Is The VIX Broken

Post on: 16 Март, 2015 No Comment

by Staff November 27, 2012 8:00 am Broad Market Analysis. Media Appearances. Quick Hits 1 Comment

Last week, I shot three videos with Jeff Macke on Yahoo! Finance’s Breakout . In the first one we talked about retail stocks and Black Friday, and you can read more about it here . In this second video we talk about everyone’s favorite fear/greed index – the VIX. Below is a summary of our conversation and why I think the VIX is one of the most misunderstood concepts in today’s market. At the bottom you can view the actual live video.

- Isnt the VIX the fear/greed index? Yet, it never seems to be telling me to buy. What gives? The media has turned the VIX into this fear and greed index, yet, all the VIX is really trying to do is forecast future volatility based on various SPX options. Looking at it from a bigger picture, just about the only new products that sell on Wall Street anymore or those linked to volatility. This ties in with the overall option activity weve seen this year. In fact, we saw more than 700,000 calls added on the VIX ahead of the election as everyone prepared for higher volatility. With everyone hedged, that is exactly why when we had that quick 5% correction right after the election, the VIX was actually flat. The event was now out of the way, everyone had ‘pre-bought’ volatility to hedge against a spike in volatility, and sure enough implied volatility imploded. As you can see below, there has consistently been huge call open interest on the VIX and last month was no different.

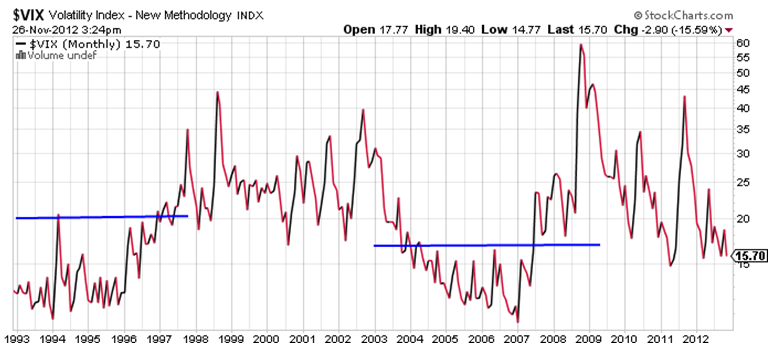

- What gets me is how everyone says the VIX is ‘low’. Yet, if you look at a longer-term chart of the VIX, weve been ‘low’ before and for several years. In the early ‘90s for years it was beneath 20 and then again last decade for several years during the bull market it was beneath that 20 area consistently. Given how many people are looking for a spike in volatility here, I wouldnt be shocked if we had another one of those multi-year ‘low’ VIX periods. It doesnt mean it’s bearish, it doesnt mean there’s complacency, it just means there might not be as much volatility.

- So what do we need for the VIX to actually spike? It very well could take another 10% correction or so, but look at what everyone was talking about heading into this year. It was the VIX, everyone wanted to be hedged against higher volatility. But take a look at the VXX, a volatility-based ETN, it is down 75% year-to-date. It has seen huge inflows, yet continues to drop lower and lower. Again, from the contrarian point of view too many people are betting on higher volatility and that makes it a crowded trade and one we’d avoid. Unfortunately, a lot of people have learned that the last few weeks, that the market can go lower and not have a spike in volatility. Lots of people thought they were hedged the past few weeks, yet, they were burned as the market went lower and their hedge didnt work. In other words, wrong on both bets.

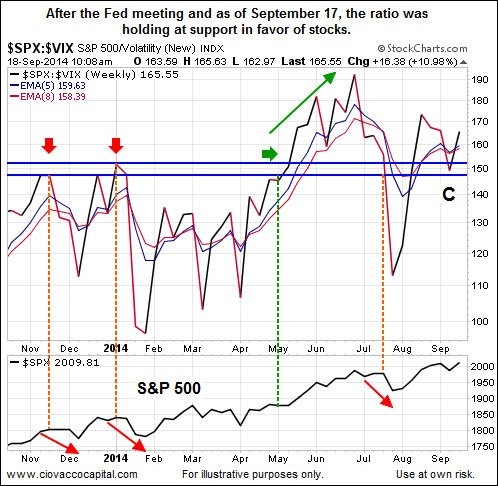

- So will the VIX just trade like a stock itself, given we’ve muted the volatility in so many different ways with all the other instruments to trade it? It very well could and that’s a good point given all the other ways to trade it, we could be muting the movements. One thing I’ve been hearing a lot about is how VIX futures are actually beneath cash VIX here and this is a sign of complacency and thus maybe a bearish sign for the stock market. First off, this is rather rare. Think about it, usually when you pay to own something in the future you will pay a premium for it. But that isn’t the case with VIX futures currently. Now, we looked into it a little more and found the last time we saw this occurrence was a year ago, late November to early December. Now think back, that wasn’t the worst time to be accumulating shares for a great multi-month rally into the April peak. So just because the VIX futures are ‘low’ again, that isn’t a bearish signal.

- Maybe the best advice is to look at the VIX and know what it is, but don’t try to get long something like the VXX. I’d agree. But there’s nothing wrong with the VXX is a short-term trading instrument for a few days, but as a longer-term hold, this is where you need to be aware that there are other factors pushing it lower and that makes it not a great longer-term hold.

More from this section