Iron Condor Trading Iron Condors in a Volatile Market

Post on: 16 Март, 2015 No Comment

Trading Iron Condors in a Volatile Market

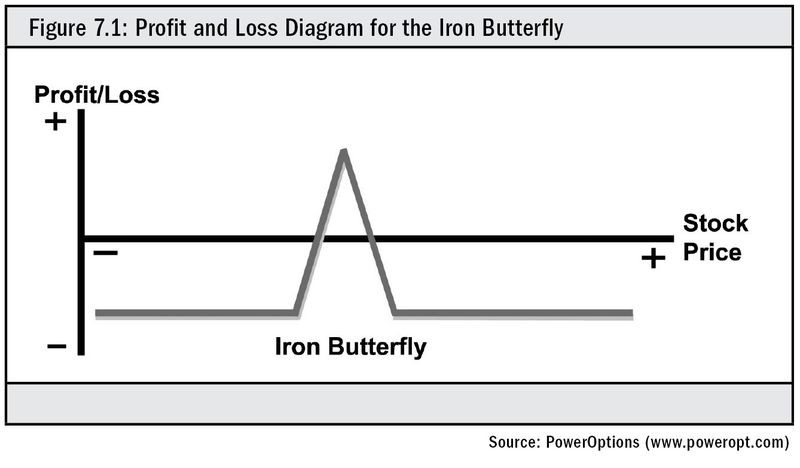

Im an iron condor trader. An iron condor is an option strategy in which you sell a call spread and a put spread with the same expiration date on the same underlying asset. I understand the risk and reward potential for these positions and recognize that skillful risk management is crucial to my success when trading these negative gamma positions.

The best part of trading iron condors occurs when the markets are calm and no adjustments have to be made. In those rare situations, I eventually cover my shorts and bank the profits.

In the current volatile market, there is little peace. Depending on the strike prices chosen, iron condor traders are making frequent adjustments to their positions. That thought took me down a strange path. Looking ahead by a few days, it occurred to me that:

1. Its very likely the underlying asset will move sufficiently so that the iron condor is no longer delta neutral (due to negative gamma).

2. If that happens, the position will have lost an unknown number of dollars.

That leads to this quandary: Why should I trade the iron condor today, when it is very likely to trade at a higher price soon? Why not simply wait for that higher price to enter the trade?

If I were to follow that unusual line of thought, I would proceed as follows:

1. Choose a specific iron condor and estimate the premium I can collect at that time.

2. Do not enter the order.

3. Wait until that trade is losing money, i.e. I can collect a higher premium.

4. Open the trade and collect that higher premium.

Obviously this trade is no longer delta neutral, nor is it likely to be the trade I would select at the future date. But its the position I would normally open today. By waiting I get to make the same trade at a better price. Doesnt that have to be better than owning it at a worse price?

By the time I enter the trade, the position may require a minor adjustment. No problem. I just open the slightly adjusted position in place of the original.

To adopt this idea, I cannot allow much time to pass or I may miss a profitable trade opportunity.

Thus, the quandary: Why trade now?

By collecting that better price, I have more risk than I prefer when making a new trade, but to compensate, I collect additional premium. I would be facing this risk had I already owned the position, so why not own it several days later with the same problem, but at a better price?

Another point to ponder: Is this truly taking on more risk?

By not opening the position sooner, I had zero risk of loss (or profit) during the time that I had no position. The easiest method for avoiding a disaster is to be out of the market. Is the benefit of a few days on the sidelines enough to offset a bit of extra risk when the non-neutral position is opened late?

And, if that quandary is not sufficient, why not take an additional step? Instead of waiting, what about opening an unbalanced iron condor right now?

I would be forced to make the trade with a choice of extra upside or downside risk, rather than allowing the market to force that decision upon me. I can go even further by opening half the trade with an upside bias and half with a downside bias.

The real question is: Does it make sense to open an iron condor position at the time I am ready to trade, or is it better to either:

1. Wait for a better price, or

2. Open two unbalanced iron condors in place of a single, neutral iron condor?

Opening positions that are not neutral when I dont have a market opinion feels wrong. Yet, the probability is very high that Im going to have that position anyway. And soon.

Why not take advantage of that by opening those two non-neutral iron condors at a better price now?

I do that by choosing an iron condor that is already unbalanced. Because it is no longer neutral suggests that it is losing money.

Bottom line: It appears that I can take advantage of the fact that whichever iron condor I choose is likely to be a (hopefully temporary) loser at some point in time. But by waiting for it to become a loser and delaying initiating the position until that time, a better premium is collected.

Logic tells me this is not sound reasoning. Yet, I cannot find a flaw in my argument. A quandary, indeed.