Management Buyout (MBO) Definition

Post on: 16 Март, 2015 No Comment

DEFINITION of ‘Management Buyout — MBO’

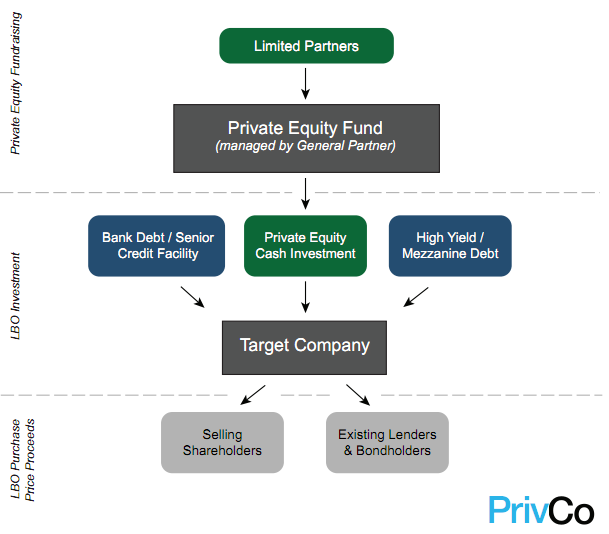

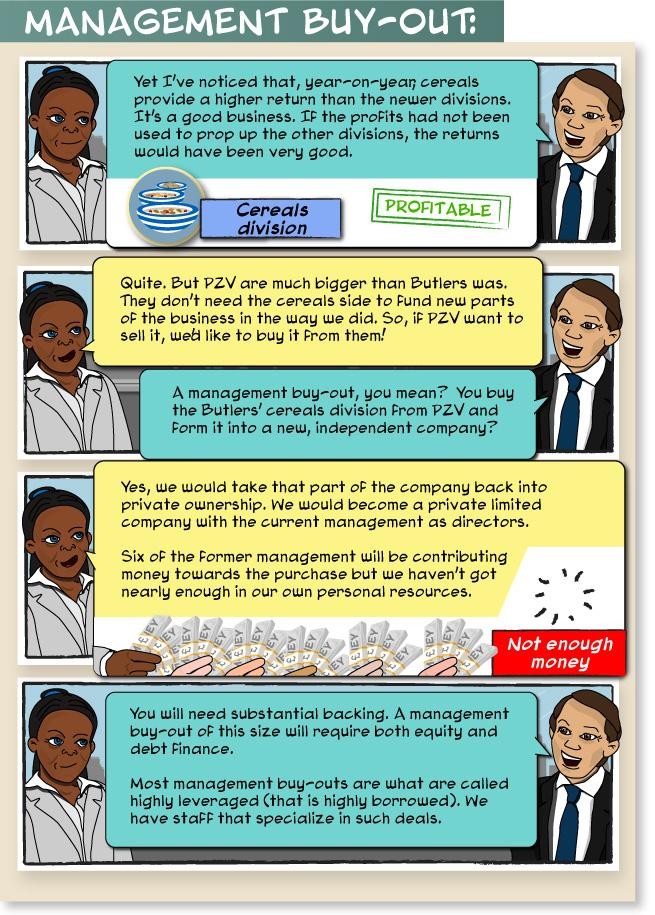

A transaction where a company’s management team purchases the assets and operations of the business they manage. A management buyout (MBO) is appealing to professional managers because of the greater potential rewards from being owners of the business rather than employees. MBOs are favored exit strategies for large corporations who wish to pursue the sale of divisions that are not part of their core business, or by private businesses where the owners wish to retire. The financing required for an MBO is often quite substantial, and is usually a combination of debt and equity that is derived from the buyers, financiers and sometimes the seller.

INVESTOPEDIA EXPLAINS ‘Management Buyout — MBO’

An MBO is different from a management buy-in (MBI), in which an external management team acquires a company and replaces the existing management team. It also differs from a leveraged management buyout (LMBO), where the buyers use the company assets as collateral to obtain debt financing.

An MBO’s advantage over an MBI is that as the existing managers are acquiring the business, they have a much better understanding of it and there is no learning curve involved, which would be the case if it were being run by a new set of managers. The advantage of an MBO over an LMBO is that the company’s debt load may be lower, giving it more financial flexibility.

However, there are several drawbacks to the MBO structure as well. While the management team can reap the rewards of ownership, they have to make the transition from being employees to owners, which requires a change in mindset from managerial to entrepreneurial. Not all managers may be successful in making this transition.

Also, the seller may not realize the best price for the asset sale in an MBO. If the existing management team is a serious bidder for the assets or operations being divested, the managers have a potential conflict of interest. That is, they could downplay or deliberately sabotage the future prospects of the assets that are for sale to buy them at a relatively low price.

MBOs are viewed as good investment opportunities by hedge funds and large financiers, who usually encourage the company to go private so that it can streamline operations and improve profitability away from the public eye, and then take it public at a much higher valuation down the road. While private equity funds may also participate in MBOs, their preference may be for MBIs, where the companies are run by managers they know rather than the incumbent management team.