IPS Investment Policy Statement Example

Post on: 3 Июль, 2015 No Comment

Investment Policy Statement - a very simple example

____________________________ 401(k) Plan is a qualified employee benefit plan established and operated pursuant to applicable federal laws and regulations. The plan fiduciaries are charged with the overall responsibility under ERISA to manage this plan prudently on behalf of plan participants pursuant to the standards of conduct contemplated under ERISA.

The Advisory Committee of _____________________________ 401(k) Plan has established this investment policy statement for the purpose of providing general investment guidelines to govern the management of the fund’s assets and communication policy to plan participants. This policy is to serve primarily as a general framework within which the funds are to be managed and communicated, and is not a binding resolution on investment performance expectations or any other fiduciary decisions pertaining to the management of the plan.

Pursuant to ERISA section 402(c)(3), the Advisory Committee may delegate the investment management duties for all or some part of the fund to one or more professional investment managers who, in turn, shall have the authority to manage the assets of the fund in accordance with the general investment guidelines contained herein.

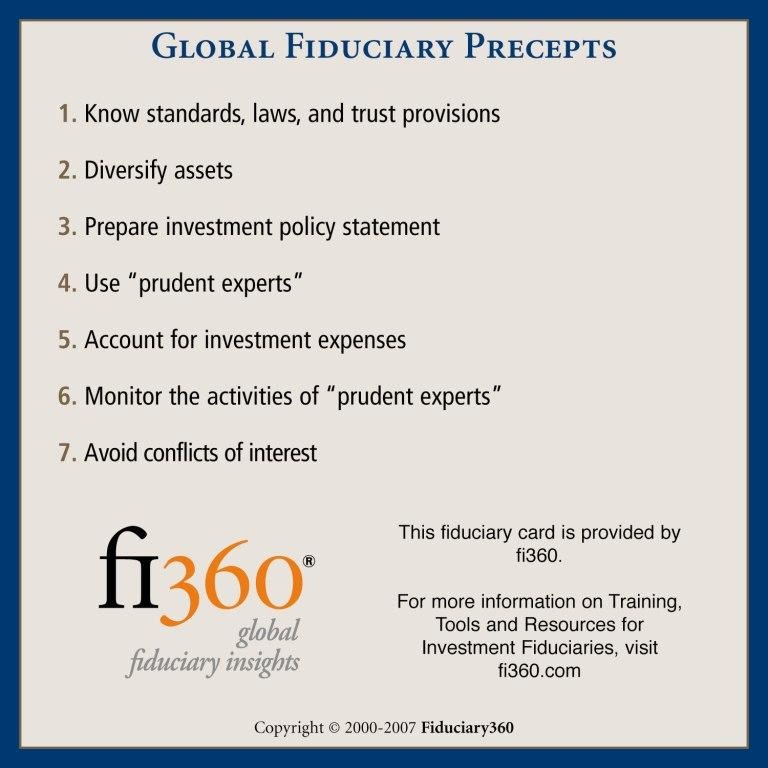

In compliance with this fiduciary obligation with regard to the management of the assets, the fiduciary plan will do the following:

Ш Establish investment policy and objectives to govern the management of the plan assets;

Ш Act prudently in selecting investment managers to manage any investment options offered to participants as investment selections in the plan;

Ш Establish and implement investment performance objectives and measurement standards; and

Ш Establish participant communications programs in an effort to provide sufficient information to participants.

To fulfill the stated investment policy, the plan sponsor and fiduciaries will select a diversified group of passive asset class investments and index funds. A selection of these passive investments will be made based upon generally accepted rules of diversification, asset allocation and risk management.

To fulfill the stated investment policy, the plan sponsor and fiduciaries will select a diversified group of passive asset class investments and index funds. A selection of these passive investments will be made based upon generally accepted rules of diversification, asset allocation and risk management.

The Advisory Committee has selected a broad range of different asset categories including fixed income, and foreign and domestic equity funds recognizing different ranges of market capitalization. The asset categories selected shall be such that taken together participants have a reasonable opportunity to materially effect the potential investment returns in their accounts while at the same time controlling risk or volatility. Investments will be limited to publicly traded mutual funds.

As part of the plan fiduciaries’ general responsibilities under ERISA, the plan must arrange to receive periodic performance evaluations of the investments in the plan. Failure to objectively monitor investment performance and volatility is a violation of ERISA’s fiduciary responsibility provisions. The Advisory Committee recognizes the volatility of individual asset classes, and as a result believes that diversifying through multiple asset classes of passively managed or index mutual funds will provide a reduction in the short-term portfolio volatility, with an increase in long term performance.

The advisory committee shall receive reports from the brokerage or custodial firm holding the plan assets, and will reflect the value of the Trust, and all of the activity occurring in the Trust during the period. The investment performance for the selected funds shall then be compared to the appropriate benchmark index returns. The benchmark will be the index most closely resembling the asset class of the actual mutual fund.

_______________________________ will provide the function of participant communications. The above stated firm will assist the Advisory Committee by providing the participants with information on basic investment principles and fund performance. Participant education will emphasize the value of diversification, and the recognition of risk tolerance and time horizon.

Advisory Committee Member(s):

Signed: __________________________________

Dated: ____________________

Fiduciary — Under ERISA section 3(21), a fiduciary is any person or legal entity who.

exercises discretionary authority or control in management of the plan or exercises any authority or

control over management or disposition of the plan assets or renders investment advice for a compensation (direct or indirect) for any assets of the plan, or has any authority or responsibility to do so or

has discretionary authority or discretionary responsibility in the administration of the plan

ERISA Section 403(c) states that, the assets of a plan shall never inure to the benefit of any employer and shall be held for the exclusive purpose of providing benefits to participants in the plan and their beneficiaries, and defraying reasonable expenses of administering the plan ( Exclusive Benefit Rule) -

AND . a fiduciary shall discharge their duties with respect to a plan with the care, skill, prudence and diligence under the circumstances then prevailing that a prudent man acting in a like capacity and familiar with such matters would use in the conduct of an enterprise of a like character and with like aims (Prudent Investor Rule)

Click here to read general DOL information about Your Fiduciary Responsibilities (16 page .dpf)

Click here for a DOL statement specifically related to Mutual Funds ( 2 page .dpf).

Fiduciary Issues & Checklist:

As a fiduciary you have personal liability (409).

Do you have proof of a fiduciary bond?

Do you have fiduciary liability insurance?

Have you received bids from competitors within the past 3 years?

Is your plan document compliant with current regulations such as EGGTRA and GUST amendments?

Do you want your plan to be 404c compliant and have you taken the steps required to get the safe harbor protections it offers?

Are contributions being deposited as soon as administratively possible (i.e. with payroll)?

In the past year, has your company performed a limited scope audit on plan functions such as loans, distributions and hardship withdrawals to ensure they are being administered correctly?

Are your fees reasonable for similar size plans with similar features (ERISA 404(a)1 and 402(c)2)?

Do you have a documented process to demonstrate that your plan is in compliance with ERISA requirements?

If you acquire businesses, are retirement plans of acquired companies reviewed prior to an agreement?

Do you have an investment policy statement in place (402(b)1 and 404(a)1(d))? AND if yes, how often is it reviewed and is your plan continuously monitored to measure how closely it matches the IPS?

What is the process for choosing investments for the plan?

Do you regularly monitor the performance of funds and is the process clear and defensible (404(a)1(b) and 405(a))?

Have funds that consistently under-perform their benchmark been replaced and is this documented?