Invest in India_1

Post on: 16 Март, 2015 No Comment

Some other Investment Options in India

Banking Sector in India: Savings are an important tool for growth in a nation. The Indian economy poses plenty of investment opportunities for the nation. Offering reasonably evolved avenues for growth of funds, the investment options in India are an excellent way for the common man to grow their savings.

Investment Plans from India: Banks are the foundation of the financial system in India. Banks have been instrumental in uplifting the rural regions of India. For ordinary people, banks have provided them the facility to keep deposits through savings and fixed deposits. Banks offer an average of over 9% for fixed deposits.

Post Office Schemes: Post offices in India are spread across many cities, and towns of the country. Apart from forming the basis of postal communication, they provide financial assistance as well. Post office schemes offer the highest rate of interest. Investments in the post office are safeguarded by the Government of India.

Inspite of the lack of efficiency and liquidity of post office savings, they are a good way to invest. Investors are also turning to Public Provident Funds, since these funds have higher returns and are also exempt from taxes.

Company Fixed Deposits: Companies float fixed deposit schemes. This acts as a source of fund-raising for companies and they also pay interest to the deposit holders. The rule of the thumb is that the safety of the company is inversely proportional to the rate of interest offered. Investing in company fixed deposits has its share of risks. If the company’s financial position is not great, then the depositors have to bear that risk. Another risk is the liquidity. Investors don’t receive their funds immediately. It may take months after the due date for them to get back their money.

Premature redemption of the invested funds to counter the interest rate volatility is not seen favorably. Even if prematurely redeemed, the returns are subject to some surcharge. Generally, the principal invested is not safe considering that a company can go bankrupt and may file for it, and leave you to the mercy of bankruptcy proceedings.

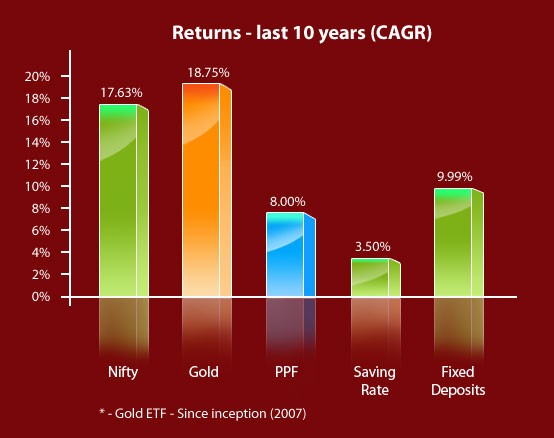

Stock markets: The Indian share market is for the brave investor. It is a case of high risk, high return. You potentially stand to gain up to 11% of the investment as returns on an average. It can be even more. For people who have not fully understood the tricks and techniques to invest in the stock market, mutual funds are a better option.

Mutual funds: People with the same objective of investment, pool their funds together and invest in a mutual fund. As an investor, you are given units in the mutual fund. The Net Asset Value of the mutual fund represents the appreciation or depreciation of the mutual fund value. Asset Management Companies (AMC) manage mutual funds and are generally sponsored by financial institutions, banks or business groups. Mutual funds offer good returns after tax and are a safe investment option compared to investing directly in the stock market. In a mutual fund, your funds (along with the others) is managed by fund managers who know the stock markets like the back of their hand.

Mutual funds diversify your investments to reduce the risk associated with investing in only one sector. The professionally managed funds have better returns than any other investment option. After picking the time frame of investment, you specify the duration of investment. On a long term, equity investments always yields significant returns. So if you are thinking long term returns, mutual funds are your surest route to success.

The above mentioned are just a snapshot of the investment options available in India. As India is a growing economy, there are plenty of upcoming investing opportunities that you have to be on the lookout for.

More about us: We are a one stop shop offering a gamut of investment opportunities in India to Non Resident Indians & people of India origin (foreign nationals and Non-Indian citizens). Our mission is to offer affordable investment solutions to Indian expatriates to invest money in India. We not only focus on delivering financial planning or NRI finances to desi expats but we also offer real time stock quotes, charts, latest news, share trading demo software. We as a NRI broker believe that the future of India is really bright and we want to be here to walk the Indian diaspora community through this wonderful investment journey by providing them best investment plans in India.

NriInvestIndia.com only offers its services and products where it is allowed to do so, therefore, not all of our securities, products or services may be available to you. Please review this Legal Notice.

Use of this website constitutes your acceptance, that you have gone through the Disclaimer mentioned in it.

**By submitting your information in the above ‘Ask your questions’ inquiry form, you agree to let NriInvestIndia.com send you Marketing emails for promotional purposes.