IRA Contribution Limits for 2013

Post on: 16 Март, 2015 No Comment

How much can put in your IRA in 2013?

Please refer to our privacy policy for contact information.

Good news. The amount you can contribute to an Individual Retirement Account or IRA increases in 2013.

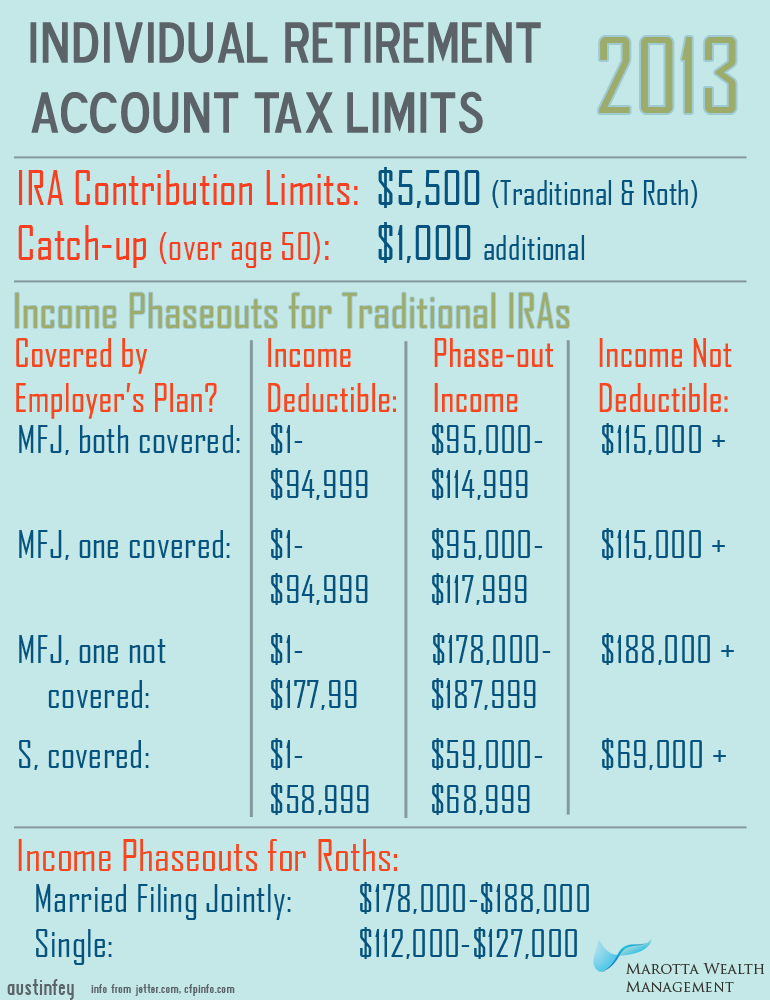

The maximum dollar amount you can put into a tax-favored retirement plan each year is known as the contribution limit. This limit adjusts over time with inflation. typically annually or biannually. In 2013, the contribution limit for IRAs is $5,500. It represents a slight increase from the 2012 contribution limit of $5,000.

For those age 50 or older, you have the opportunity to add $1,000 to your contribution limit in 2013. It’s called a catch-up contribution. and the limit remains unchanged from 2012. A catch-up contribution allows you to set aside a little bit of extra money in the years before retirement, and hopefully increase your tax-deferred investment earnings. Think of it as a government-sponsored retirement gift, one that starts 12 to 17 years before you retire. Whether you are a diligent retirement saver or truly are behind and in need of catching up, you should take advantage of catch-up contributions.

Why should you take advantage of extra contributions? For one thing, they can lower your taxable income. Contributions to an IRA can be income-tax deductible, or partially tax deductible, depending on your circumstances. Here’s how it works. If you don’t have a workplace retirement plan. such as a 401(k), you can deduct contributions from federal and state income taxes. If you have a 401(k) or other workplace retirement plan, you may be able to deduct a portion depending on your income. In 2013 the amount you can deduct is reduced or phased out for individuals with modified gross incomes of between $59.000 and $69.000, or married couples filing jointly with modified gross incomes of between $95,000 and $115,000. If you are not covered by a workplace retirement plan but your spouse is, the deduction is reduced between $178,000 and $188,000.

Note: You can make contributions to an IRA for a given tax year up until the time you file your income taxes for that year. That means you can make a 2013 contribution up until April 15, 2014. This makes the IRA a great tax planning tool. If you are looking for a deduction come tax time and you qualify, an IRA should be a consideration.

2013 Contribution Limits for Other Types of IRAs

The contribution limits are the same for Roth IRAs. which are slightly different than a traditional IRA. Contributions to a Roth IRA are not deductible, they are made after tax. But when you take distributions at retirement, you pay no income tax. Roth IRA contribution limits are $5,500 in 2013, $6,500 if you are age 50 or older.

Self-Employed IRA Limits for 2013

If you have a self-employed IRA, your contribution limits may have changed in 2013 as well. The limits for SIMPLE IRAs have risen to $12,000 in 2013, with catch-up contributions of $2,500.

Contribution limits for SEP IRAs work differently. You can contribute up to 25% of gross income up to a maximum of $51,000 in 2013.

Why Make the Maximum Contribution to an IRA in 2013?

For those who are able, contributing the maximum amount to your IRA or Roth IRA each year makes a lot of sense. Especially if you have no other workplace plan and/or can make the contributions on a pre-tax, or tax deductible, basis. Anything that lowers your taxable income is a great strategy. Plus, it helps you meet your retirement goals. And as you near retirement. in particular, you should find as many possible ways to set aside retirement dollars for investment. If you have maxed out your IRA contributions, consider a Roth IRA for tax-free investment growth for the long term. It’s a great bet, especially if you are currently in a low tax bracket and expect it to increase throughout your career and lifetime.

So go ahead, put a little bit more into your IRA in 2013. You are not likely to regret it.

Disclaimer: The content on this site is provided for information and discussion purposes only, and should not be misconstrued as investment advice. Under no circumstances does this information represent a recommendation to buy or sell securities.