Is Cash Value Life Insurance A Good Investment

Post on: 19 Май, 2015 No Comment

(By Miranda Marquit) As you put together your financial plan. one of the items you need to make sure you include is life insurance. Life insurance protects your family in the event that you meet an untimely end and your income is no longer available to support your family in a financial manner.

One of the options you have as you put together your stated plan is cash value life insurance.

What is Cash Value Life Insurance?

As you choose a life insurance policy, you are usually confronted with two options. You buy a policy that expires after a set period of years, and that has a lower insurance premium, or you can choose a policy with a higher premium – but that has the potential to build cash value over time. A policy that builds cash value also has the added attraction of having no expiration date; instead it covers you for your entire life as long as you continue to pay the premiums (and the insurance company doesn’t go out of business).

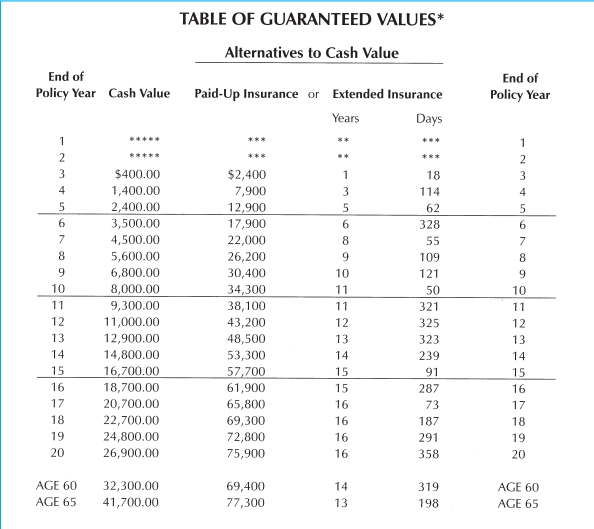

The theory behind cash value life insurance is that you pay a higher premium, and a portion of your premium is invested in a way that provides you with a return over time. As you continue to make premium payments, your cash value increases.

Many insurance companies allow you to borrow against the cash value these life insurance policies accumulate. You can also, later on, decide to cash in your insurance policy on your own and receive the cash value of it.

Is it a Good Investment?

Cash value life insurance is often marketed as a good investment. The returns are safe, since they are yours, no matter what. How much of a return you earn each year might be subject to market conditions, but once the money is in your account, it’s yours. Some insurers even guarantee a minimum return – although it’s not going to be a very big return.

However, whether or not cash value life insurance is actually a good investment depends on your own needs and goals, and what you expect to get out of your insurance policy. If you are looking for a vehicle to provide asset protection for your loved ones in the event of the unthinkable (and you like the idea of coverage that doesn’t expire), and you think it would be nice to earn a return on the side, cash value life insurance can work for you.

On the other hand, if you are trying to build a retirement nest egg, the reality is that the return you will likely receive from such a policy will be too small. Realistically, you can’t pin your retirement hopes on the return from your cash value life insurance policy. You are usually better off investing in a low-cost index fund over a period of decades if you want to build wealth.

Consider your long-term financial goals and your needs. Then decide whether you want to invest in cash value life insurance, or whether you’re better off getting term insurance and investing the premium savings into something that offers the potential for better returns.