cover the events in the market

from today as well as prepare you for watching the

Stocks started lower today but closed higher on

heavier volume. That was enough follow through to

yesterdays rally that I have bump up the levels

of support and resistance on our index charts. I

also notched up our trading bias from Neutral to

Neutral / Bullish. Quite a few TradingTrainer.com

members have been reporting back to me that they

made amazing gains on long trades in the past two

Oil prices dropped today on news that the Gulf

Coast was coming back online as far as producing

and refining the black gold, faster than expected.

And, the bond market responded to reports that

inflation fears are still around with yields of

I stayed away from Alcon today. There was no

follow through. Price dropped below resistance at

$120 per share on heavier volume. That level of

Team, did you notice CERN finally broke out of its

consolidation pattern yesterday. Check out that

chart team!

My EOG resources October 60 calls closed higher at

$7.50 an option. My current return on my

invested capital is 21%. Ive been in that trade

for 47 days. My Pacificare Health Systems November

75 calls closed higher at $4.10 an option. My

current return on my invested capital is 41% after

being in the trade for 47 days. My Quicksilver

September 40 Puts closed flat at $0.40 an option.

I held off of getting out of Tenaris after I got

my lagging stop loss alert because I want to see

the effects of tomorrows energy department oil

stocks report on the market.

This is my plan for tomorrow. Ill be setting my

stop loss alerts for EOG resources at 10% return

on invested capital and for Pacificare Health

Systems, Ill set it 20% return on invested

capital. My stop loss alert for Tenaris will be

set at 65% return on invested capital but, again,

I want to wait for the 10:30 a.m. EDT report. For

all of these positions Ill be watching where

stock price is relative to the 7 day moving

average. Throughout the day, Ill be watching ACL

and AMZN. I have to be honest team, Ive still

got the willies. If the energy report is

Click on the below play button to hear

the blog as an audio from A.J. himself!

A.J. Brown is a full time options trader, author,

speaker and consultant. Watch him review stock