Know your target date funds

Post on: 16 Март, 2015 No Comment

Share This Story

Much has been written about target date funds and their effectiveness, or lack thereof, as investment choices inside a defined contribution plan. And with both the Securities and Exchange Commission and the Department of Labor voicing their respective opinions on these funds earlier this year, it would seem prudent to prepare for the changes advocated by both of them.

If you recall, in the far distant past, when a participant for whatever reason (too many choices, too little education) was unable to select an investment option for their deferrals, they were automatically directed to something called a default investment, more commonly known as the plan’s money market fund. The theory, at the time, was that in a money market there is no risk (to the participant) of invested principal and as money market funds credit interest periodically the participant would earn something for their retirement.

The drawbacks to using a money market fund as the (then) default investment for the plan were multiple:

In a rising stock market, the returns offered by the money market paled by comparison, and as participants rarely change their initial investment option or allocation, the retirement assets available to the money market participant were minimal.

So, the Qualified Default Investment Alternative was conceived and crafted by the Department of Labor as part of the Pension Protection Act of 2006 to allow for more investment options that were potentially more profitable for the participant other than a money market. (By adopting a qualified default investment alternative to the money market, theoretically our plan sponsors are provided with a degree of fiduciary protection.)

And so, the target date funds were born and have (so far) proved popular with plan sponsors; according to a recent study, 70 percent of plan sponsors who have adopted a QDIA have chosen target date funds as their default investment.

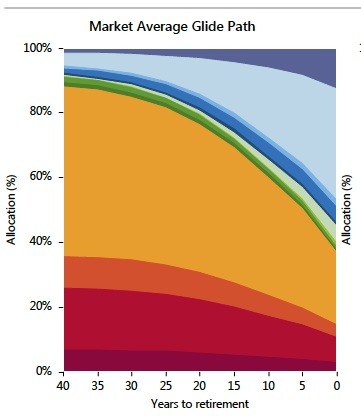

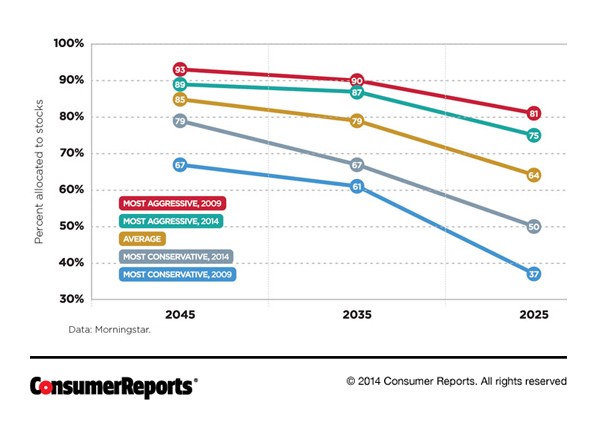

So, what’s the (potential) problem with target date funds? Suitability would be foremost. Let’s suppose you and I are planning on retiring in 2030 and while you have any number of assets you can use at retirement, I only have this target date fund. As we both progress towards 2030, the investments inside this 2030 target date fund become more conservative, which might work well for you but not necessarily well for me.

Education would be another. Using the same 2030 target date fund, the participant, whether defaulting into this option or actually choosing it needs to be made aware that investment in this type of fund provides no guarantees. And, the participant needs to know that while the asset allocation with the 2030 target date fund does change up to the target date, at some period after the target date, that allocation becomes final.

So, while target date funds may seem suitable as a qualified default investment for your plan sponsors, it would be prudent for plan sponsor and participant alike to become aware of the workings of target date funds. If you would like a copy of the Investor Bulletin released by the DOL and the SEC earlier this year, please let me know.We do recommend this bulletin be disseminated to plan sponsors and plan participants alike to further fulfill the requirement of providing education to plan participants.

Check out last month’s Retirement Matters column.