Investing in a unit trust or an RCA

Post on: 7 Июнь, 2015 No Comment

Stafford Thomas

Investing in a unit trust or an RCA

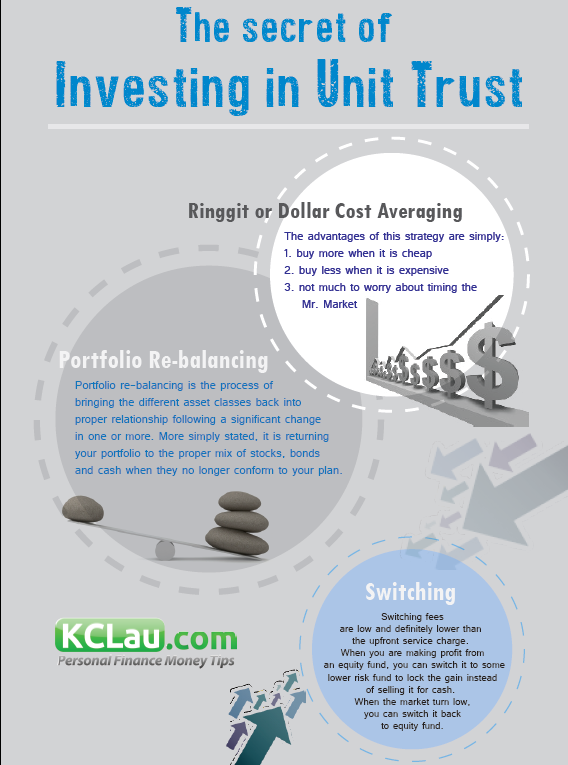

INVESTORS WITH a lump sum to invest are faced with two options: commit the sum in one go or phase it in over a set period in equal amounts, for example in a unit trust, using a rand cost averaging (RCA) approach. Both alternatives have pros and cons that should be considered. When investing in a unit trust, an investor buys units priced to reflect the exact value of the fund’s underlying portfolio on a daily basis. When the portfolio value, and hence unit price, is falling, a given sum will purchase more units than when the portfolio value is rising. The same principle applies to exchange traded funds.

For an investor with a lump sum to commit, Rhynhard Roodt, an equity analyst at Investec Asset Management, is not an RCA fan. People follow an RCA strategy because it makes them feel more comfortable, says Roodt. It is a behavioural bias encouraged by some financial advisers. Studies support Roodt’s contention that an RCA is generally counter productive. including one by US asset management firm Vanguard. Vanguard assessed total returns from US equities over 10-year rolling periods between 1926 and 2011, using lump sum and 12-month phasing-in approaches.

In 66% of the assessment periods the lump sum approach produced the best total return. When a phasing-in period of 36 months was used, the lump sum approach achieved superior returns 90% of the time. Vanguard extended its study to the equity markets of the UK between 1976 and 2011 and Australia between 1984 and 2011. The results were similar to those in the US. Where RCA comes into its own is in a serious, protracted equity market fall. The most recent SA fall began in May 2008 and ended in March 2009. A lump sum investment in the JSE all share index (Alsi) in May 2008, ahead of its 45% plunge over the next 10 months, would have been an unpleasant experience.

The total return on the lump sum would have also been inferior to the return from a 12-month phasing-in strategy. Based on the Alsi’s performance since May 2008, a lump sum investment would have produced a total return of 71% by the end of 2013. Had it been phased in in equal amounts over 12 months between May 2008 and April 2009, the total return would have been 123%.

SA equity has been kind to investors, having produced few market slumps of a severity similar to the 2008-2009 slump over the past five decades. Between 1963 and the end of 2013 the Alsi experienced six notable slumps spanning a combined 80 months, or 13% of the total period. The average period of decline — just over 13 months — includes the most serious postwar bear market. It began in April 1969 and ended in October 1971, a 30-month period during which the Alsi fell 62%.

For many investors RCA is insurance worth the cost, particularly at this juncture when the Alsi is trading on a heady 18,6 p:e, well above its 14,7 mean since 1993 and its highest level since 1998. Also notable is that the Alsi’s p:e has equalled or exceeded 18,5 in only five of the past 50 years. RCA is a viable strategy at present, says 36One Asset Management analyst Jean Pierre Verster. It is getting harder to find investment opportunities. It shows that the market is becoming expensive but does not mean it won’t get more expensive. Claude van Cuyck of Sanlam Investment Management points out that the Alsi’s p:e is inflated by a number of top-40 shares with very high ratings. They are Naspers (62 p:e), Anglo American (62 p:e), SABMiller (27,6 p:e) and Richemont (22 p:e). The four shares have a combined weighting of 29% in the Alsi. Arguably, periods in which the Alsi’s p:e has been well above average in the past have also had their share of highly rated heavyweight shares. In 1998, for example, when the Alsi’s p:e peaked at 19,4, the then market heavyweight, Dimension Data, traded at an average 74 p:e during the year.

But Van Cuyck is not a roaring bull. Though he sees value in the banking sector, for example, he believes the market as a whole is no bargain. This is not an environment in which to expect fantastic returns, he says. There is not an enormous amount of upside potential for the Alsi from current levels. If a decision is made to phase in a lump sum, a phasing-in period must be chosen. AllianceBernstein puts the optimum phasing-in period at six to 18 months. The US asset management firm draws its conclusion from a study similar to Vanguard’s.

AllianceBernstein’s advice appears applicable in SA, where the past three market slumps have been far shorter than the previous three. The 2008-2009 slump lasted 10 months; the 1998 slump in which the Alsi fell 36% lasted four months and the 1987-1988 slump in which the Alsi fell 43% lasted seven months. Investors who opt for a phasing-in strategy must be prepared to be disciplined. Verster says the risk when applying an RCA approach is that an investor could lose his or her nerve if the market starts falling and stop phasing in money. Never try to second-guess the market, Verster advises.