Lease Purchase Pitfalls

Post on: 8 Июль, 2015 No Comment

Lease Purchase aka Rent-To-Own

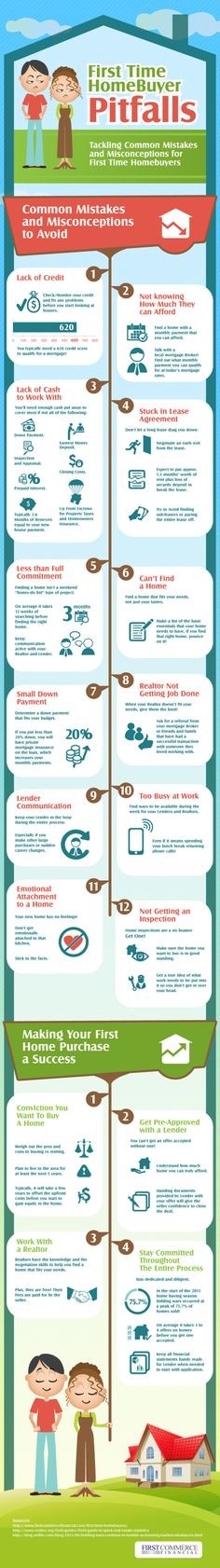

With overwhelming changes to the real estate and lending industries over the past few years, traditional means of home financing have been moved out of reach of many willing buyers. Buyers have begun to seek out creative means of financing, while sellers have looked for ways to make their home stand out, or to get it off the market. One such method that brings the two sides together is the lease purchase.

A lease purchase is a legal, binding contract between buyer and seller which establishes terms of a lease, and subsequent purchase of a particular property. All of the terms of both parts, lease and purchase, are binding. Essentially a buyer rents a property from the seller for a specific period of time and pays rent to the seller/landlord. At the beginning of the lease, both parties establish a sales price for the property, and at the end of the lease, the buyer/tenant is obligated to purchase the property by all of the terms outlined in the purchase contract.

While this scenario can be beneficial for both parties (a buyer may have time to correct credit issues or save up additional money for a larger downpayment; and a seller may take the property off the market in a saturated market while still collecting income), there are definitely many factors which could complicate the deal, much more than a traditional real estate purchase. Below are some of the stickiest areas. Knowing about them and negotiating a highly specific agreement to address these issues can help alleviate a lot of frustration, hassle, and stress in these types of contracts.

Lease Purchase Tips

Inspections/Repairs In a standard real estate contract, inspections are generally conducted within the first few days after a contract is executed. Repairs are negotiated and the seller has until closing to correct specific deficiencies. Since the time between contract and closing is much longer in a lease purchase, this leaves a lot of time for things to break. Buyers should have inspections conducted in a lease purchase initially, and outline specific repairs for a seller based on the condition of the property at the time of contract. Once those repairs are agreed to, future repairs should be addressed. If the AC system breaks after 6 months, who should pay? Parties should evaluate the Texas Property Code for a more specific outline of landlord and tenant repair obligations. Other options would be for a specific criteria regarding repairs (example: any repair costing over $500 to be split evenly by buyer and seller, all else is tenant liability). Also address who chooses repair companies.

Foreclosure If a seller has an existing mortgage at the time of the contract, the buyer may want to make arrangements to verify that the money he or she is paying each month in rent is actually going towards this existing mortgage. If the seller fails to make timely payments to their mortgage company, that lender does have the right to foreclose on the property, leaving the buyer high and dry.

Taxes Whether or not a seller has property taxes escrowed through an existing mortgage, a buyer may ask for verification that these payments are being made. Again, this would help as evidence that no foreclosure or insurmountable liens filed on the property could delay or prevent closing.

Insurance Sellers should maintain property insurance on a home throughout the term of the contract. They should consult with their insurance agent about specific coverage needed once the property becomes a rental. In addition to requesting evidence of the existence of this insurance, buyers may also want to secure their own renters insurance during the term of the lease.

Appraisal In a lease purchase, a price is determined for the purchase months or years in advance. As we have seen, many circumstances, beyond the control of either party, can drastically impact the value of a property. Establishing a price at the get-go is essentially making a prediction of value far off in time. An influx of foreclosures could drive the property value down substantially and cause the buyer to be in a position of having promised to overpay. Or incoming businesses could actually increase the propertys value more than expected and the seller would be obligated to sell the house at much less than it is worth. Both parties run a risk by setting the price so early on. An appraisal will likely be done within 60 days of the actual date of sale. Parties should prepare to address a low (or high) appraisal value as the sale date approaches, or make accommodations in preparation of this from the start.

Financing Just as it is hard to predict the real estate market over an extended period of time, it is also difficult to predict life and finances. What happens if a buyer loses his or her job midway through the lease? Or gets transferred? Or isnt able to improve the credit scores enough to qualify for the financing as they originally intended? What recourse would the seller have?

Default As these are all serious issues, the lease-purchase agreement should outline what means of recourse a buyer or seller would have, should the other party default on their obligations. If a buyer pays late on the rent, is there a financial penalty, or would the seller instantly need to go through an eviction process to reclaim the house? If the seller refuses to make necessary repairs, is the buyer still obligated to buy the property?

Its the what-ifs and the multitude of obligations involved in this type of transaction that makes it so complex. While these transactions can be beneficial to both parties, they should not be entered into lightly. In fact, real estate agents are not even allowed to conduct these type of transactions without the involvement of a real estate attorney.

Readers are encouraged to consult with an attorney before entering into any real estate contract, particularly one involving a lease purchase. This article is designed to address only a few of the many complex issues or points of contention that may arise from this type of real estate transaction. Suggestions made are not intended as legal advice.