Introducing the CBOE Low Volatility Index (LOVOL)

Post on: 3 Июнь, 2015 No Comment

November 29, 2012 — 8:42 pm

Nov. 29, 2012 Today CBOE introduced the new CBOE Low Volatility Index SM (ticker: LOVOL), a benchmark index designed for investors whose preferences have shifted from investing in riskier assets to lower-volatility assets. The LOVOL Index aims to provide investors with the ability to replicate an investment strategy that is subject to less downside volatility in a portfolio of S&P 500 stocks, while still preserving the bulk of market gains.

The LOVOL Index is a blend of two of CBOE’s popular strategy benchmark indexes –

The CBOE LOVOL Index measures the performance of a portfolio that overlays SPX TM and VIX ® calls over the S&P 500 Index. The index holds a portfolio of S&P 500 stocks and simultaneously selling SPX calls and buying monthly VIX 30-delta calls on a monthly basis.

PEFORMANCE OF THE LOVOL INDEX

The backtested historical data time series for the LOVOL Index begins in March 2006, the month after the launch of VIX options . In the period from March 31, 2006 through October 31, 2012, here are the percentage changes for select total return indexes – LOVOL up 40%, S&P 500 up 25%, Russell 2000 up 17%, and MSCI EAFE up 1%.

For the five-year period ending in October 31, 2012, the annualized return for the LOVOL Index was 2.9% (versus 0.4% for the S&P 500 total return index), and the standard deviation for the LOVOL Index was 13.6% (versus 19.1% for the S&P 500 index).

Since March 2006, the worst one-calendar-month drawdowns were down 9% for the LOVOL Index, down 16.8% for S&P 500, and down more than 20% for both the Russell 2000 and MSCI EAFE Indexes.

INDEX FOR THE LEAST VOLATILE STOCKS

While the LOVOL Index uses options to help manage volatility, the S&P 500® Low Volatility Index measures the performance of the 100 least volatile stocks in the S&P 500. The index is designed to serve as a benchmark for low volatility or low variance strategies in the U.S. stock market. Constituents are weighted relative to the inverse of their corresponding volatility, with the least volatile stocks receiving the highest weights.

MORE INFORMATION

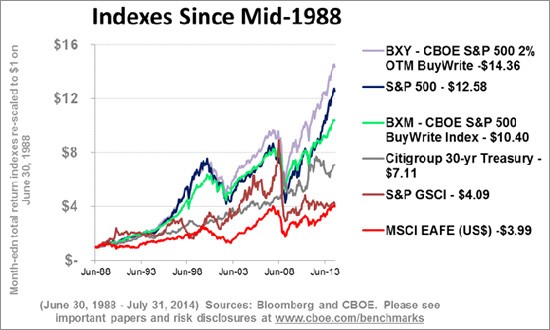

Subsequent to the 1993 introduction of the CBOE Volatility Index ® (VIX ® ), CBOE introduced more than 20 volatility indexes that are posted at www.cboe.com/volatility . After the 2002 introduction of the CBOE S&P 500 BuyWrite Index (BXM SM ), CBOE introduced ten option-related benchmark indexes that are available at www.cboe.com/benchmarks .

CBOE will disseminate the CBOE LOVOL Index value every 15 seconds during the trading day. The index values will be available from quote data vendors and at the LOVOL webpage www.cboe.com/LOVOL .

Options involve risk and are not suitable for all investors. Prior to buying or selling an option, a person must receive a copy of Characteristics and Risks of Standardized Options. The information in this document is provided solely for general education and information purposes. Past performance is not indicative of future results. No statement within this document should be construed as a recommendation to buy or sell a security or to provide investment advice.