Iron Condor

Post on: 26 Июнь, 2015 No Comment

When to Run It

Youre anticipating minimal movement on the stock within a specific time frame.

The Sweet Spot

You achieve maximum profit if the stock price is between strike B and strike C at expiration.

About the Security

Options are contracts which control underlying assets, oftentimes stock. It is possible to buy (own or long) or sell (“write” or short) an option to initiate a position. Options are traded through a broker, like TradeKing, who charges a commission when buying or selling option contracts.

Options: The Basics is a great place to start when learning about options. Before trading options carefully consider your objectives, the risks, transaction costs and fees.

The Strategy

You can think of this strategy as simultaneously running an out-of-the-money short put spread and an out-of-the-money short call spread. Some investors consider this to be a more attractive strategy than a long condor spread with calls or with puts because you receive a net credit into your account right off the bat.

Typically, the stock will be halfway between strike B and strike C when you construct your spread. If the stock is not in the center at initiation, the strategy will be either bullish or bearish.

The distance between strikes A and B is usually the same as the distance between strikes C and D. However, the distance between strikes B and C may vary to give you a wider sweet spot.

You want the stock price to end up somewhere between strike B and strike C at expiration. An iron condor spread has a wider sweet spot than an iron butterfly spread. But (as always) theres a tradeoff. In this case, your potential profit is usually lower.

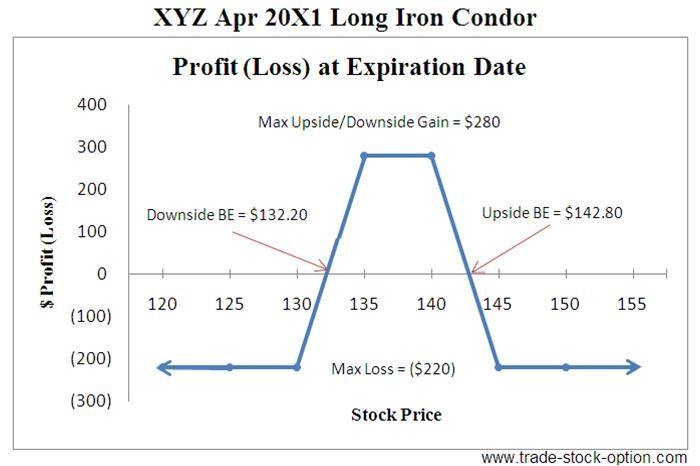

Maximum Potential Profit

Profit is limited to the net credit received.

Maximum Potential Loss

Risk is limited to strike B minus strike A, minus the net credit received.

Break-even at Expiration

There are two break-even points:

- Strike B minus the net credit received.

- Strike C plus the net credit received.

TradeKing Margin Requirements

Margin requirement is the short call spread requirement or short put spread requirement (whichever is greater).

NOTE: The net credit received from establishing the iron condor may be applied to the initial margin requirement.

Keep in mind this requirement is on a per-unit basis. So dont forget to multiply by the total number of units when youre doing the math.

As Time Goes By

For this strategy, time decay is your friend. You want all four options to expire worthless.

Implied Volatility

After the strategy is established, the effect of implied volatility depends on where the stock is relative to your strike prices.

If the stock is near or between strikes B and C, you want volatility to decrease. This will decrease the value of all of the options, and ideally, youd like the iron condor to expire worthless. In addition, you want the stock price to remain stable, and a decrease in implied volatility suggests that may be the case.

If the stock price is approaching or outside strike A or D, in general you want volatility to increase. An increase in volatility will increase the value of the option you own at the near-the-money strike, while having less effect on the short options at strikes B and C. So the overall value of the iron confor will decrease, making it less expensive to close your position.

Option Guy’s Tips

- One advantage of this strategy is that you want all of the options to expire worthless. If that happens, you wont have to pay any commissions to get out of your position.

- You may wish to consider ensuring that strike B and strike C are around one standard deviation or more away from the stock price at initiation. That will increase your probability of success. However, the further these strike prices are from the current stock price, the lower the potential profit will be from this strategy.

- As a general rule of thumb, you may wish to consider running this strategy approximately 30-45 days from expiration to take advantage of accelerating time decay as expiration approaches. Of course, this depends on the underlying stock and market conditions such as implied volatility.

- Some investors may wish to run this strategy using index options rather than options on individual stocks. Thats because historically, indexes have not been as volatile as individual stocks. Fluctuations in an indexs component stock prices tend to cancel one another out, lessening the volatility of the index as a whole.