Managers take tactical tack with strategic bond funds

Post on: 20 Июль, 2015 No Comment

Since June, Ben Bernanke of the US Federal Reserve has repeatedly hinted that the central bank is finally on the verge of reining back on its stimulative quantitative easing (QE) policy.

Yet at each of the Fed’s monthly pronouncements on policy, he has stuck with QE at its current levels.

On bond markets, buoyed for so long by the huge sums with which the Fed and other central banks around the world have pump-primed the global economy, the will he-won’t he soap opera has caused huge volatility.

And for investors who bought fixed-income funds because they were looking for safety, this has been deeply unnerving.

Bond yields’ record lows

The bonds that could be equities

Convertibles are an important holding for some strategic bond funds — and an increasingly interesting asset class on a standalone basis.

Like conventional bonds, these securities pay a fixed income and are repayable on a set date in the future.

But if the issuing company’s share price hits a specific level, the bonds can be converted into equities.

Convertibles are therefore hybrids, displaying some of the features of both bonds and equities.

When stockmarkets rise, convertibles’ prices tend to rise in line, as investors anticipate being able to turn them into equities.

But in falling markets, the fixed income paid by convertibles offers investors compensation for capital losses, and they begin to behave more like bonds.

Tom Wills, the executive director and portfolio manager of the Morgan Stanley Global Convertible Bond fund argues that for this reason the best time to own convertibles is when equities are moving ahead but the market remains volatile.

Does that sound like now? Institutional investors appear to think so, with allocations towards convertibles at many pension funds having risen sharply over the past couple of years.

Several fund managers are also seeking to persuade retail investors of the merits of convertibles, with new launches this year from firms including NASDAQ :AVOA:Avoca, NYSE :JPM:JPMorgan and LSE :POLR:Polar Capital in both the open- and closed-ended sectors.

Tread carefully. Convertibles will still lose money in falling markets — and they’ll underperform equities when the latter rise.

Still, these bonds could be a useful middle ground for cautious investors and their track record is good.

Between 1994 and 2011 convertibles delivered an average annual return of 7% — ahead of the 6% a year of the MSCI World Equity index over the same period, and with much lower volatility.

Having seen bond yields hit record lows at the beginning of this year, the Fed’s willingness to contemplate tighter monetary policy — even though interest-rate rises remain years away — pushed yields sharply higher throughout the summer in both government and corporate bond markets.

The corresponding capital losses for US and European bond investors alike were 10% between May and August, a highly unusual level of volatility.

In the UK, the bond market sell-off has prompted renewed interest in strategic bond funds.

The sector was the most popular of all with retail investors during 2012, according to the Investment Management Association, and has continued to sell well during 2013.

The appeal of these funds is that their managers have much greater freedom to respond tactically to the changing market environment than those in charge of conventional bond funds.

The latter typically set their managers a narrow mandate — to limit investments to blue-chip corporate bonds, say, or high-yield paper — whereas strategic bond funds can invest more broadly.

Their holdings may include a wider range of conventional fixed-income assets, but also securities such as convertibles, floating-rate notes and asset-backed securities.

Moreover, strategic bond fund managers have a remit to invest dynamically, to boost yield or total return or manage risk.

In the current market environment, for example, they might choose to target short-duration bonds — those due to be repaid soonest — which tend to be less sensitive to market speculation about changes in monetary policy.

In other circumstances, their strategy would be different. The allure of a dynamic bond fund, in other words, is its flexibility.

Strategic bond funds are the best way to access exposure to fixed-interest markets, given where we are in the interest-rate cycle, argues Danny Cox, head of financial planning at broker Hargreaves Lansdown.

Managers can vary their portfolios to suit market conditions and where they believe the best value is — this gives investors a more diverse bond fund and should ensure better protection when interest rates rise.

The catch

There is, however, a catch. As Cox’s colleague, Hargreaves Lansdown head of research Mark Dampier, points out, managers have to make the right market calls.

They should be in a better position to both defend capital and make money, but there is no guarantee and it is important investors understand that, says Dampier.

For example, none of them went big on gilts in 2008 when they should have done.

