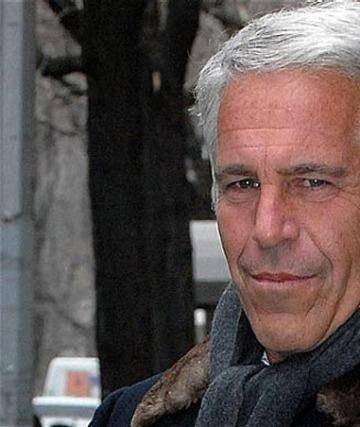

Jeffrey Epstein International Moneyman of Mystery

Post on: 9 Июнь, 2015 No Comment

Jeffrey Epstein: International Moneyman of Mystery

Epstein was in many respects the perfect candidate for Greenberg’s consideration. Greenberg, a senior partner at Bear Stearns at the time and a legendary trader in his own right, has long made it clear that it’s the hungry, brilliant guys lacking the fancy degrees that he favors at Bear. They even have an acronym: PSDs — poor, smart, and a deep desire to be rich. It was a description that fit Epstein to a T. He was a Brooklyn guy with a motor for a brain, and while he did love teaching, this close-up view of the rarefied Upper East Side life of his students’ gave him a taste for the big time.

So in 1976, he dropped everything and reported to work at Bear Stearns, where he started off as a junior assistant to a floor trader at the American Stock Exchange. His ascent was rapid.

At the time, options trading was an arcane and dimly understood field, just beginning to take off. To trade options, one had to value them, and to value them, one needed to be able to master such abstruse mathematical confections as the Black-Scholes option-pricing model. For Epstein, breaking down such models was pure sport, and within just a few years he had his own stable of clients. He was not your conventional broker saying ‘Buy IBM’ or ‘Sell Xerox,’ says Bear Stearns CEO Jimmy Cayne. Given his mathematical background, we put him in our special-products division, where he would advise our wealthier clients on the tax implications of their portfolios. He would recommend certain tax-advantageous transactions. He is a very smart guy and has become a very important client for the firm as well.

In 1980, Epstein made partner, but he had left the firm by 1981. Working in a bureaucracy was not for him; what’s more, in rubbing up against ever greater sums of money during his time at Bear, he began to feel the need to grab his own piece of the action.

In 1982, according to those who know Epstein, he set up his own shop, J. Epstein and Co. which remains his core business today. The premise behind it was simple: Epstein would manage the individual and family fortunes of clients with $1 billion or more. Which is where the mystery deepens. Because according to the lore, Epstein, in 1982, immediately began collecting clients. There were no road shows, no whiz-bang marketing demos — just this: Jeff Epstein was open for business for those with $1 billionplus.

His firm would be different, too. He was not here just to offer investment advice; he saw himself as the financial architect of every aspect of his client’s wealth — from investments to philanthropy to tax planning to security to assuaging the guilt and burdens that large sums of inherited wealth can bring on. I want people to understand the power, the responsibility, and the burden of their money, he said to a colleague at the time.

As a teacher at Dalton, he had witnessed firsthand the troubled attitudes of some of the poor little rich kids under his charge; at Bear, he had come to the realization that, counterintuitively, the more money you had, the more anxious you became. For a middle-class kid from Brooklyn, it just didn’t make sense.

From the get-go, his business was successful. But the conditions for investing with Epstein were steep: He would take total control of the billion dollars, charge a flat fee, and assume power of attorney to do whatever he thought was necessary to advance his client’s financial cause. And he remained true to the $1 billion entry fee. According to people who know him, if you were worth $700 million and felt the need for the services of Epstein and Co. you would receive a not-so-polite no-thank-you from Epstein.

It’s nice work if you can get it. Epstein runs a lean operation, and those close to him say that his actual staff — based here in Manhattan at the Villard House (home to Le Cirque); New Albany, Ohio; and St. Thomas, where he reincorporated his company seven years ago (now called Financial Trust Co.) — numbers around 150 and is purely administrative. When it comes to putting these billions to work in the markets, it is Epstein himself making all the investment calls — there are no analysts or portfolio managers, just twenty accountants to keep the wheels greased and a bevy of assistants — many of them conspicuously attractive young women — to organize his hectic life. So assuming, conservatively, a fee of .5 percent (he takes no commissions or percentages) on $15 billion, that makes for a management fee of $75 million a year straight into Jeff Epstein’s pocket. Nice work indeed.

It has been rumored that Linda Wachner and David Rockefeller have been clients, too, but both parties deny any such relationship. What’s more, who ever heard of a financial adviser turning down $500 million accounts? All the speculation and mystery has proved fertile ground for some alternative Jeffrey Epstein stories — the most bizarre of which has him playing the piano (he is classically trained) for high rollers in a Manhattan piano bar in the mid-eighties.

A nother focus of curiosity is the relationship that Epstein has with his patron and mentor Leslie Wexner, founder and chairman of the Columbus, Ohiobased Limited chain of women’s-clothing stores. Wexner, who is said to be worth more than $2.5 billion by Forbes. became an Epstein client in 1987. It’s a weird relationship, says another Wall Streeter who knows Epstein. It’s just not typical for someone of such enormous wealth to all of a sudden give his money to some guy most people have never heard of. The Wexner-Epstein relationship is indeed a multifaceted one.

Given the secrecy that envelops Epstein’s client list, some have speculated that Wexner is the primary source of Epstein’s lavish life — but friends leap to his defense. Let me tell you: Jeffrey Epstein has other clients besides Wexner. I know because some of them are my clients, says noted m&a lawyer Dennis Block of Cadwalader, Wickersham & Taft. I sent him a $500 million client a few years ago and he wouldn’t take him. Said the account was too small. Both the client and I were amazed. But that’s Jeffrey.

Epstein’ s current residence in Manhattan — a 45,000-square-foot eight-story mansion on East 71st Street — was originally bought by Wexner for $13 million in 1989. Wexner poured many millions into a full gut renovation, then turned it over to Epstein in 1995 after he got married. One story has Epstein paying only a dollar for it, though others say he paid full market price, which would have been in the neighborhood of $20 million. Epstein then undertook his own $10 million gut renovation (special features: closed-circuit TV and a heated sidewalk in front of the house for melting snow), saying to friends: I don’t want to live in another person’s house.