Leg in Options Trading by

Post on: 25 Июнь, 2015 No Comment

Legs in Options Trading — Definition

Legs are the component options or set of options that make up each part of an options spread.

Legs in Options Trading — Introduction

Options strategies or Options Spreads. are commonly identified by the number of component options that make up the spread. These components are known as legs. Indeed, legs are simply professional options trading jargon for the number of options types that make up an options strategy. An options strategy with 2 components, such as the long straddle, is known as a two legged options strategy or an options strategy with two legs.

Explosive Options Trading Mentor

Find Out How My Students Make Over 45% Per Trade,

Confidently, Trading Options In The US Market Even In A Recession!

What Is Leg in Options Trading?

When a stock investor talk about a leg up or down, it refers to a price trend in a certain direction. A bullish price trend is known as an up leg and a bearish price trend is known as a down leg. However, the term leg in options trading mean a completely different thing. Leg in options trading is a name for the individual component options that makes up an options strategy.

When you simply buy or write a single options contract, you are executing a single legged options strategy. This means an options strategy that comprises of only one component options contract regardless of how many contracts are being traded. Buying one contract of call options is a single legged options strategy (long call ) and buying ten contracts of that same call options is still a single legged options strategy as only one specific call options contract is involved in that options position. Basically, legs are used to describe the number of component options in an options strategy.

More complex options strategies, such as the Butterfly Spread, can comprise of many legs in a single position. Such options strategies are known as Multi-leg Options Strategies or Multi-legged Options Strategies. The Butterfly Spread is a three legged options strategy as three different options contracts are involved in making up the strategy.

The moneyness state of a leg is also used in describing the individual legs of an options strategy. As you can see above, the butterfly spread consists of an out of the money leg (OTM leg) and at the money leg (ATM leg) and an in the money leg (ITM leg).

Legging Into an Options Position?

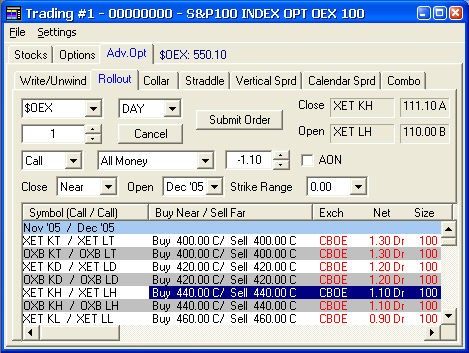

The term legging into a position or to leg into a position refers to entering a multi-leg options position one leg at a time instead of simultaneously. This is an approach used by many options professionals in order to result in better filling prices for each individual leg, thereby giving an options position a good headstart. Read more about Legging.

Popular Two Legged Options Strategies

Two legged options strategies refers to options strategies with two legs, or component options contracts. Here is a list of the most popular options strategies comprising of two legs.

Bear Put spread

This is a bearish options strategy comprising of a long put leg and a short put leg at a lower strike price. Learn the Bear Put Spread.

Long Straddle

This is a volatile options strategy comprising of a long call leg and a long put leg at the same strike price in order to profit when the underlying stock breaks out in either direction. Learn the Long Straddle.

Popular Three Legged Options Strategies

Three legged options strategies refers to options strategies with three legs, or component options contracts. There is only one options strategy with three legs that is the most popular in the options trading world and that is the:

Butterfly Spread

This is a neutral options strategy comprising of a long call/put leg, short call/put leg comprising of twice the number of at the money contracts and a long call/put leg at a higher strike price. Learn the Butterfly Spread.

Popular Four Legged Options Strategies

Four legged options strategies refers to options strategies with four legs, or component options contracts. Similarly, only one four legged options strategy is so well known almost all options traders know about it and that is the:

Condor Spread

This is a neutral options strategy comprising of long and short options across four different strike prices in order to profit should the underlying stock remain within the bounds of the middle two strike prices. Learn the Condors Spread.