It’s an argument that Stuart Rumble, fixed income investment director at Fidelity Investments, understands well.

Fidelity Strategic Bond's management team prefers to stick with its medium to long-term asset allocation policy, Rumble explains, rather than trying to second-guess the market, because these big macro calls are very difficult to get consistently right.

Instead, Rumble and his colleagues have set a framework for the fund — broadly 20% in government bonds, 60% in corporate bonds and 20% in high-yield paper — and individual bond choices are made in that context.

We chose to stick with that allocation during the sell-off this year because we believe yields can only rise so far, Rumble adds.

That may have led to some short-term underperformance, but we’re ultimately looking at risk-adjusted returns over three to five years.

Not that Rumble did nothing at all in response to the bond market’s plunge. His broader remit enabled him to use derivatives and credit default swaps to manage volatility.

And the fund’s portfolio turnover is generally quite high — 80 to 100% over three years,compared to 60 to 70% for Fidelity's Moneybuilder Income corporate bond fund.

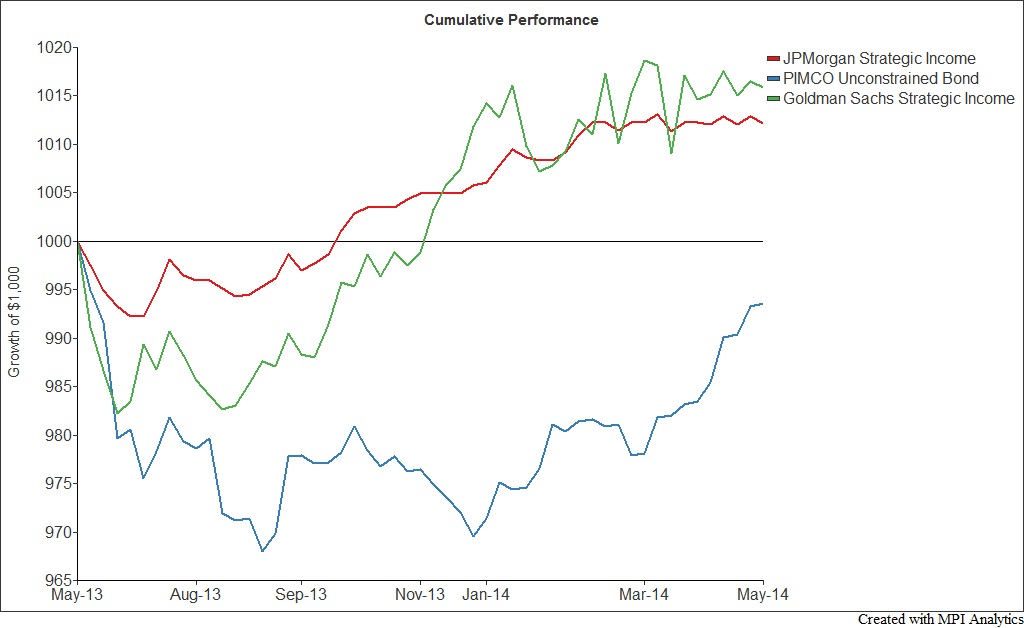

Still, other strategic bond funds chose to use their flexibility more dynamically. The point for investors is that it is important to understand how strategic bond fund managers will make market calls — and what investments their decisions will prompt.

Credible option

Strategic bond funds are our preferred method to get exposure to fixed income, but there can be vast differences in how funds are constructed and run, says Patrick Connolly, director at independent financial adviser Chase de Vere.

