Iron Condor Strategy_2

Post on: 26 Июнь, 2015 No Comment

Analyzing risk/reward

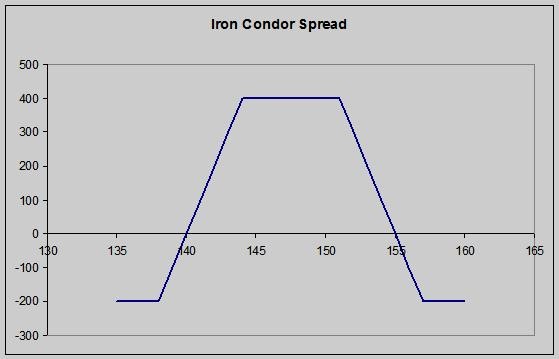

The Iron Condor is a defined risk strategy. I know up front exactly what my maximum profit and maximum loss are. These are the absolute extremes of the trade. The maximum profit is the credit I receive. Just like in the short vertical spread strategy, I will receive a credit for the spread sold. In this case, I receive a combined credit for each of the spreads.

The maximum loss will be the result of having the underlying instrument be totally above the short call spread or completely below the short put spread. In this case, the maximum loss will be the difference between the short and long strike prices minus the credit.

With the Iron Condor, I am effectively receiving twice the credit by selling both the call and put spreads and taking no additional risk over selling either one or the other of the vertical spreads. That’s the beauty of this strategy when traded in the appropriate climate .

In the above diagram, I’ve selected short strikes of $19 put and $23 call. These each have a delta of about .30. With this trade, the net credit is $.96. The maximum risk is the different between the strike prices ($2) minus the credit or $1.04. This makes the reward/risk of the trade about .92:1 or very close to 1:1.

When trading this strategy, there are several exit rules I follow that can alter my reward/risk. When trading the more aggressive approach with higher deltas and a higher overall credit, I’ll exit when I can lock in 50% of the credit. In this case, if I can close the trade for $.48 or less, then I still keep $.48 and my return on risk is about 46%.

Why is that? If I just let the trade go until expiration, the most I risk is still $1.04. So my return on risk is $.48/$1.04 or 46%. I like to exit the trade in this case because I have a guaranteed profit in the trade and it will raise the probability of success.

Placing the order

Prior to placing the order, I’ll need to determine the size of my position. I do this based on the maximum loss for the more aggressive strategy. In past strategies, I’ve used a total risk amount of $1000. Since I know the most I can lose on the trade is $1.04, I can calculate the position size as $1000/(1.04 x 100) or 9.6 contracts. I’ll round that number down to 9 contracts.

Many brokers require approval for level 3 trading authority, which allows right to trade spreads. Before you begin trading spreads, you may want to check with your broker to make sure you are approved.

As orders go, this is a fairly complex one. I am attempting to buy a call, sell a different call, buy a put and sell a different put. Most brokers support the ability to enter this trade as a simultaneous order. Many even recognize this order as an Iron Condor and will only set aside margin for one side.

Some brokers designate opening and closing orders differently. In this case, I might place the order as ‘Buy to open the April 25 call, sell to open the April 23 call, sell to open the April 19 put and buy to open the April 17 put for a net credit of $.96′

Because of the number of options (or legs) in the Iron Condor, the price between the bid and ask price for the total spread may be somewhat wide. I will usually attempt to put the order in for somewhere near the mid price or slightly toward the bid price. I may wait up to an hour to get filled but it is worth it if I can get a better price.

Trade Exit

I’ve already mentioned that I like to close my Iron Condor trade when I can lock in 50% or more of the credit. There are a couple of other exits I use as well. Let me outline the exits here.

- When I can close for 50% or less of the initial credit. I can even leave a standing order (or good until canceled order) to buy back the entire position when I can do it for 1/2 the initial credit.

- If the stock moves strongly one direction or the other, I’ll usually try to close the opposite side of the spread for about 10% of the initial credit. For example, let’s assume that EEM moves strongly to the up side. In this case, my put spread could decrease significantly in value. I’ll simply close it when I could close it for about $.10 (that’s roughly 10% of the initial $.96 credit).

- I prefer to close the trade at least 4-5 days before expiration. At this point, I’ll either have a partial profit or partial loss. In either case, if I close at that point, I can minimize the risks of trading in the last week (called gamma risk). That means relatively small changes in the price of the underlying can have a large affect on the price of the options, especially those close to the current stock price.

Summary

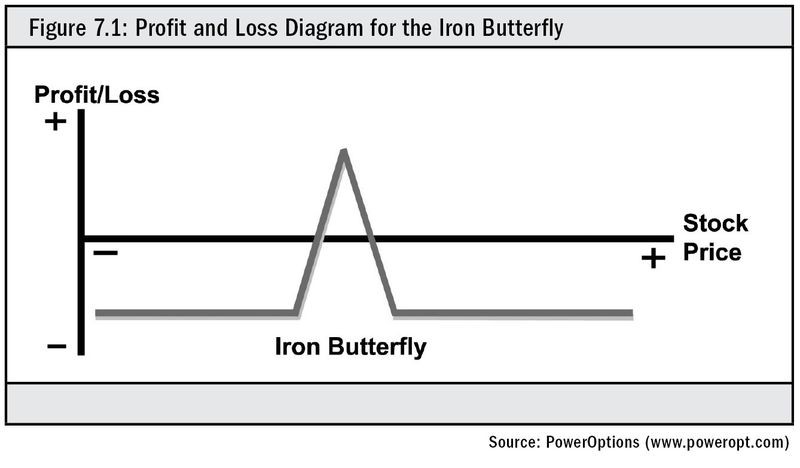

The Iron Condor strategy isn’t nearly as complex as it appears. It can be a very nice strategy in a situation where the stock, ETF or index is trading in a range. In addition, since I am selling two short vertical spreads, I am taking advantage of the passage of time. In addition, this strategy benefits from a decrease in volatility since that will in turn decrease the price of the options.

This has been a quick run through the Iron Condor strategy. In the process, I’ve covered some of the key elements of a trading plan as well. These are based on a set of trading rules I follow, which are part of an overall option trading system I follow. This is a critical aspect of successful options trading. I’ve found I can’t be successful trading any strategy just by knowing the mechanics. Having a system that defines what I do every time I trade is what helps me be consistent in my profits.