Learn to Forecast the FX Market with the COT Report

Post on: 8 Май, 2015 No Comment

Learn to Forecast the FX Market with the COT Report 5.00 / 5 (100.00%) 1 vote

Trading in the foreign exchange market can bring an investor a substantial amount of earnings. Forex trading has many advantages to it such as a 24-hour market, low commission structure and low transaction costs. No one can corner the market in forex trading, either. However, a trader still needs to have a precise strategy to make it in forex trading. The wrong decision could cause a large loss, and forex trading does not offer the partial refunds that other trading types offer. A forex trader will want to use a tool such as the COT report. The person can forecast the FX market with the COT report.

Forex Trading Complexity

First, a trader cannot succeed in forex trading without obtaining a proper education. The individual will need to take a forex course to understand the mechanics of it. The course would explain the different aspects of trading such as chart reading, currency patterns and strategy development. A new trader may not be ready to trade successfully for six months. Forex is different from other trading systems such as binary options trading. Binary options trading does not require much training, but forex trading does. Once a person builds foreign currency skill and knowledge, then he or she can consider using the COT report to forecast market changes.

What Is the COT Report?

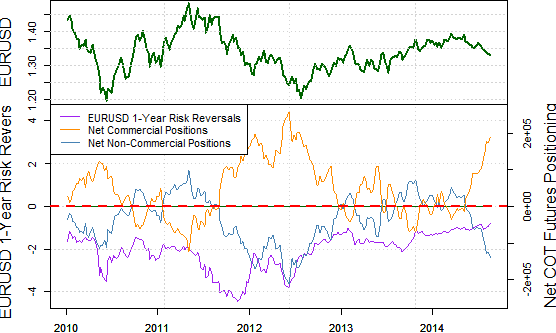

The commitment of traders (COT) report is a weekly statistical report that describes current market operations. The trick to using the COT report is to recognize its delay. The COT report is not a real-time report. The report summarizes the market activities that occurred on the Tuesday before the reports release. In other words, the COT report is three business days behind. Traders can use the COT report to gauge price action with the right timing mindset.

Information in the COT Report

A wealth of helpful information exists in the COT report. First, the report can tell a prospective trader which entities are buying and selling. Next, the report can describe the type of people who are buying and selling. Speculators fall into three categories: commercial traders, large speculators and small speculators. A commercial trader is an n entity such as a factory, producer, farmer or hedger. A large speculator is an entity such as a bank or a money manager. A small speculator is usually a single individual.

A trader will want to pay close attention to two pieces of information to forecast the FX market with the COT report. The first important piece of information is the trends of the noncommercial futures traders. The second piece of information to review is the open interest. The open interest is the number of options that have not yet been exercised. Traders who use a strategy that includes the two aforementioned figures have a 73 percent chance of predicting a correct market change in the value of USD.