Managing Risk with CFDs

Post on: 16 Июнь, 2015 No Comment

Experienced traders know that understanding risk and finding effective ways to manage it are fundamental parts of a successful trading strategy.

While the risk of loss is embedded within the very nature of trading, keeping potential risk factors towards the front of your mind as you consider your options can greatly reduce the possibility of placing an unsuccessful trade.

With CFDs, there are two major risk factors to consider: volatility and leverage.

Be wary of volatility

Markets can move quickly and unexpectedly. Major earnings announcements, political upheavals, or natural disasters are some of the events that can impact equities, bonds, and commodities. While volatility can provide trading opportunities, it can also pose significant risks. There is no way to completely avoid volatility in the market, but you can learn to manage the risks it poses to your trading.

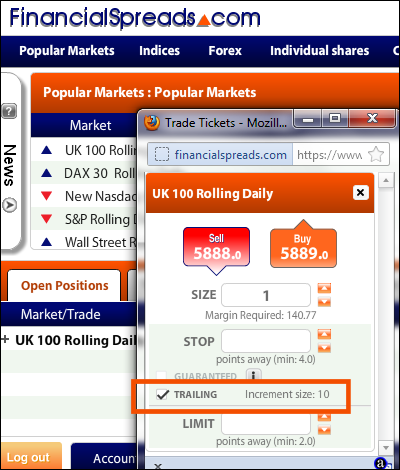

Tradefair’s platforms can help you to manage your CFD positions. You can use order types, such as trailing stops, to exit trades at an acceptable price before the market goes too far against you.

These order types can be accessed easily and quickly by right-clicking on a chart in Tradefair Pro. Most of them are also available in Tradefair WEB by clicking New Order and using the Type dropdown.

Market order

A market order is a request to buy or sell at the current market price guaranteeing execution, but not price. As such, a market order may be filled at a different price than the price submitted by the customer.

Stop

Trailing stop

Like a regular stop order, a trailing stop is set a specific number of pips away from the current market price. When the market moves with your position, the stop setting automatically changes so that it ‘trails’ the current price by the number of pips you set. When the market moves against your position, the stop remains set at the last trailing price reached when the market was moving your way. You can use this to protect profits without limiting potential gains.

Order-cancels-order (OCO)

An OCO allows you to set both a stop and a limit order at the same time. When market movements cause either order to be filled, the unfilled order is automatically cancelled. Traders often use this to protect a market order.

Parent & contingent (P&C) Order

Guaranteed stop order

These orders guarantee execution at your specified price when you place a P&C order. Available in Tradefair Pro, this requires an extra charge and is not available for all markets.

Scale-out order/partial close

In Tradefair Pro, you can use a scale-out order to exit (as well as enter) a trade in increments. When you select this order type, you can place multiple OCOs to open or close a multi-lot order.

*Slippage on all stop orders is possible during times when Tradefair is closed, around fundamental announcements, and times of extreme market volatility. Slippage relates to orders being filled at a price which is worse than the stop price requested by the customer.

Understand the risks of leverage

CFDs are traded on leverage, which can be both a benefit and a risk. Leverage allows you to take a larger position with less capital, but a high degree of leverage can work against you as well as for you. When you trade, keep in mind that the leverage on your CFD is a significant factor that can magnify both positive and negative outcomes. You may end up losing more than your initial deposit.

Practice

We can’t give you a permit to trade, but we can help you get plenty of practice. Put your trading plan to work in real market conditions with a risk-free CFD practice account. You’ll get a chance to see what it’s like to trade in real market conditions, while also taking your trading plan for a test drive — without risking your capital. Tradefair offers

free, no- risk practice accounts so you can get a feel for the markets and our trading platform.

This information should not be relied on as a substitute for extensive independent research before making your investment decisions. Tradefair Financials is merely providing this for your general information. In addition, any projections or views of the market provided by this author may not prove to be accurate. Tradefair Financials will not be responsible for any losses incurred on investments made by readers and clients as a result of any information contained in this page. Tradefair Financials does not render investment, legal, accounting, tax, or other professional advice. If investment, legal, tax, or other expert assistance is required, the services of a competent professional should be sought.