Market Neutral Funds Are NOT Cash Substitutes

Post on: 13 Май, 2015 No Comment

Oliver Burston / Ikon Images / Getty Images

Market neutral funds have caught on in the past decade, reflecting investors’ desire to find relatively safe alternative to money market funds in this era of low interest rates. While the idea may sound good on paper, it’s important to understand that market neutral funds shouldn’t be used as a substitute for money market funds and other low risk investments – even though providers often position the funds that way.

What is Market Neutral Fund?

A market neutral fund invests about 50% in “long” stock investments, meaning that it buys stocks and holds them in the portfolio. The other half of the portfolio “shorts” individual stocks (or the broader market itself via ETFs). A short sale is a bet against a stock or index; when the price of the underlying security falls the value of the short position rises, and vice versa.

Keep in mind, such funds aren’t always weighted exactly 50-50 – this allocation can change based on market movements or the manager’s views on the future direction of stock prices.

In theory, however, the funds work like this. Say the stock market goes up 1% in a given day. In this case, the dollar value of the fund’s long portfolio (the stocks it owns) should rise about 1%, while the dollar value of those it is short should fall 1%. The net result is that the two sides of the portfolio cancel out – meaning that the fund is “neutral” in terms of its total market exposure.

So how would such a fund make money? The idea with most market neutral products is that the manager actively adds value via stock selection. By identifying the stocks that are more likely to out- and underperform the broader market, the manager captures a “spread” between the two sides of the portfolio.

For example, say the stock market rises 20% in a year. The manager of the market neutral fund, through his or her individual stock selection abilities, earns 21% in the long portion of the portfolio and 21% in the short portion. The net result: a gain of 2% without exposure to the volatility of the broader market.

The Problems with This Approach

This type of “risk-free” return sounds like a great idea at first, if for no other reason than it puts a traditional hedge-fund strategy into the hands of individual investors. The problem is that market neutral funds are often promoted as being higher-return alternatives to safer investments such as money market funds.

In this regard, the funds simply don’t measure up.

In any fund that’s invested in equities, there’s a chance that the manager can underperform by picking the wrong stocks. As a group, market neutral funds have outperformed money market funds in recent years. According to Morningstar, the average fund in its Market Neutral category had returned 1.65% in the five years ended July 25, 2014.

That’s not bad, and it certainly beats money market funds at a time in which the average fund has offered a yield of about .01%. At the same time, however, 37% of the funds in the category finished the five-year period with a negative total return. The numbers improve slightly in the three-year period, but not by much: during this time period, a full 30% of the funds in the category suffered a negative total return .

This means that more than a third of investors in market neutral funds saw their principal decline. For an investor who is looking for the level of safety typically associated with money market funds, that simply isn’t good enough.

One reason for this shortfall is expenses – funds in the market neutral category typically charge high fees, often in the 1.5% — 2.0% range each year. It takes a unique degree of stock-picking acumen for a manger to deliver a positive return over and above these fees on a consistent, year-by-year basis.

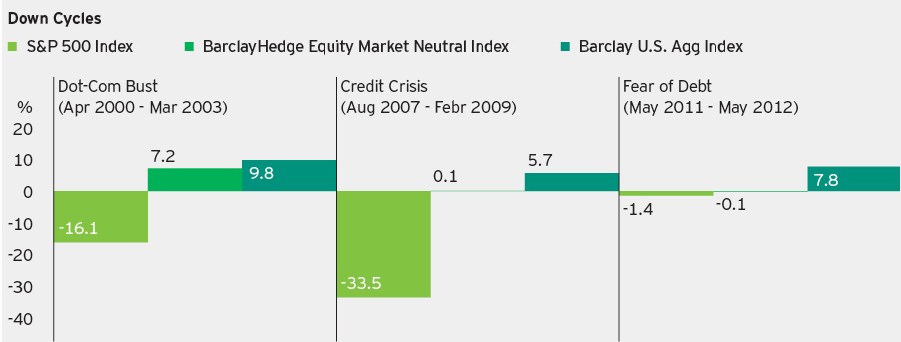

With this said, market neutral funds may serve a purpose for many investors by providing an additional source of diversification within their portfolios. These funds typically don’t feature a return profile similar to that of the other major asset classes (stocks, bonds. commodities, etc.), which may be a selling point to those for whom diversification is a priority.

The Bottom Line

Market neutral funds are safer than traditional stock funds, but they aren’t “safe” in an absolute sense. If you’re priority is preserving capital, focus on traditional options such as money market funds and ultra short-term bond funds. and give market neutral funds a pass.