Iron Condor explained

Post on: 10 Июнь, 2015 No Comment

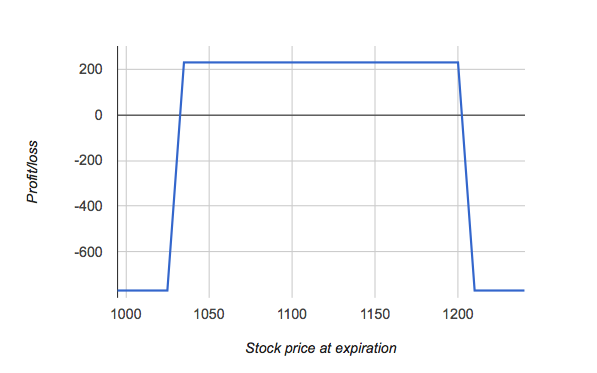

The iron condor is a neutral strategy that is a combination of a bull put spread and a bear call spread. It is a limited risk, limited profit trading strategy that is structured for a larger probability of earning smaller limited profit when the underlying stock is perceived to have a low volatility.

To setup an iron condor, the options trader sells a lower strike out-of-the-money put, buys an even lower strike out-of-the-money put, sells a higher strike out-of-the-money call and buys another even higher strike out-of-the-money call. This results in a net credit to put on the trade.

Limited Profit

Maximum profit is equal to the net credit received when entering the trade. Maximum profit is attained when the underlying stock price at expiration is between the strikes of the call and put sold. At this price, all the options expire worthless.

Limited Risk

Maximum loss is also limited but significantly higher than the maximum profit. It occurs when the stock price falls at or below the lower strike of the put purchased or rise above or equal to the higher strike of the call purchased. In either situation, maximum loss is equal to the difference in strike between the calls (or puts) minus the net credit received when entering the trade.

Example

Suppose XYZ stock is trading at $45 in June. An options trader executes an iron condor by buying a JUL 35 put for $50, writing a JUL 40 put for $100, writing another JUL 50 call for $100 and buying another JUL 55 call for $50. The net credit received when entering the trade is $100, which is also his maximum possible profit.

On expiration in July, XYZ stock is still trading at $45. All the 4 options expire worthless and the options trader gets to keep the entire credit received as profit. This is also his maximum possible profit.

If XYZ stock is instead trading at $35 on expiration, all the options except the JUL 40 put sold expire worthless. The JUL 40 put has an intrinsic value of $500. This option has to be bought back to exit the trade. Thus, subtracting his initial $100 credit received, the options trader suffers his maximum possible loss of $400. This maximum loss situation also occurs if the stock price had gone up to $55 instead.

To further see why $400 is the maximum possible loss, lets examine what happens when the stock price falls to $30 on expiration. At this price, both the JUL 35 put and the JUL 40 put options expire in-the-money. The long JUL 35 put has an intrinsic value of $500 while the short JUL 40 put is worth $1000. Selling the long put for $500, he still need $500 to buy back the short put. Subtracting the initial credit of $100 received, his loss is still $400.

Commissions

It is important to note that commission charges weigh heavily in a condor trade. This is because there are 4 legs involved in this trade and profit is made by writing out-of-the-money options with very low premiums. To reduce the impact of commissions on profits, one may wish to trade options that expire in 2 to 3 months instead of trading the near month options.