Iron Condor Iron Condor The Importance Of Learning How To Adjust

Post on: 7 Апрель, 2015 No Comment

Saturday, April 10, 2010

Iron Condor — The Importance Of Learning How To Adjust

The iron condor method is a fantastic method for option traders wanting to profit via the stock market with out having to pick direction. Essentially, these option trades execute finest in non trending markets, however, they can in addition be fruitfully made use of during trending and much more volatile markets providing the one trading them gets the know-how and the ability to take the time needed to effectively handle and adjust them.

This can be a spread that will take benefits of theta decay in options — that options really are a decaying asset and lose value with time. When iron condors are placed, and expiration day approaches — provided that the ‘sold’ strikes of the placement are set far enough past ‘harms way’, these trades can normally expire worthless supplying the iron condor trader an amazing return in a very short timeframe.

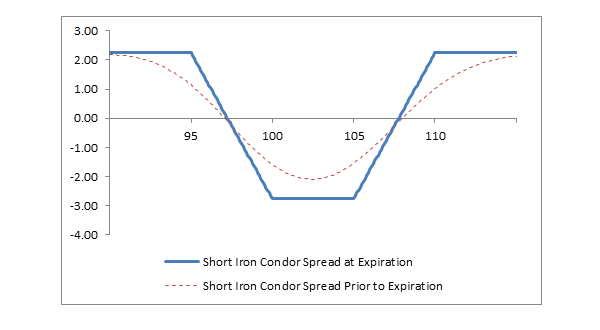

Iron Condors are in fact made from 2 independent credit spreads — one on both end from the location where the underlying being used is currently trading at. Situated on top of the underlying latest trading price is a bear call spread. Positioned under the present trading price is a bull put spread. With regards to the broker used, these can be placed individually as unique vertical spreads- or together united iron condor trade.

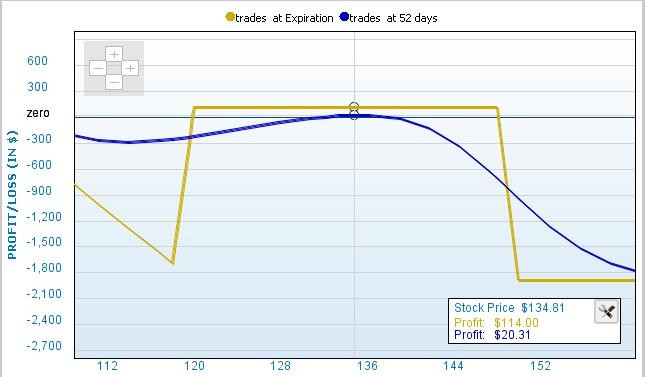

The goal of the trade is for the underlying to be contained inside ‘range’ built from the two sold credit spreads. While the trade is on, the underlying can maneuver on the chart providing it keeps contained within this ‘range’. If the underyling starts moving around a rediculous amount, or proceeds too much in either direction, the trade will end up threatened and the trader will need to take some sort of motion to treat and/or adjust.

This trading system delivers an exceedingly big possibility of achievement — allowing it to be profitable most of the time. Nonetheless, you should be aware of that the risk to reward ratio of these trades will not be the best choice — as one losing month, if they are not correctly maintained, can remove a total years worth of rewards.

Mastering easy methods to set suitable profit marks, exit and stop loss guidelines, as well as developing the suitable know-how on how to effectively handle and modify an iron condor position that is getting into a hard time is critical to long-term success with this trade.

Once i very first started trading this tactic, I discovered myself succeeding month after month — Until finally — suddenly I hit a negative month and wound up giving the whole thing back and then some — simply because I did not take the time up front to effectively discover ways to control and adjust.

Had I first discovered just some of the very simple iron condor adjusting tips, tricks, and very simple management techniques identified at this iron condors website, I really could have continued to be successful even with the remainder of the market crashing all about me.