Iron Condor options strategy Fidelity Investments

Post on: 26 Июнь, 2015 No Comment

Your e-mail has been sent.

Although volatility has risen during August 2014, in reaction to rising geopolitical risks around the world, it is still relatively low by historic standards. To wit, the CBOE Volatility Index ® ( VIX ), commonly referred to as the “fear index,” has risen from a near-term low of 10.32 in early July 2014 to 15.85, as of August 6, 2014. That is still well below the 2014 high above 21, and nowhere close to the mid-2011 spike above 43.

If you are an experienced options trader looking for a limited-risk strategy that can take advantage of low volatility, the iron condor might be the way to go.

How do you construct an iron condor?

The iron condor is a combination of two vertical spreads—a bear call spread and a bull put spread. This strategy has four different options contracts, each with the same expiration date and different exercise prices.

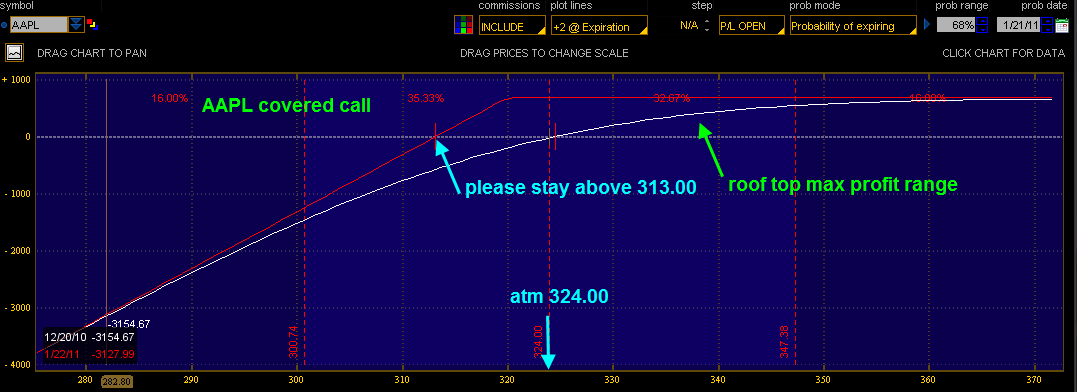

Profit/loss diagram of an iron condor

Screenshot is for illustrative purposes only.

To construct an iron condor, a trader would sell an out-of-the-money call and an out-of-the-money put, while simultaneously buying a further out-of-the-money call and a further out-of-the-money put. Like the butterfly spread. the iron condor gets its name from the profit/loss diagram that resembles a large bird with wings.

The primary reason that a trader would consider the iron condor strategy, compared with other low volatility options strategies, is that it allows the trader to collect two sets of premiums, instead of just one. However, it’s important to realize that there are additional costs associated with option strategies that call for multiple purchases and sales of options, as is the case with an iron condor—due to there being four legs of the trade.

The objective of the iron condor

Traders who think an underlying security’s price will not move much by expiration and want to limit their risk could consider constructing an iron condor. The benefit of this strategy, as previously state, is that it allows a trader to collect two sets of premiums—one for selling the credit call spread and one for selling the credit put spread. Additionally, the margin requirement to support the position is limited to just one spread, allowing for a higher potential return on investment.

The iron condor is a limited-risk, limited-profit strategy that benefits from low volatility in the underlying security while the strategy is open. Maximum profit potential is the credit received at the outset of constructing the position and is earned if the underlying asset does not move much (that is, it settles between the two inner sold options at expiration). 1

A loss on an iron condor would be realized if the underlying security’s price did move and closed outside the inner strikes. The maximum potential loss is calculated as the difference between the strike prices of either spread, times the contract size, less the premium received at initiation.

Understanding the maximum potential profit and loss is crucial to an iron condor trade. The strategy is designed to generate a small profit, and while the potential loss is larger than the profit potential, the loss is capped. Moreover, depending on how the iron condor is constructed, it is possible to increase the probability of a profitable trade, albeit at the expense of profit potential. So, you can trade off some upside profit potential for increasing the likelihood of a profitable trade.

A hypothetical iron condor trade

Assume that on December 1, XYZ Company is trading at $50. To construct an iron condor, a trader would initiate a multi-leg options strategy. This could be done by purchasing one January 40 put with a $0.50 premium at a cost of $50 ($0.50 premium times 100 shares controlled by the one contract) and one January 60 call with a $0.50 premium at a cost of $50 ($0.50 premium times 100 shares controlled by the one contract). At the same time, to complete the iron condor a trader would sell one January 45 put with a $1 premium at a credit of $100 ($1 premium times 100 shares controlled by the one contract) and one January $55 call with a $1 premium at a credit of $100 ($1 premium times 100 shares controlled by the one contract).

Here is what the trade ticket might look like:

Screenshot is for illustrative purposes only.

In this scenario, the trader would receive $100 at the outset of the trade ($200 received from the sold 45 put and the 55 call, less $100 for the purchased 40 put and the 60 call). This $100 credit is also the maximum profit potential. If the underlying stock were to settle anywhere between the two inner sold options (the 45 put and the 55 call) at expiration, the maximum profit potential would be realized. This is because all four options would expire worthless, and so the trader would get to keep the premium received at the outset.

If XYZ stock closed anywhere outside the profit range ($45–$55), a loss would be incurred. For example, if it moved to $40 at expiration, a loss would be incurred because all the options would expire worthless, except the sold 45 put. This option would be worth $5 to the person you sold it to (45 minus 40, times 100 shares controlled by the contract). Hence, the maximum loss of $400 is realized ($500 loss on the 45 put, less the $100 credit received at initiation). Similarly, if the stock moved to $60 at expiration, all the options would expire worthless except the sold 55 call. Again, this would result in the maximum potential loss of $400. It is worth noting that, even if the underlying stock fell below $40 or rose above $60, the loss cannot exceed $400 because of how the iron condor is constructed.

More tips

Choosing the proper strike prices is crucial to being successful with the iron condor. It is important to understand the trade-off between the probability of success and maximum profit potential. Traders will seek to position the sold strike prices close enough to produce a higher net credit, but far enough apart that there is a strong probability of the underlying asset’s settling between the two at expiration. By narrowing this range, a trader is reducing his or her probability of success. The further apart these strike prices are, the better the probability of the underlying security’s settling between the two prices at expiration.

One way to forecast this probability is by using delta. A short contract with a delta of 0.05, for instance, would be two standard deviations, representing a 95% probability of the contract’s expiring out of the money. The trade-off for this very high probability of a successful trade would most likely be a very small credit received. As previously mentioned, you can also adjust your desired profit in order to increase or decrease the probably of a profitable trade.

The most significant factor is your volatility expectation. Volatility is currently low, but that could change at any time. If you do believe that this low volatility environment will persist, iron condors can be a powerful, limited-risk tool.

Learn more

- Discover more about trading options .

- Find options contracts .

- Test single- and multi-leg options strategies with a strategy evaluator (login required).