Is It Smart to Own Commodities

Post on: 25 Июль, 2015 No Comment

Don’t let it get away!

Keep track of the stocks that matter to you.

Help yourself with the Fool’s FREE and easy new watchlist service today.

Should you be investing in commodities?

That question provokes vigorous, heated debate among experts. Commodities are widely viewed as an inflation-resistant store of value. Owning gold or oil or wheat, something that will continue to have tangible value in the future, seems like a great hedge against everything from an overheated stock market to the specter of inflation, as well as helping to diversify a stock-heavy portfolio.

And with commodities like gold or oil, it seems almost inevitable that demand will eventually outpace supply. For many, that’s a compelling reason to invest. But if you look a little deeper, there are reasons to steer clear as well.

Hope you’ve got a big barn

First off, most investors who own commodities don’t actually own commodities. While it isn’t too hard for ordinary folks to own and store a small amount of gold or silver, most individual investors aren’t equipped to deal with crude oil or cattle or a few silos of wheat.

Instead, most investors who want commodities exposure get it by investing in derivatives like futures contracts, in the stocks of companies that develop or sell commodities, or in funds or ETFs that hold stocks, derivatives, or (occasionally) actual physical commodities. Most investors are better off leaving futures contracts to professionals, but individuals have plenty of options for adding commodities exposure to their portfolios:

- Funds and ETFs. Few individual investors trade futures directly, but funds and ETFs that hold commodities futures and stocks are quite popular. These range from the entertainingly tickered Market Vectors Agribusiness ETF ( NYSE: MOO ). which holds a basket of agriculture-related stocks including Archer Daniels Midland and PotashCorp. to high-volume entries such as United States Oil Fund ( NYSE: USO ). an ETF that holds crude oil futures. A few ETFs, such as the popular SPDR Gold Trust ( NYSE: GLD ) and iShares Silver Trust ( NYSE: SLV ). hold the relevant commodity directly.

- Commodity-related stocks. Lots of companies have commodities exposure to some degree — automakers buy steel and rubber, airlines buy jet fuel, cookie-makers buy grain, and so forth. But some companies are worth buying specifically for the exposure. These can range from the obvious, like ExxonMobil ( NYSE: XOM ). to a company like CGG Veritas ( NYSE: CGV ). which makes seismic detection equipment used in oil and gas exploration. Both of these stocks will tend to rise and fall with oil prices to some extent, but — unlike an ETF like United States Oil Fund — buying a stock gives you exposure to a corporation as well. That can be good (think dividends) or bad (think mismanagement), but either way, it means that your investment requires an additional layer of research beyond I think oil prices are going to go up.

So now we know how to get commodities exposure into our portfolios. But should we?

The ups and downs of commodities

In the new issue of the Fool’s Rule Your Retirement newsletter, available online at 4 p.m. ET today, advisor Robert Brokamp ponders the ups and downs of holding commodities in a long-term portfolio.

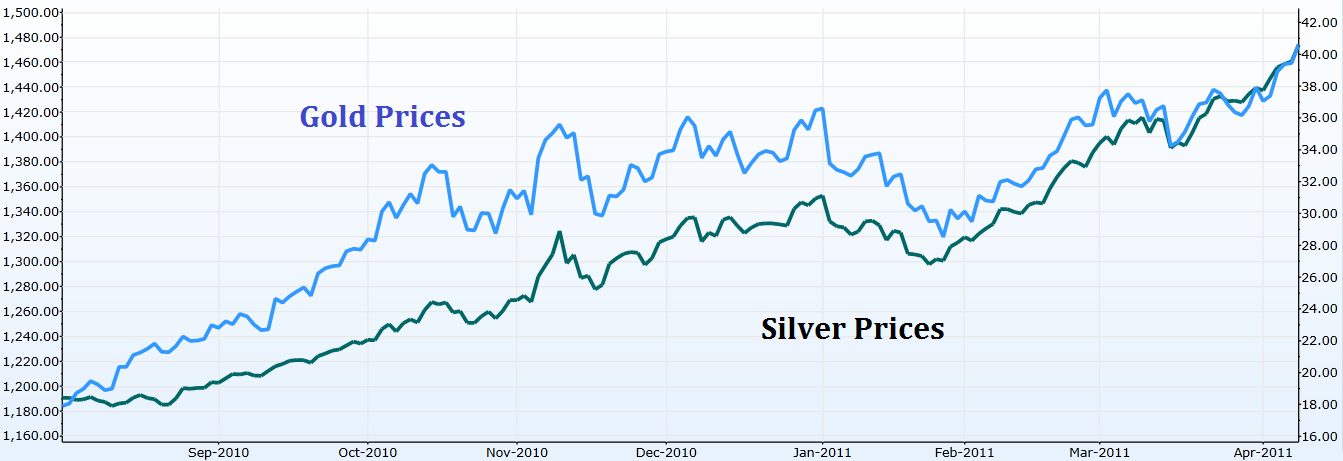

It turns out that ups and downs is an apt term, as commodities’ volatility takes many investors by surprise. Shares of iShares Silver Trust fell 30% in a week recently, as global markets were rocked following a hike in margin requirements by a major exchange. Silver wasn’t the only turbulent commodity; oil prices dropped by more than 15% during the first week of May.

Such gyrations are fairly common in the commodities markets, which tend to be bubble-prone and sensitive to geopolitical events. While there are times when commodities are the best thing to own — generally, when everything else is headed south, like during a global crisis — there are also times when commodities are the only asset class that isn’t going up, frustrating investors.

So what to do? While Robert isn’t a fan of commodities for long-term investors, he does acknowledge that devoting a small piece of your portfolio to commodities can have benefits. I agree, and if you’re interested in some lower-drama ways to add commodities exposure, I encourage you to check out Robert’s article — and especially the list of commodities-oriented mutual funds he suggests.

Rule Your Retirement is a paid service, but don’t let that stop you. You’re just a few seconds away from full access with a free 30-day trial. There’s absolutely no obligation to purchase — just click here to get started.

Fool contributor John Rosevear has no position in the companies or funds mentioned. The Fool owns shares of CGG Veritas. You can try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy .