Long Guts

Post on: 18 Июль, 2015 No Comment

Advanced Option Strategies/Bullish Volatility

Exploiting Volatility with Long Guts

Andrea Kramer (akramer@sir-inc.com)

Condors, butterflies, strips, straps. Options trading strategies come in a rainbow of colorful names. One relative to the popular straddle strategy is the long guts strategy. another unique option play with the potential to profit from a stock�s volatility.

The Play

Who should tune in? Similar to the straddle and strangle, the long guts strategy is best suited for traders anticipating a dramatic price swing in the stock price. The strategist is neutral on the underlying equity, as the position can make money if the shares make a monstrous move in either direction.

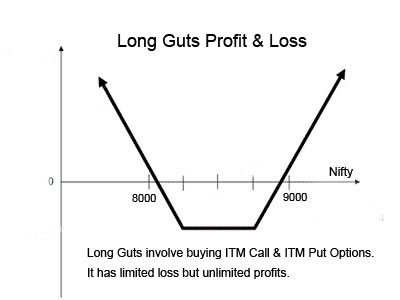

How does it work? While the long straddle typically centers on a single at-the-money strike, and the long strangle usually centers on two out-of-the-money strikes, the long guts position focuses on two in-the-money strikes. More specifically, the investor would simultaneously purchase one in-the-money call and one in-the-money put with the same expiration.

What�s in it for me? The goal of the long guts play is for the underlying stock to make a massive move in either direction ahead of expiration. Ideally, the intrinsic value of one of the options will be enough to offset the loss incurred by the worthless option, resulting in a net gain.

In order to avoid a loss, the strategist needs the shares to muscle past one of two levels before expiration: the put strike minus the net premium paid, or the call strike plus the net premium paid.

If the stock makes a move lower before expiration, the profit on the position is calculated by subtracting the new stock price from the put strike, minus the net premium paid. If the security rallies before expiration, the profit on the position is calculated by subtracting the call strike from the new stock price, minus the net premium paid. Theoretically, the profit potential for the play is substantial if the stock declines, and is unlimited if the stock skyrockets before the options expire.

What do I have to lose? Aside from unlimited profit potential, the primary appeal of the long guts trade is that the risk is limited. More specifically, if the underlying equity remains between the strike prices at expiration, the maximum loss is limited to the net debit plus the put strike, minus the call strike.

In addition, don�t forget to include any brokerage fees when calculating the total cost of this play.

For Example

For instance, let�s assume that Amelia has been following Company XYZ, which is set to take the earnings stage in mid-August. In the past, the shares of XYZ have been volatile following the firm�s dates in the earnings confessional, and Amelia wants to cash in on any potential price swings. With this in mind, she opts to take the road less traveled by implementing a long guts strategy.

Ahead of earnings, the stock is flirting with the $50 level. As such, Amelia purchases the in-the-money August 45 call for $6, and the in-the-money August 55 put for $6, for a net debit of $12. or $1,200 (x 100 shares).

To avoid forfeiting the initial premium paid, Amelia needs the shares of XYZ to breach either the $43 level (put strike � net debit) or the $57 level (call strike + net debit) by options expiration on Friday, Aug. 21.

Now, let�s fast forward to XYZ�s Earnings D-Day.

First, let�s assume that the company surpassed the Street�s expectations, fueling the shares of XYZ to the $60 level as a result. The August 55 put would then expire worthless, but the August 45 call would harbor an intrinsic value of $15. Subtracting the $12 paid to initiate the strategy (and not including any brokerage fees), and Amelia�s long guts play comes out $3 ahead.

On the flip side, let�s say the firm fell short of analysts� estimates, sending the shares of XYZ to the $45 level. The August 45 call would have no value, but the August 55 put would have an intrinsic value of $15. Again, minus the net debit of $12 (sans brokerage fees), and Amelia�s position makes $3 on the play.

Finally, let�s assume the company�s quarterly figures were in line with the consensus estimate, and the shares of XYZ remained relatively stagnant at the $50 level. In this case, both the August 45 call and August 55 put would be worth only $5 apiece, or $10 total, as neither option would hold any more time value. Considering Amelia paid $12 to purchase the options originally, her position would result in a net loss of $2.