Is Apple Stock Too Expensive Try Options (AAPL)

Post on: 25 Июнь, 2015 No Comment

With the largest cap value in the market of $628.42 billion, NASDAQ -listed Apple is known as the most valued company in the world, far ahead of the next two most valued companies – Exxon Mobil ($388.31 billion) and Microsoft ($378.47 billion). (Figures stated are as of January 2015).

The 7:1 stock split in June 2014 managed to bring down its stock market price by a factor of 7 (from $645.57 to $92.22), while keeping the overall company valuations unchanged. (For related reading, see: How To Profit From Stock Splits And Buybacks ).Though the split made the stock price relatively affordable for small investors, the price — hovering in the range of $107 — is still considered expensive by many small and workaday investors. High-priced stocks are often perceived as over-valued, with little or no room for further appreciation, while low-priced stocks are seen to have more growth potential (hence investors tend to go after penny stocks ). Stock splits generate more liquidity due to low prices, which leads to more market participation, which includes small investors. (For related reading, see: The Lowdown On Penny Stocks ).

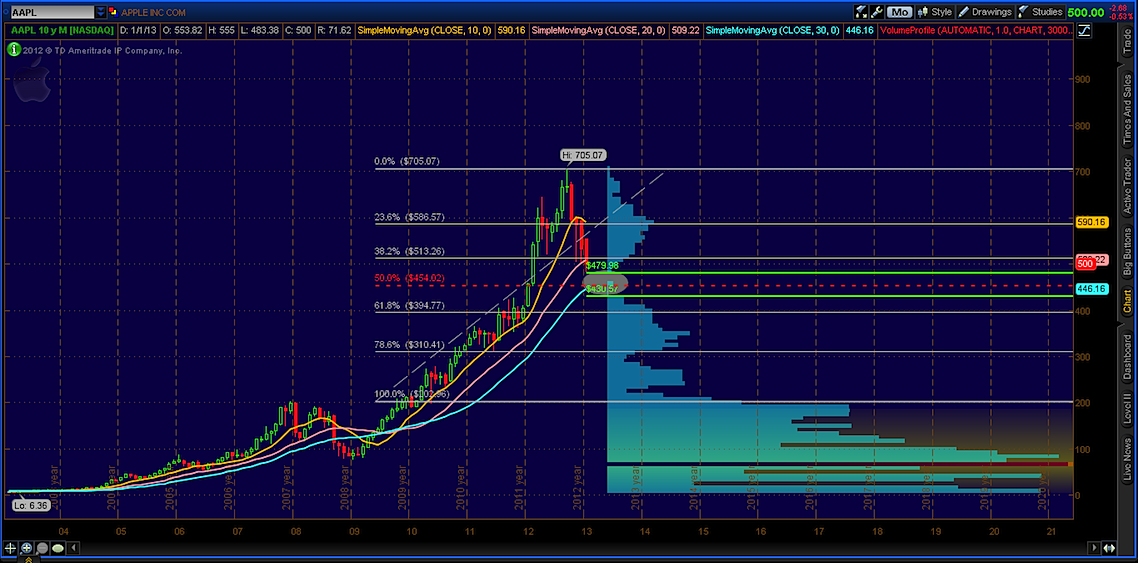

Apple’s post-stock-split performance

Although the Modigliani-Miller (M&M) Theorem states that businesses don’t create any additional value just by reorganizing their corporate equity structure (such as a stock split), historical data confirms that splitting a stock does have a positive impact on stock price. WSJ provides the following data about stock performance being better in the long run, subsequent to a split:

Challenges in trading Apple stock

Even after the stock split by a factor of 7, the price above $100 makes it difficult to attract common investors (psychological price barriers). But there are other ways to trade Apple through low-cost options.

To maintain a base case for comparison, assume that an investor has $2,000. He can therefore purchase 20 Apple shares, assuming the price is $100. Let’s keep the price target of $135 on long positions (35% profit) and $80 on the downside (20% loss).

