Managed Accounts Investment U

Post on: 16 Июнь, 2015 No Comment

by Alexander Green. Chief Investment Strategist, The Oxford Club Wednesday, April 30, 2008 Wisdom of Wealth

by Alexander Green. Chairman, Investment U

Investment Director

Monday, April 21, 2008: Issue #786

At a recent investment conference, I was asked a question that I hear pretty frequently. Just what are managed accounts — and do you recommend them?

Whether an investor would benefit from having a managed account or not is a personal question, really. I’m no longer a money manager. And, as an editor, I don’t give personal investment advice.

Traditionally, institutional investors used a money manager to run a portion of the institution’s money and make all the investment decisions. Until recently, individual investors could only get access to these managers if they had millions of dollars to invest.

But in recent years, the minimum investment requirements — and, just as importantly, costs — have come way down.

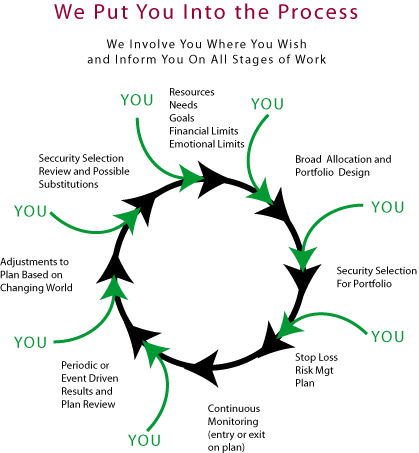

When you open a managed account, it means you have signed a limited power of attorney to let an investment professional run your portfolio or some portion of it. Generally speaking, the manager will begin by determining your investment goals, time horizon and risk tolerance. A 70-year-old widow’s portfolio, for example, may look very different than a 25-year old couple’s.

But I can tell you that managed accounts have both advantages and drawbacks. Let’s take a look at both.

The Benefits of a Managed Account

Here are the benefits of a professionally managed account:

The Disadvantages of Managed Accounts

Of course, managed accounts have disadvantages too.

I recently spoke with Greg Galloway, President of Fund Advisors in Orlando, FL, who runs some managed accounts based in part on our asset allocation and investment recommendations. I asked him to address the drawbacks I just mentioned.

Managed Accounts Aren’t For Everybody.

Look, he said with a laugh, I’ll be the first to concede that managed accounts aren’t for everybody. However, I speak to a lot of investors who realize they could be doing a lot better than they are. They know they should asset allocate their portfolios, but they don’t. Or they aren’t sure how. They don’t want to be over- or under-diversified, but we look at their portfolios and see that they are.

They know they should run trailing stops behind their stocks, but they get distracted or forget. Many of these people are smart, sophisticated investors, incidentally. They’re just too busy running a company, taking care of their families or pursuing their interests to give their portfolios the attention they deserve.

How about investors who say they can save money by managing their own accounts individually?

You may be able to do it more cheaply on your own, says Greg. But, remember, the most important question is not ‘what are my costs?’ It’s ‘Am I satisfied with my investment returns net of whatever fees I’m paying?’ If the job isn’t getting done, you may want some help.

In the end, whether or not you need to consider a managed account really boils down to whether or not you prefer to grow your own tomatoes. Stick with me a moment.

Some people are natural gardeners. They want to till the soil, plant the seeds, water them, fertilize them, weed them and, eventually, harvest them. When they eat those tomatoes, they have the pride and satisfaction of knowing they raised them themselves.

Other folks are uninterested, unqualified, or too busy to grow their own tomatoes. They stop at the Farmer’s Market on the way home and just pick up a bag.

In the end, the choice is yours.

Learning More About Managed Accounts

If you’d like to learn more about managed accounts, here are some good places to start:

In sum, managed accounts are an excellent choice for some investors. Others may well decide to give them a pass.

But it never hurts to know your alternatives.

Good investing,

Alex

Today’s Investment U Crib Sheet

For those of you who are comfortable managing your own accounts, here are three resources you can put to work right away. They’re free.