Leveraged & Inverse ETFs FAQ

Post on: 13 Июнь, 2015 No Comment

Monthly 2x Mutual Funds

Leveraged & Inverse ETFs FAQ

Direxion Daily Exchange-Traded Funds (ETFs) are leveraged funds that provide powerful leverage and the ability for investors to navigate changing markets with bull and bear flexibility.

For example, Direxion Daily 3x ETFs are designed to seek daily investment results, before fees and expenses, of 300% of the performance (or 300% of the inverse of the performance, in the case of a Bear fund), of the benchmark index that they track. There is no guarantee that the funds will achieve their objective.

Frequently asked questions

Q. Are Direxion ETFs Right for You?

A. Perhaps if you are a sophisticated, aggressive investor with:

- The willingness to accept substantial losses in short periods of time

- An understanding of the unique nature and performance characteristics of funds which seek leveraged daily investment results

- The time and attention to manage your positions frequently to respond to changing market conditions and fund performance.

Definitely not if you are a conservative investor who:

- Cannot tolerate substantial or even complete losses in short periods of time

- Is unfamiliar with the unique nature and performance characteristics of funds which seek leveraged daily investment results

- Is unable to manage your portfolio actively and make changes as market conditions and fund performance dictate.

All Investors should read the Prospectus before investing.

Q. If the target index is up 10% for a month, shouldnt I expect to have a 30% gain in my Direxion Bull Fund?

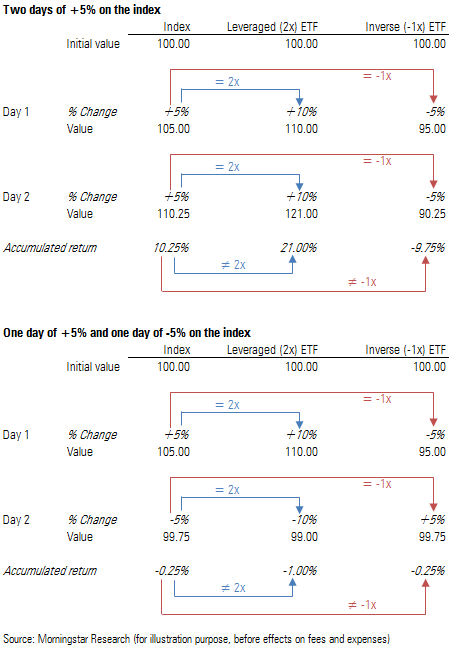

A. No, not typically. For example, the investment objective of a Direxion Daily 3x ETF is to seek investment results of 300% (or -300%), before fees and expenses, of the price performance of its benchmark index, is a daily objective, and does not apply to longer periods of time. The actual longer-term performance may be close to the daily targets—but depending on certain market movements and due to the portfolio adjustments required to pursue the daily investment targets set by the fund, performance over time may vary. This will, in some cases, be to the advantage of the shareholder; other times, it will be to their disadvantage.

In markets predominantly trending in one direction with low volatility, the performance for periods longer than a day may exceed the return of the index, multiplied by the target beta of the portfolio. However, in volatile markets, the pursuit of daily investment targets will typically have a negative impact on the performance for periods longer than a single day. For more details, please see our article entitled Understand the Impact of Changing Market Exposure on Leveraged Exchange Traded Funds (ETFs).

Q. How can the Bull and Bear Fund that track the same benchmark index both have a negative return for the same given period?

A. Direxion Daily ETFs seek daily investment results. As described in the question above, over longer periods of time, especially when markets experience significant market volatility, investment results can vary. The path of the benchmark index during these longer periods may be at least as important to the funds return as the cumulative return of the benchmark for the period. As a result, even though the benchmark index had a positive return, a bull fund that tracks it can have a negative return, due to the product of the daily events that take place during the period.

Q. What happens if the value of the index that a Direxion ETF is tracking moves more than 33% in one day?

A. Each Direxion ETF seeks daily exposure to its target index equal to 300% of its net assets. Consequently, a fund could theoretically lose an amount greater than its net assets in the event of a daily movement of its target index in excess of 33% in a direction adverse to the fund (meaning a decline in the value of the target index of a Bull Fund and a gain in the value of the target index for a Bear Fund). It is very rare that this type of market activity would occur in a single day, given the trading curb rules that are in place on most exchanges, but in the event that it does, Direxion Shares reserves the right to be responsive to index movements up to, but not beyond, a certain point. For example, if a Bull Funds target index gained 25%, the Fund would be expected to gain 75%. However, if the target index gained 30%, the Funds portfolio might not respond to the index gains which result in the difference between the 25% daily movement from 25% to 30%—meaning the Funds return would be capped for the day at 75%. This precaution is in place for the protection of the investment interests of shareholders.

It is important to understand that an investor in Direxion ETFs cannot lose an amount greater than their initial investment.

Q. Are Direxion Shares ETFs appropriate for buy and hold investing?

A. No, this is not recommended. Leveraged ETFs seek daily investment results and should therefore be considered primarily for short-term trading purposes. It may, however, be appropriate to hold the funds for periods longer than one day depending on the performance path of the funds underlying benchmark index and the investors risk tolerance. Investors who choose to hold leveraged ETFs for periods longer than one day should recognize that their holding period is not in line with the funds objective and such investors should regularly monitor and adjust their position to maintain a level of exposure consistent with their investment objective.

