Making an Investment Policy Statement (IPS)

Post on: 16 Март, 2015 No Comment

Questions About Investment Policy Statements? Call (734) 369-0580 Sorry but there’s no free demo to evaluate

This sample is what the IPS software program says on its first page. It’s the investment advisor explaining what an IPS is to the client. This is the only thing that serves as a demo, as you can read on the IPS product page. Sorry, but there is no free demo other than this page.

Your Investment Policy Statement

This Investment Policy Statement is the linkage between you, the investment manager, and your portfolio(s).

The most important duty of a fiduciary or trustee is the creation, adherence to, and maintenance of an Investment Policy Statement. This is an important written document that should clearly define your objectives and constraints over a relevant, explicitly stated, time horizon.

The IPS is the foundation of managing your investments, and serves as a structured decision-making process for us to make most all of your investment decisions. This helps to balance return seeking and risk taking; increasing the probability of success in achieving your long-term investment goals.

A properly constructed Investment Policy Statement provides support for the investment manager to follow a well-conceived, long-term investment discipline, rather than one that is based on ad hoc revisions spawned by overconfidence or panic in reaction to short-term market fluctuations.

The absence of written policy reduces decision making to an individual event basis, and often leads to chasing short-term opportunities that may detract from reaching long-term goals. The presence of investor policy encourages all parties to maintain their focus on the long-term nature of the investment process, especially during turbulent, or exuberant, times.

The IPS provides a long-term plan and a basis for making disciplined investment decisions over time. Written investment policy helps to clearly and concisely identify your pertinent objectives and constraints. Once this is done, we can establish investment guidelines that we feel are appropriate, given the universe of strategies and realities of the marketplace.

Clients are surprised when they realize they are responsible for establishing their own investment policy. Once established, it is then the advisor’s role to follow that policy. Once policy is established, we would not expect to change it until there is a material change in your personal or financial circumstances. Investment policy normally doesn’t change in response to market moves, and should be long-term to prevent arbitrary or impulsive revisions.

The Investment Policy Statement also provides an effective channel of communication between client and advisor. This will help clarify issues of importance and concerns to both parties. Conflicts of interest and general misunderstandings are minimized since the IPS is in writing and both the client and investment managers have agreed to adhere to it.

Having a professionally prepared IPS also helps provide a structured means of presenting investment performance, and provides continuity from current manager(s) to future ones, if needed.

Rate of return objectives are mostly tempered by your risk tolerance, but other factors also apply. These are constraints, such as: time horizons, income / liquidity needs, tax considerations, legal and regulatory requirements, and unique preferences or circumstances that may apply to each individual client.

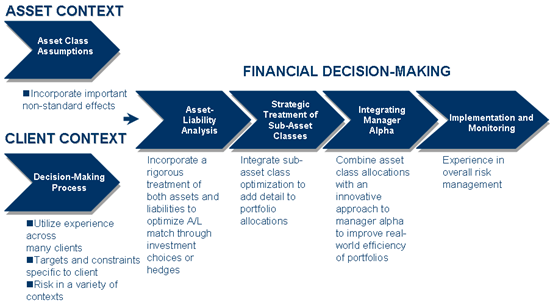

These objectives and constraints, considered in the light of investment market expectations (expected returns, return volatilities, and return correlations), will dictate the appropriate investment strategies to be followed, including asset allocation and selection, the investment style to be pursued, and the appropriate way to monitor and evaluate performance.

Signing and returning the IPS will let us know that you concur with its contents. This Investment Policy Statement is not a contract of any kind, and it is not required to make trades in your account. It is only meant to be a summary of our agreed upon investment management techniques. You can suggest any changes you want to it before formally agreeing to it with your signature.

More IPS Basics

An Investment Policy Statement has five components:

• Account information and summary of investor circumstances.

• Investment objectives, time horizon, and risk attitudes.

• Permissible asset classes, constraints, and restrictions.

• Asset allocation ranges and targets.

• Selection, monitoring, reporting, and control procedures.

To Serve as the Guide in Making Investment Decisions, Your Investment Policy Statement Will Summarize:

• Your financial goals and objectives; and time frames for reaching them.

• Your personal preferences and constraints; and any tax, legal, or regulatory issues.

• Your rate of return goals.

• Your willingness and ability to assume investment risk (summarized by your Investment risk tolerance category ).

• Your ongoing income distribution needs from the investment portfolio, and other liquidity concerns stemming from withdrawals from the portfolio.

• Personalized guidelines for the allocation of your assets. This process will determine which overall asset classes will be used, and how your investments should be divided between these asset classes.

Your personal (non-tax qualified) assets may be allocated separately from your qualified retirement assets, or they may be combined.

• The time frame for achieving your proposed asset allocation, and when rebalancing is required.

• Whether techniques such as Dollar Cost Averaging will be used in achieving allocation ranges over time.

• Whether or not portfolio optimization techniques will be used to enhance investment performance by helping to control risk and return.

• Benchmarks to be used in evaluating investment performance, and how they will be applied.

• The frequency and types of portfolio reporting and evaluation.

• Security selection guidelines used to control how much of a certain type, and which types, of investments are permissible.

The Benefits of Using an IPS:

Using a properly-composed Investment Policy Statement should bring the following benefits:

• An IPS compels the investor and the investor’s advisors to be more disciplined and systematic in their decision making, which is in itself, should improve the odds of meeting the investment goals.

• Objectives and expectations are clarified for all concerned parties.

• Misunderstandings are more likely to be avoided.

• Approved procedures are specified in advance so everyone concerned will know what to expect. Decisions can be made as to how things will be done under a variety of circumstances in a deliberate fashion, rather than in heat of the battle. Planning ahead makes it easier for all when the environment gets stormy.

• The IPS establishes a record of decisions and an objective means to test whether those serving the investor are complying with the investor’s requirements.

• The Investment Policy Statement provides a ready means to communicate to advisors, beneficiaries, and current and future fiduciaries about how the investor proposes to go about acting upon their duties.

Who Needs an IPS?

Every investor that hires a money manager needs an Investment Policy Statement. In certain circumstances, law mandates having it in writing.

When it is mandated by law? In general, having an Investment Policy Statement is required any time a person or group of people are making investment decisions for the benefit of others, whether or not the decision-makers also may have a direct personal interest in the investments.

For example: When the investments are subject to ERISA, Taft-Hartley Plans, held in a trust / endowment / foundation, when the investments are in an estate and the executor is making investment decisions, or when there is more than one investment manager acting in a fiduciary capacity under the Uniform Prudent Investor Act.

Financial Planning Software Modules For Sale