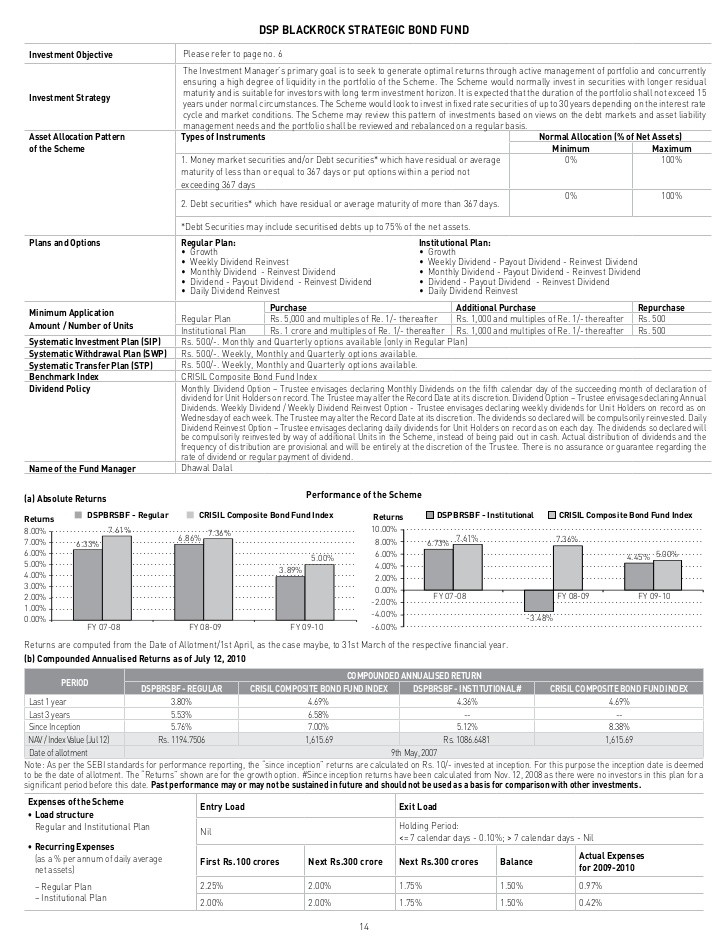

This is evidenced in current fund yields ranging from 1.2% to 6.8%, and performance over the past year ranging from a loss of 5.5% to a gain of 16.1%.

Jason Hollands, managing director of communication at IFA Bestinvest, agrees with that analysis.

Nevertheless, he says, strategic bond funds do represent a credible option for those who want to maintain fixed-income exposure in their portfolios despite anxieties about further sell-offs to come — particularly once interest-rate rises become more likely.

Some funds have greater flexibility and a wider toolkit than others, Hollands says.

But flexibility is a distinct advantage in the recent and current market environment, where central bank asset-purchase programmes have resulted in severe distortions to fixed-income markets and there have been sharp movements in spreads as investors try to anticipate future changes in the yield curve.

The challenge faced by investors

The challenge for investors in strategic bond funds, then, is to work out which vehicles offer an approach that delivers these advantages in a way that sits comfortably with their objectives and risk attitude.

For example, Hollands tips the Kames Strategic Bond fund as a good option for lower-risk investors because its high-yield exposure doesn’t go above 30%.

But for total return, he prefers Legal & General Dynamic Bond. which has performed well throughout the credit crisis and has a total return approach with no formal yield target, dynamically asset allocating across the fixed-income spectrum.

Hollands also likes M&G Optimal Income. which has an especially broad investment remit that includes equities and derivatives, and PFS TwentyFour Dynamic Bond. a concentrated best ideas fund with a focus on UK and European credits and assetbacked securities.

Other strategic bond funds that rate consistently highly with financial advisers include Invesco Perpetual Tactical Bond and Jupiter Strategic Bond. which both have management teams with proven trading records.

Still, Brian Dennehy, managing director of financial adviser Dennehy Weller, warns investors to be careful with performance comparisons.

A number of the funds topping the performance charts at present have exposure to equities, while others have a significant high-yield bond exposure, even though high-yield bonds are often closely correlated to the fortunes of equity markets, he says.

Dennehy does, however, recommend one vehicle.

It is good to see Artemis Strategic Bond. run by James Foster, performing strongly, he adds.

This fund has no equity exposure and is run in a sober fashion, recently benefiting from an astute call on US Treasuries ahead of September’s Federal Reserve announcement.

Bear in mind, however, that while strategic bond funds give managers more options in times of stress, as well as the opportunity to target total return, when fixed-income markets are in the doldrums, these vehicles will still suffer accordingly.