Investing in Farmland 4 Ways to Play the Agricultural Boom

Post on: 2 Июнь, 2015 No Comment

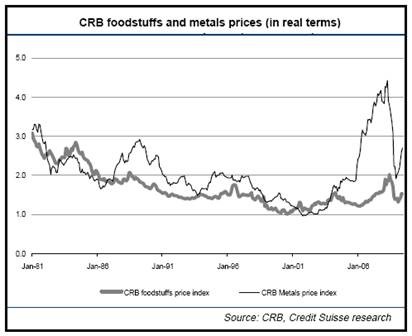

For at least the last decade, economically savvy investors have been investing in hard assets as an inflation hedge against future and present economic uncertainty. While much of this demand for these hard assets has poured into precious metals and energy, other investors have been buying farmland as an investment hedge against future inflation in food prices. And this trend is not isolated to America. Global investors are scooping up deals on farmland in Russia, Brazil, and many African countries.

Investors are often drawn to farmland based upon its cash flow potential (rents or crop yields) in addition to its capital appreciation. Additionally, many investors who are seeking less exposure to paper assets often find that farmland offers the type of diversification that they desire.

For years, U.S. farmland could be purchased at phenomenally low prices. However, as more investors lined up to buy, supplies of good arable farmland began declining, causing nationwide prices to double just over the past five years.

For the millions of Americans who have followed the corporate-controlled mainstream media’s financial advice to “buy a house and max out your 401(k)”, investing in farmland probably sounds exotic, and even perhaps risky.

One of the best assets to own during times of crisis, and especially during a period of growing inflation, is farmland.

The Returns on Farmland Investing

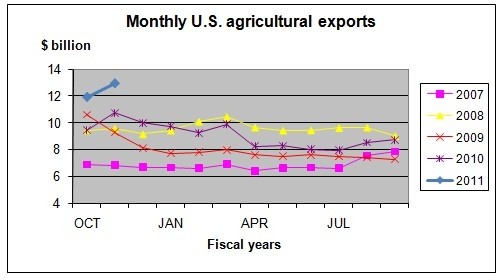

According to the National Council of Real Estate Investment Fiduciaries, U.S. farmland generated a total return of 15.1% in 2011. In contrast, the S&P 500 Index ended the year flat.

The USDA provided a state-by-state breakdown on farmland real estate values. See below.

And this is not a new trend.

For the last 10 years. farmland has consistently outperformed U.S. stocks.

The U.S. Department of Agriculture has predicted that 2012 will be the third-highest year for farm income on record since 1980. Meanwhile, U.S. farmland values are forecast to increase almost 6 percent in 2012.

A well run farm typically provides an investor with a minimum annual return of 6%-7%. And the investment returns are only expected to increase as the global population continues to explode and a growing number of people from emerging nations join the ranks of the middle class. On average, people living in emerging nations consume about 70 pounds of meat per year. While that is much lower than the 176 pounds of meat consumed annually by the average person living in the developed world, the global middle class is rising and the trend towards increasing food prices is firmly established.

Physical farmland is not for everyone

Just because farmland can be a solid investment with great future potential does not make it a great investment for everyone. Investing in physical farmland requires time and a large amount of financial capital to get started. And the risks are numerous including: unpredictable weather patterns (consider our current drought), potentially large upfront costs, a lack of liquidity, and the fact that it can be a downright complicated process for the uninitiated.

Nearly half of the farmland in the Midwest is owned strictly by investors who employ others to do the “dirty” work. Of course, this hands-off approach eats into profits and can increase your risk significantly.

Investing Options

If you truly desire to buy a piece of physical farmland, the best way to start is to investigate your options. The U.S. Corn Belt, composed of states like Iowa, Illinois, Indiana, and Michigan, have some of the most fertile, and therefore desirable, farmland anywhere in the United States. Once you settle on an area that you want to invest in, begin working with a local rural real estate agent who specializes in working with farmland investors. A quick Google search for “investing in farmland” pulled up this website which appears to connect buyers and sellers.

As you go shopping for land, you may be surprised by the prices. U.S. farmland values have appreciated by more than 1,200% since 2000, making it one of the top three best performing asset classes over the last decade. Today, the average price for U.S. farmland is over $2,000 per acre. But expect to pay upwards of $6,000 or more for the more desirable farmland.

However, if you would prefer to gain access to farmland through the financial markets, there are a few options.