Investing in Digital Marketing for the Enterprise A Look at the Current Market Thomvest

Post on: 16 Март, 2015 No Comment

Investing in Digital Marketing for the Enterprise: A Look at the Current Market

by Thomvest Team on November 4, 2013

It’s a very interesting time to be in marketing. You’ve got more raw data about consumers now available than ever before, so much so that it must feel like you’re standing on the beach wondering just how high the next wave of data is going to be. As investors focused on the enterprise – including enterprise saas and ad-tech for the enterprise – we’ve pulled together data from a number of sources, including roughly 75 interviews that we conducted over the last six months among both brands and vendors in the space, in order to get a sense for where the market is heading. We thought we’d share this for those entrepreneurs who might be either working in this area or considering starting a company focusing on the junction between the enterprise and ad tech.

If you reflect on some of the goals of marketing for the enterprise – building brand awareness, establishing a sense of connection and desire among potential customers, positioning one’s products as a means of satisfying customer problems, or simply performance-based marketing – all of these are areas that are undergoing a transformation as a result of the increasing use of digital channels for consumer engagement. These channels offer the promise of greater measurement and, presumably, marketing effectiveness.

What we’ve found is that investment in start-ups has followed this opportunity and appears to have peaked in the last year or two, creating a vast and confusing number of companies. Enterprises have in many instances responded by shifting budget for technology spend towards the CMOs office; we’ve also begun to see the advent of marketing technologists inside the marketing department itself. Large incumbents as well as newer challengers in the space have recognized these shifts and have responded by pursuing acquisitions to build out a unified ‘marketing cloud’ offering, pushing the market towards a consolidation phase.

VC investments in marketing and ad-tech companies

As early as 2006, there was a fairly dramatic increase in the number of U.S. companies in the ad-tech space that received venture funding. The number of investments in marketing start-ups was slower but followed shortly thereafter.

The challenge that this ramp in investment created, however, is that the noise level for marketers has gotten very high. As we found in speaking with CMOs at Advertising Week in New York recently, just deciding which vendors are worth have a discussion with has become a job in itself:

Marketers are faced not only with deciding which vendors to use but also how best to integrate these to achieve the goals of the enterprise overall. As Michael Fauscette of IDC’s Software Business Solutions Group has noted. “One of the biggest issues facing marketers today is the overwhelming influx of technology into the marketing process. The tools are powerful and necessary but too often disconnected and their use isnt necessarily tied to an overall marketing strategy and plan.”

Enterprises are adapting

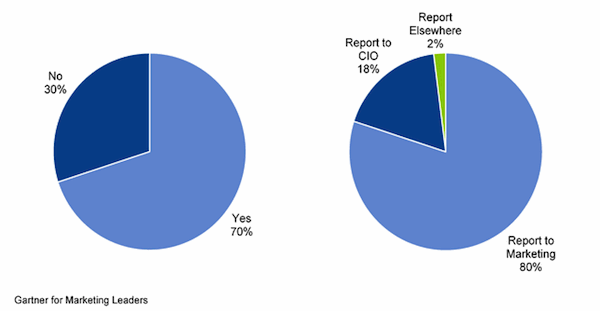

To deal with this complicated and fragmented vendor landscape, corporations are creating specialized technical roles to discover, analyze, and implement new marketing technologies. According to a recent Gartner study. 70% of corporations have a chief marketing technologist, which is defined by Gartner as “broadly equivalent of a CTO and CIO dedicated to marketing, familiar with all kinds of marketing software, data & analytics, social & mobile platforms, content marketing, web mechanics, digital advertising networks, among other topics.” This role has quickly matured as a support role to the CMO; this year 80% of chief marketing technologists report to the CMO (18% to CIOs) compared to 62% last year (37% to CIOs).

The construction of the ‘marketing cloud’ by incumbents and challengers

As this market has matured, we’ve seen a number of both public and private companies get acquired by the larger incumbents in the enterprise software and marketing spaces. A summary review of Crunchbase data illustrates the level of M&A activity in the space:

From a functional standpoint, it seems fairly clear that the marketing cloud promises to bring together many of the disparate functions noted in the market landscape above. This cloud promises to provide an integrated suite that helps define customer segments and leverage that information to better target potential customers in a way that is both real-time and measurable. Based off the interviews that we’ve conducted over the last several months, our view of the forthcoming marketing cloud looks something like the following:

Interest in the marketing cloud continues to grow even as some of the hype around advertising and marketing technology itself has begun to ebb. Much of this can be attributed to the development of formalized marketing cloud products by incumbents such as Salesforce (ExactTarget), Adobe (Marketing Cloud), Oracle (Eloqua), IBM (Marketing Center), and HP (Autonomy Marketing Cloud), fueled by the integration of acquired technologies. Pure-play players such as Webtrends, Marketo and Hubspot are also expanding their services to access more areas in the marketing cloud.

One way to bring the discussion about all of these trends back to something more immediate is to look at the growth in the CRM marketing automation industry, which serves as a close corollary to the marketing cloud space. This industry is expected to grow substantially over the next couple years, with IDC predicting that the market will grow from $3.7 billion in 2011 to $5.5 billion in 2016. Similarly, Gartner predicts that the market will grow from $3.1 billion in 2012 to $4.7 billion in 2016, representing a compounded annual growth rate of 10.7%.

Looking ahead

The sheer number of companies in the marketing space is daunting, and we’ve seen a number of other VCs pull back from investing in the space after making previous investments. The results of our research into the state of the market above leads us to believe that we are indeed moving from a phase of initial identification of a coming trend to more of a consolidation phase in the market where reach, scale, and the support organizations of larger vendors becomes increasingly important. For entrepreneurs, we see several areas of opportunity in these circumstances:

- There is a clear opportunity for those companies that have already reached scale (such as a number of companies that are recently public or at a stage where this is an option) to try to compete with the incumbents head on

- We see an opportunity for entrepreneurs with younger companies to create best-of-breed products that perform significantly better on a given dimension than the offerings being constructed by the incumbents (particularly where their better functionality is tied to better ad performance)

- We see an opportunity to create a marketing cloud suite that integrates the functionality of the larger marketing clouds but with an easier UI/UX for smaller companies or SMBs

- We see an opportunity for many in-between vendors to exit via a sale to one of either the larger incumbents or the challengers in the space

Though we’ve seen the beginnings of a decline in the number of ad tech and marketing companies being funded in the U.S. we also think that the rapidly changing consumer behavior and the sources of new data will continue to drive opportunities for new start-ups as well. As investors we’ll continue to focus on the companies that we think have the ability to become the leader in their respective space, and so continue to invest in working with new entrepreneurs, be they with younger companies (such as Virool) or more established players in the space (such as DataXu). We’ll also continue to do our own independent research on the market landscape and share our findings here; to the extent that you can also add to the conversation, we’d welcome your input along the way and will return the favor in kind by sharing our research with you.