Introduction to Futures Trading

Post on: 9 Апрель, 2015 No Comment

Brief history of futures markets

In the 1840’s in the United States food producers came to Chicago to sell their crops, since construction had begun on railroads between the east and the Midwest. This naturally allowed Chicago to become the hub of trade, when buyers and sellers would come to grain markets, they would negotiate for immediate delivery, which is called the spot market, or forward delivery which is the futures market as we know it today.

A consortium of Chicago based business men formed the Board of Trade in the late 1840’s. The Board was a member owned organization that offered a central location for spot trading of a variety of commodities, as well as forward contracts. Members served as brokers who facilitated trading in return for commissions.

Popularity of forward contracts began to grow, so the board decided that standardizing those forward contracts would streamline the transaction and delivery processes. The board of trade realized standardizing contracts on quality, quantity, delivery date and location, would eliminate the need for private contracts for buyers and sellers, which was far too complicated and time-consuming.

These new futures contracts where legal agreements to buy or sell an asset on a specific date or during a specific month.

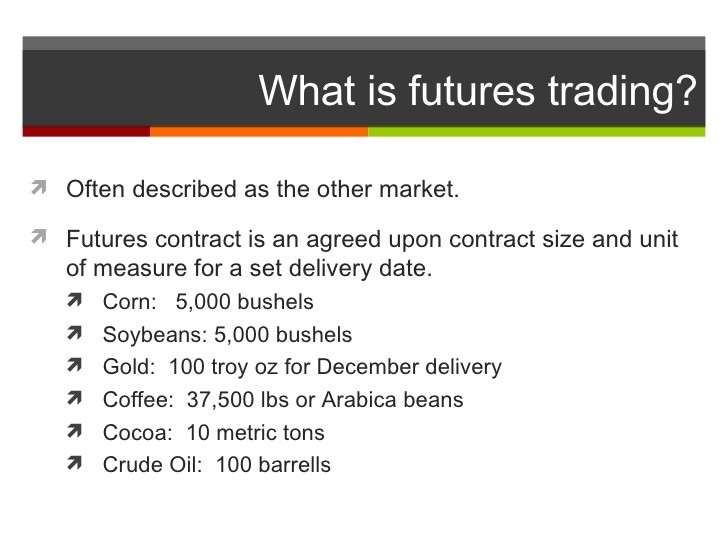

Futures contract. is a standardised legally binding contract that sets the conditions for the future delivery of commodities or financial instruments at a specific time period. The future contacts are regulated to an individual commodity exchange.

Forward contract. A private negotiation, cash-market contract between a buyer and seller for the future delivery of a commodity, at an agreed upon price. In difference to futures contracts, forward contracts are not standardized as they are private agreements between a buyer and a seller.

Spot Market. is known as the cash market, as commodities are settled in cash on the spot at current market prices, as opposed to forward prices.

CME GLOBEX – Chicago Mercantile Exchange

CME GLOBEX is a global electronic trading exchange for futures and options, which evolved to become the world’s leading marketplace for derivatives trading.

Futures Market today?

Introduction to Futures Trading

Trading is conducted in two methods, open outcry and the CME GLOBEX electronic trading exchange platform. A small number of traders still go to the pits and open outcry, however this only represents maybe less than 10% of the market. Electronic futures and options trading is a simple and efficient way to participate in the market.

Futures contracts can be traded on variety of commodities and financial products. There are futures contracts for almost anything, interest rates futures, stock index futures, bond futures, treasury futures, FX futures, gold futures and all the other food related commodities are traded on the futures markets. Some companies use the futures markets to hedge against unpredictable outcomes.

Today financial and commodity markets are interlinked, with futures and spot markets functioning as a single entity on a daily basis. To successful at trading futures, you need to understand the basics of all major markets and their relationships to each other.