Is Bankruptcy The Best Option For You Finance and Investment

Post on: 16 Март, 2015 No Comment

Is Bankruptcy The Best Option For You?

For some, personal bankruptcy is a concept shrouded in mystery and fear. However, the fact is that it can be a helpful tool for those who need a fresh financial beginning. The key to approaching bankruptcy in a sensible manner is thorough knowledge of the subject. Apply the tips in this article to your personal circumstances, and you will be able to view bankruptcy in a new, rational light that may pave the way to brighter days for you and your family.

Laws regarding bankruptcy vary by state, so you need to find a lawyer that can walk you through the entire process and help keep your rights protected. In several cases, you can keep your car and your home, but its your attorney that will tell you what rights you have, what you can keep, and what you will need to surrender.

A critical tip for anyone considering a personal bankruptcy filing, is to make sure not to wait too long to seek relief. Delaying a bankruptcy filing can result in potentially devastating events. including home foreclosure, wage garnishments, and bank levies. By making a timely decision to file, it is possible to maximize your future financial options. Getting a clean start faster than you may have thought possible.

A huge mistake people make before filing for bankruptcy is maxing out their credit cards. This can lead to disaster when you file and the credit card companies might not discharge the debt. If you can, you need to stop using your credit cards at least six months before you file, and ideally for a year prior. Also, do your best to pay the minimum payments on these cards for at least six months before you file.

Before resorting to bankruptcy, contact your creditors in a good-faith effort to renegotiate your payment terms, or interest rate. If you get in touch with them early enough, they may be willing to waive fees or negotiate a new payment schedule. If they are it means they are more likely to receive the money that you owe.

Dont wait too long to file for bankruptcy. So many people suffer with debts, and sleepless nights for years. They could have filed for bankruptcy, and been in the clear by now. If you are thinking about filing for bankruptcy, time is of the essence. Make the decision so you can move on that much quicker.

Make sure that you pay all of your bills on time, since this will contribute to 35 percent of what is on your credit report. This looks good if you are trying to rebuild your credit after you have had to file for bankruptcy. Making on-time payments will increase your credit score.

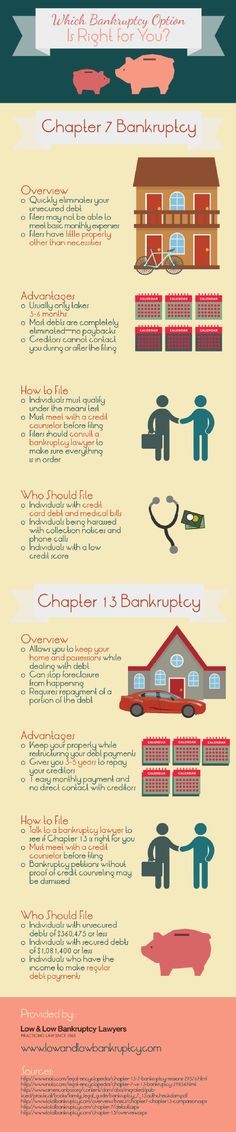

Before deciding to file for bankruptcy, you may want to look into other options. Remember, when you file for bankruptcy, you are greatly hurting your credit score, which in turn, can prohibit you from buying a house, car, and other big purchases. Consider safer, alternative methods first, such as consumer credit counseling.

Bankruptcy laws vary from state to state. Play it safe and hire an attorney that works in your own state to be sure that the correct laws are followed. Some lawyers are better than others, so be sure to select one that is qualified to handle your case. It could make a big difference in how smoothly things go and the end result.

It is important that you dont let bankruptcy get you down in the dumps. Bankruptcy can be a challenging time in anyones life, but it is meant to give you a fresh start, enabling you to establish good credit and move toward a better future for you and your family. Remember, bankruptcy is your legal right, so dont feel guilty or ashamed of taking advantage of it. If you do feel that you are suffering excess anxiety or depression over financial issues, counseling may help you to better deal with your emotions and concerns.

It is quite common to view personal bankruptcy as something to be avoided at all costs. The truth for many consumers, however, is that it represents the best way to regain control over their financial futures. In order to understand the best way to use personal bankruptcy filing to your advantage is to acquire solid knowledge of the topic. Take the ideas in this piece to heart and you will have a better idea of how best to move forward regarding personal financial matters.