Investing In Properties Through A Real Estate Investment Trust (REIT)

Post on: 22 Май, 2015 No Comment

March 14, 2012

By Dennis Ng (guest contributor)

One way to value a REIT is by looking at its net asset value (NAV). As the primary value of a REIT comes from the market value of the properties owned, the NAV, which is equivalent to its assets less liabilities, of a REIT would give an indication of its value.

Singapore’s property market has been in the limelight for some time now. Market sentiments have been upbeat, as telling in the fact that many new real estate projects have been selling like hot cakes when they are launched.

For many investors, the objective of investing into properties is to earn rental income. As it is, the current rental yield of residential properties in Singapore is about 3% to 4%. But other than buying properties to earn from rental income directly, an indirect approach to similarly earn from such income is to invest in real estate investment trusts (REITs).

What are REITs?

A REIT owns properties and collects rental income. Essentially, REITs are unit trusts listed on the stock exchange. They are mainly invested in long-term real estate where rental income is its main income. In which case, REITs are listed in the stock market so as to get funding from the public. With these funds raised, the company buys and manages real estate to earn rental income. In this type of investment, 90% of the net income obtained by a REIT is paid out to investors in the form of dividends.

Specific rules for REITs in Singapore

In Singapore, there are specific rules and regulations that a REIT has to abide. Firstly, 90% of its net income must be distributed to its shareholders in the form of dividends. Unlike other listed companies, they do not have the liberty to choose to retain a higher percentage of their profits. Other than that, a minimum of 70% of their assets must be invested into properties and at least 75% of their income must be derived from rental income.

In Singapore, there are also specific requirements on how much debt REITs can incur. If the company does not have a credit rating, their debt to asset ratio cannot exceed 35%. And even if the company has a credit rating, their debt to asset ratio cannot exceed 60%. Such regulations have been enforced to ensure that REITs would not face the problem of over-borrowing. What this means is that if they purchase a property priced at S$100 million, the maximum amount they can borrow to finance the purchase is 60% of the property price, or S$60 million in this case.

REITs were first introduced to Singapore only 10 years ago, where the first REIT was Capital Mall Trust listed in 2001. However, the history of REITs dates back to as early as 1960 in the US. Today, there are over 180 REITs in the US, amounting to total assets worth about US$350 billion.

Advantages of investing in REITs

REITs allow investors to have the opportunity to invest in real estate with as little as S$1,000. Because each REIT typically owns a portfolio of properties, even by investing in a single REIT, you are effectively diversifying your money into several property projects. On the other hand, if you are to directly invest in real estate, the minimum capital required in Singapore would probably amount to at least S$100,000.

To an investor, REITs provide them with ‘pooling of resources’—a collective investment scheme for real estate—as it allows investors to indirectly earn rental income through earning dividends, without the need to directly invest in real estate.

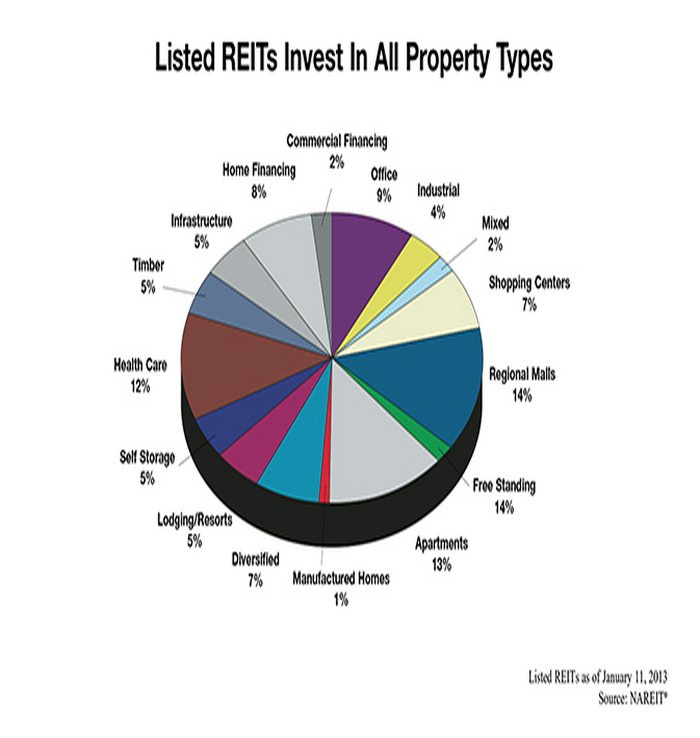

In Singapore, there is currently a wide selection of listed REITs, ranging from those that invest in shopping malls, industrial properties, office buildings, service apartments and even hospitals!

As an investor, you have no lack of options when deciding on REITs to place your investment with. For instance, if you prefer to be exposed to overseas shopping malls, you can choose to invest in Lippo Indonesian Retail Trust, which has a collection of shopping malls in Indonesia, or Fortune REIT, which has a collection of shopping malls in Hong Kong. Otherwise, you can choose to invest in Capital Mall Trust, with most of its shopping malls in Singapore, or even Starhill Global REIT, which has shopping malls in Singapore, Malaysia and even Japan.

REITs offer high dividend yields and are less volatile than stocks

Because REITs in Singapore are required to pay out 90% of its net income as dividends, their dividends are typically quite attractive. As it is, most of the REITs listed in Singapore provide a dividend yield of 5% or higher, which is about 3% higher than the yield of Singapore government bonds, as in 2011.

As its main revenue is derived from rental income, REITs enjoy a certain level of stability in revenue and thus prices of REITs tend to be less volatile than stocks. When the stock market crashed in 2008, some stocks fell as much as 50% to 90%. But most REITs fell 40% to 50%, in comparison.

Furthermore, dividends received are not taxable, as taxes have already been paid by the company. This is as opposed to receiving income from rental, which is subjected to further tax.

How do you to value a REIT?

One way to value a REIT is by looking at its net asset value (NAV). As the primary value of a REIT comes from the market value of the properties owned, the NAV— which is equivalent to its assets less liabilities—of a REIT would give an indication of its value. For example, at the time of writing this, the NAV of Suntec REIT is close to S$2.

Another way to conclude on the value of a REIT is to compare its dividend yield with other investments that provide a stable yield, such as government bonds. As the Singapore government is rated AAA and has almost zero risk of default, we would attach a premium over the yield provided by Singapore government bonds. As a general rule, I would personally attach a premium of 3% on the dividend yield of REITs over Singapore government bonds.

Even though REITs have been introduced to Singapore a decade ago, many investors in Singapore are still unfamiliar with REITs and have yet to invest in them. I hope that by offering an insight on REITs, you would better be able to decide if such an investment is for you. Should you be in favor of such an investment, you should seek the advice of a competent investment advisor to help access your specific financial situation, objectives, needs and risk profile, before really investing.

By guest contributor Dennis Ng, Director of Leverage Holding and Master Your Finance .

Excerpted from his latest book, What Your School Never Taught You About Money . For a limited time our readers can buy the hardcopy book at just $23 including free delivery (within Singapore), more than 20% off the usual price of $28.90. Click here to get it now

by Propwise.sg on March 14, 2012 3 comments