Trade Apple stock through options and option combinations

Options trading not only allows a lot of flexibility to match the stock trades at a fraction of the cost, but also enables investors to create different combinations with varying returns to suit their risk appetite. (For related reading, see: Measuring And Managing Investment Risk ).

First things first – decide your time horizon for investment in Apple.(See: Understanding Risk And Time Horizon ). NASDAQ allows up to two yearlong options to be traded for Apple (screenshot of available Apple options in January 2015 showing option contracts up to January 2017):

Let’s assume a two-year-long duration. Next, take a directional view to trade. Will the price go up (long stock position) or will it go down (short position ) in the desired time horizon?

Let’s now create the Apple option position to fit the trading strategy

The company has maintained its top spot even after the passing of Steve Jobs. Overall, the increased liquidity in the market as seen after the stock split appears to have a positive impact, with a price rise from $92.2 to present-day $100, with AN intermediate high of $119. (See: Why Is Liquidity Important? ). Assuming the potential for further appreciation to a price target of about $135 within 2 years, here’s how a common investor can benefit from trading options on Apple, instead of the stock itself.

In this scenario, it is possible to purchase a call option on Apple stock with an ATM strike price of $100 that is expiring in Jan. 2017, and is currently available for $20 (option premium ). With $2,000 trading capital. you can purchase 100 call option contracts. If the price target is reached and the underlying Apple stock touches $135 during the two-year time span, the trader will benefit by a minimum of ($135-$100) * 100 contracts, i.e. $3,500. That is a 175% profit on the capital amount of $2000 (compared to a mere 35% that would have been netted on an actual stock trade).

However, the downside is proportional. If the Apple stock tanks to $80, the call option will be worthless upon expiration and the trader will lose the entire $2,000, i.e. a 100% loss, much worse than the 20% loss she would have suffered on the actual stock trade.

To improve and mitigate the risk of 100% loss, let’s replicate the exact stock position using an ATM long call and short put option:

The long call costs $20, and the short put gives $19. Net price to replicate the stock position is $1. (For more, see: Managing Risk with Options Strategies: Long and Short Call and Put Positions ). However, the short put will require margin money, which varies from broker to broker. Assuming $1,800 is needed for a short put margin, the remaining $200 can get us 200 similar stock positions. If the price target of $135 is achieved, the trader will earn $35 *200 = $7,000 profit. If the price hits $80 on the downside, the loss will be limited to $20*200 = $4,000. In this case, more leverage leads to high returns and relatively lower risk potential.

Furthermore, assume that trader has a defined profit level and risk level (he is fine with a maximum profit of $16 and maximum loss of $14). A bull call spread will be ideal.

It is comprised of:

1) A long call with $90 strike price costing $28 (Green Graph)

2) A short call with $120 strike price giving $14 (Pink Graph)

3) Net position reflected with the Blue Graph

4) Taking A net cost of $14 ($28-$14) into consideration, the net payoff function is reflected in the dotted Blue Graph.

In this case, the maximum possible loss is limited to $14, while maximum profit achievable is $16, irrespective of which way and how far the Apple stock price moves (i.e. limited profit, limited loss scenario).

Similar to above (price appreciation scenarios), Apple options and combinations can be created for declines – long put, combination of short call and long put. and bear put spread positions. (For more, read: Three Ways to Profit Using Call Options ).

The Bottom Line

Apple options are highly active and liquid, enabling price fairness and competitiveness. Using options to replicate stock positions at a fraction of the cost has the benefit of leverage (high returns) and the ability to apply various combinations to suit the desired risk-return preference. Along with standard options traded in lot size of 100, mini options are also available in lot size of 10.

But option trading comes with risks of high loss, margin requirements and high brokerage charges. Moreover, stocks can be held for an infinite period, but options have expiry dates. Traders attempting to replicate stocks with options should remain alert of the pitfalls and trade cautiously.