Iron Condor Option Trading Mini Course

Post on: 26 Июнь, 2015 No Comment

In this multi-part mini course, I plan on explaining the major facets of the Iron Condor Option Trade. First I will go over the basics of the trade, the philosophy, the risk, putting the trade on, and possible adjustments

Part 1: Iron Condor Spread Basics

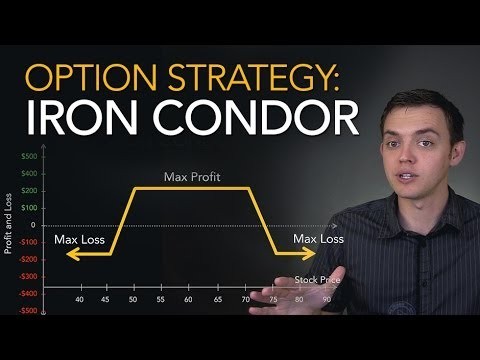

The iron condor is an option trading strategy that uses two credit spreads.

The strategy is simple: Sell credit spreads out of the money: both puts and calls thus creating a “box”. As long as the underlying, stock, etf, or index stays within this box, the trade makes money. Since you are selling options the trade results in a credit, and this credit is the maximum amount you can make on your iron condor trade .

When you place an iron condor trade. you will be selling the condor. In most circles this is considered a short iron condor. I myself do not know too many traders that trade long iron condors. mainly because in a long iron condor you want the stock to move a lot and if you feel a stock is going to make a large move, there are other option strategies that can make you more money. So I will focus on the short iron condor.

When you trade an iron condor. you want the underlying not to move very much. The biggest threat of the iron condor is a large move in one direction, especially if it is early in the trade. The condor is a slow trade, meaning that it takes time for the options to decay and lose value.

The iron condor is also considered a very conservative trade because you can set it up to have a very high probability of profit. The iron condors I trade are in the 75-80% probability of profit range. And since the underlyings that I choose do not move much, I do not need to spend much time monitoring my position.

Let’s look at an iron condor example. Let’s say I trade a condor spread on IBM. If IBM stock is selling at 100, I might short the following iron condor :

- Sell the 115 Calls, Buy the 120 Calls.

- Sell the 85 Puts, Buy the 80 Puts.

This trade creates a box that puts my expiration breakeven points at roughly 85 and 115. As long as IBM stays within those prices, my iron condor example will make money.

If I have this trade on, I can check IBM’s price movement 1-3 times a day. As long as it is not near an adjustment point, I don’t have to do anything.

The Lazy Trade

Put it on, watch it once or twice during the day, and that’s it. Entering the trade takes less than ten minutes when you know what you are doing, adjusting it takes just as long if you have a trading plan, and exiting the trade can be as easy as doing nothing and letting the options expire worthless or exiting the trade (which is the same as entering but easier).

The Benefits of the Iron Condor

- High Probability of Profit

- High monthly return on investment: 8-15% a month

- You can do the same trade month after month on the same underlying. You do not need to “wait for a set-up”.

- Easily adjusted so you can save your trade if it goes against you.

- Takes very little of your time.

- Can be done anywhere in the world with access to the internet.

The Negatives of the Iron Condor

- Since the reward is high, the risk can also be high. An iron condor trader can risk $9 to make $1. He will win most months. But even one loss of $9 will wipe out several months of gains.

- The trade takes time and patience. A trader has to wait for the options to lose value.

- The iron condor is not the best trade in very volatile markets.