Introduction To Open Interest In The Options Market

Post on: 3 Июнь, 2015 No Comment

Introduction To Open Interest In The Options Market

Introduction To Open Interest In The Options Market

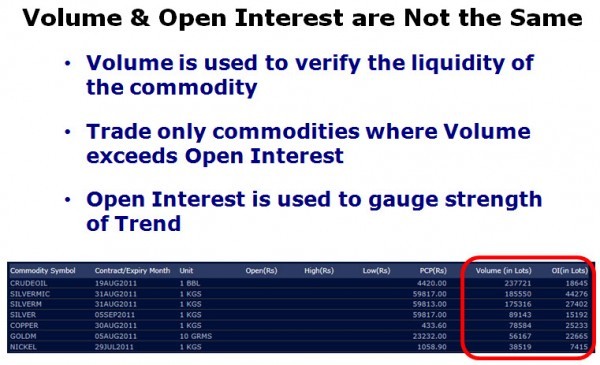

Open Interest is the total number (or a tally) of open contracts on a security which may include Futures or Options. Option and Futures traders should pay attention to Open Interest as it can be used to confirm trends or trend reversals and assist in making better trading decisions. We will now look at the information open interest provides to a traders which can be used to their advantage.

What information does Open Interest provide to Traders

An option/future contract has both a buyer and a seller, so the two market players combine to make one contract. Open Interest keeps a tally of this contract when the buyer/seller duo open the contract. Open Interest value is subtracted only when the buyer/seller duo close out the contract.

Example: To open a new position, I BUY 5 (five) option contracts from a SELLER A on day x. These 5 contracts will be added and included in the total Open Interest for day x. I close the position on day x+3 by SELLing the 5 option contracts. Now, these 5 contracts will be subtracted from the total Open Interest on day x+3.

Conversely, if I open a new position by SELLING 5 option contracts to a BUYER B on day x, the 5 contracts will be added and included in the Open Interest on day x. The Open Interest will be reduced by 5 only when I BUY back the 5 open positions. T

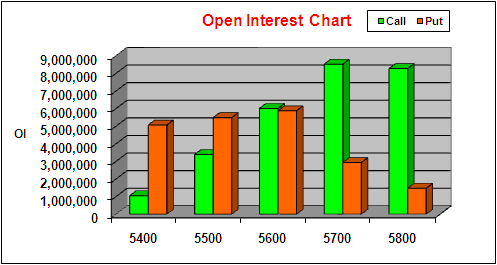

An increase in open interest when price is also increasing, is confirming an upward trend. Similarly, if there is an increase in open interest and the price is going down, it is seen as a downward trend. An increase or decrease in prices while open interest remains flat or declining may indicate a possible trend reversal.

Some pointers on Open Interest

As an options trader here are a few things you must consider when you look at Open Interest.

1. If both underlying stock price and its option open interest are rising then it is a a bullish sign. This means that there are more participants that are entering the market aggressively.

2. If the underlying stock price is rising BUT the open interest is flat, then one should pay attention as this could be an early warning of the stock price hitting a top.

3. If there is high open interest when a stock price has a sudden drop from its top, then consider this as a bearish signal. This scenario will often see mass liquidation of long positions and can lead to a downward spiral in stock price.

4. An unusually high open interest in a bull market is also a warning signal and one should pay close attention to any reversal in open interest trend which will mark the start of a bearish trend.

5. If open interest rises during the consolidation period, you can expect a breakout in the underlying. This happens because the traders who are caught on the wrong side of the market are forced to cover their positions en masse.

6. If underlying prices are rising but the open interest is declining, you can expect a bearish trend to start soon. The price rise in such conditions is most likely due to short covering. When the short covering has run its course, the underlying prices will start to decline.

7. When underlying stock prices are declining BUT the open interest is rising at an above normal rate, you can expect the bearish trend to continue. Once open interest starts declining, you can expect a trend reversal soon.

8. You are in a bearish trend if you notice a decline in both underlying stock price and open interest. After the open interest stabilizes to a low level, you can expect a trend reversal with the underlying stock price moving higher.

Options and futures traders can get an idea of the market conditions by observing the open interest levels and trends and improve their trading results.