Q. I am an Investment Advisor or Registered Representative, How do I contact Direxion?

A. Financial professionals can contact the Direxion Sales Desk at 866.476.7523.

Q. The target benchmark index for the Direxion ETF in which I invested was up 3% yesterday, but if I compare the funds closing price from two days ago to yesterdays close, I only see a gain of approximately 7.5%. Shouldnt this return be closer to 9%. (This is a hypothetical example and investors return may not replicate this example.)

A. Ordinarily, yes. But when we see this type of daily performance discrepancy, it is commonly due to the fund trading at an abnormally large price premium (as compared to the funds NAV) at the time of the market close. This is usually caused by a higher demand for shares than are currently available in the market. That is, there are more interested buyers than there are sellers of shares in the market at that time. The result is a temporary inflation of the market price for the fund. This means that those investors who bought shares at this premium paid more than the actual net asset value per share; or more than the actual value of the underlying holdings per share in the fund. The disadvantage of buying at a premium is that the investor will essentially be selling a portion of the funds returns to the buyer. This is the reason for the difference in the expected daily returns that can sometimes be seen.

The good news is that this situation is typically resolved relatively quickly. Historically, weve often seen that, as new shares are introduced to the market, supply and demand come back into relative balance and the price premiums ordinarily decline.

ETF shares trade on the open market throughout the day on securities exchanges (the NYSC ARCA in the case of Direxion ETFs). Direxion does not have any control over how they trade—whether at a premium or a discount. As mentioned above, at times when supply is lower than demand, the shares can trade at significant premiums. We do recommend that when investors are considering a trade in any ETF, they check to see if the shares are trading at excessively large premiums or discounts, and consider the impact of this on their investment.

Q. What are the trading spreads?

A. Trading spreads, or the bid ask spread, is the difference between the best price a buyer is willing to pay for a security (bid) and the best price a seller is willing to sell that same security (ask). The bid ask spread depends greatly on the liquidity of the asset. If it is a heavily traded security the spread will tend to be very narrow (i.e.1 or 2 pennies), which cuts back on transaction fees. Less liquid or more thinly traded securities will have wider spreads.

Q. I purchased a Direxion Daily 3x ETF after the market opened and didnt get an exact 3x return, why?

A. Intra-day, the total exposure of a Fund may be higher or lower than the stated daily objective depending on the movement of the target index away from its value at the end of the prior trading day.

After a move in the index that is favorable to the fund either up for a bull fund or down for a bear fund total exposure will decline below the daily stated objective. Conversely, if the value of the index moves in a direction that is unfavorable to the fund either down for a bull fund or up for a bear fund total exposure would rise above the daily stated objective. This occurs because, although the net asset levels of the fund and the total exposure to the index move directionally together, the rate in which they move is disproportionate as a result of leverage.

On days when market fluctuation is minimal, the intra-day changes to exposure levels are small. However, on days when there is substantial fluctuation in the value of the benchmark index, the intra-day changes to exposure levels could be greater. Direxionshares Daily ETFs are intended to be used as short-term trading vehicles.

Important Disclosures

An investor should consider the investment objectives, risks, charges, and expenses of Direxion Shares and Direxion Funds carefully before investing. The prospectus and summary prospectus contain this and other important information about Direxion Shares and Direxion Funds. Click here to obtain a prospectus or call (877) 437-9363. The prospectus or summary prospectus should be read carefully before investing.

Direxion Shares Risks — An investment in the ETFs involve risk, including the possible loss of principal. The ETFs are non-diversified and include risks associated with concentration that results from the Funds’ investments in a particular industry or sector which can increase volatility. The use of derivatives such as futures contracts, forward contracts, options and swaps are subject to market risks that may cause their price to fluctuate over time. The funds do not attempt to, and should not be expected to, provide returns which are a multiple of the return of the Index for periods other than a single day. For other risks including leverage, correlation, compounding, market volatility and specific risks regarding each sector, please read the prospectus.

Direxion Funds Risks — An investment in the Funds involve risk, including the possible loss of principal. The Funds are non-diversified and include risks associated with concentration risk which results from the Funds’ investments in a particular industry or sector and can increase volatility over time. Active and frequent trading associated with a regular rebalance of the fund can cause the price to fluctuate, therefore impacting its performance compared to other investment vehicles. For other risks including correlation, compounding, market volatility and specific risks regarding each sector, please read the prospectus.

Hong Kong Investors — This website and the investment products referenced herein (“Website”) are directed to persons who are “Professional Investors” within the meaning of the Hong Kong Securities and Futures Ordinance (Cap. 571) (“Ordinance”). This Website is not directed to the general public in Hong Kong. You agree that your use of this Website is subject to you reviewing and acknowledging the terms of this disclaimer and the website’s terms of use. Information herein is not intended for Professional Investors in any jurisdiction in which distribution or purchase is not authorized. This Website does not provide investment advice or recommendations, nor is it an offer or solicitation of any kind to buy or sell any investment products. Direxion Asia Limited (“DAL”) is licensed with and regulated by the Securities Futures Commission of Hong Kong (“SFC”) (CE Number: BAZ386) to provide services to Professional Investors. DAL does not maintain nor is it responsible for the contents of this Website, which has not been approved by the SFC. DAL is an affiliate of other companies within the Direxion Group companies which may manage the products and provide the services described herein, which are not directed to the general public in Hong Kong. Companies within the Direxion Group which do not carry out regulated activities in Hong Kong are not subject to the provisions of the Ordinance. Foreside Fund Services, LLC is the distributor for the Direxion Shares in the United States only.

Distributor for Direxion Shares: Foreside Fund Services, LLC.

Distributor for Direxion Funds: Rafferty Capital Markets LLC.

Direxion 2010 — 2015