Intrinsic Value by

Post on: 16 Март, 2015 No Comment

Intrinsic Value — Introduction

Find Out How My Students Make Over 43% Profit Per Trade,

Confidently, Trading Options In The US Market Even In a Recession!

What is Intrinsic Value of Options?

Intrinsic value of options is the value of its underlying stock that is built into the price of the option. In fact, options traders buy stock options for the sake of those options gaining intrinsic value ( Long Call or Long Put options trading strategy).

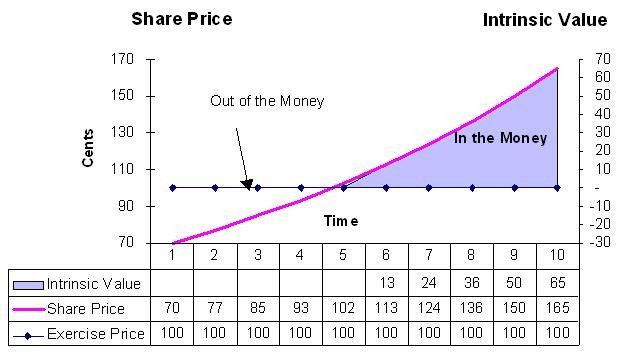

When you buy call options. you do so because you want to to profit when the stock goes up. When the stock moves higher and higher, more and more of the stock’s value gets built into the price of the option in the form of intrinsic value.

For example, AAPL is trading at $100 today and you bought AAPL’s $100 strike price call options. If AAPL rises to $150 at expiration of the call options, your $100 strike call options will be worth $50 because they allow you to buy AAPL at $100 when it is trading at $150. That $50 is intrinsic value.

Similarly, if you own AAPL’s $200 strike price put options when AAPL is trading at $150, those put options would also have a $50 intrinsic value because they allow you to SELL AAPL’s shares at $200 when it is trading at only $150.

Basically, intrinsic value is the value that you will receive from exercising your in the money options.

How is Intrinsic Value Calculated?

To completely understand the concept of Intrinsic Value, one must first be familar with what options moneyness is. Options moneyness is an extremely important concept in options trading and directly affects how Intrinsic Value is calculated.

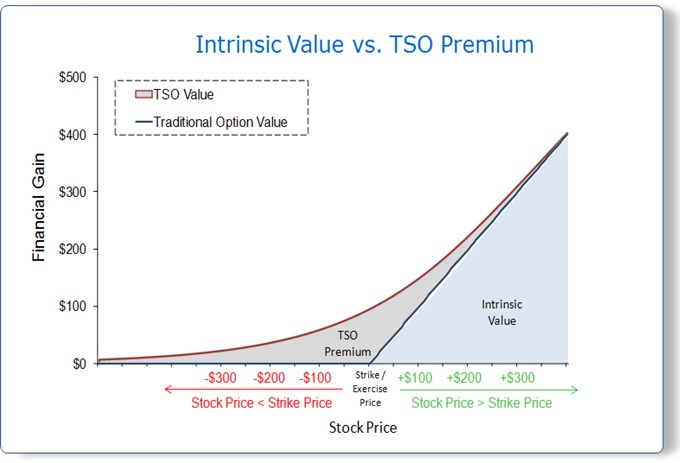

The price of a stock option comprises of two components; Intrinsic Value and Extrinsic Value.

The intrinsic value of a stock option is the built in value due to how much the option is in the money.

Extrinsic Value of a stock option is the extra money you are paying above the intrinsic value in order to own that option.

The picture below depicts the price component of an In The Money Call Option.

The stock price in the example above is $10 while the strike price of the call option is $9. As the Call option allows its holder to purchase the stock at $9 when the stock is trading at $10, there is a $1.00 value built in or intrinsic value. As such, out of the total price of $1.30 for the call option above, $1 is intrinsic value while $0.30 is Extrinsic Value.

Out of the money options. which are options with no built in value, would consist of only Extrinsic Value.

In short, In the money options contain both intrinsic value and extrinsic value while out of the money options contain only extrinsic value because there are no built in value in the option at all. All options have Extrinsic Value while only in the money options have intrinsic value.

Intrinsic value will also always be the same for both American style options and European style options.

Formula for Calculating Intrinsic Value from Strike Price and Stock Price

Intrinsic Value of In The Money Call Options = Stock Price — Strike Price

All at the money and out of the money options contains only Extrinsic Value and no intrinsic value.

Characteristics of Intrinsic Value

Do Not Decay Over Time

Unlike extrinsic value, intrinsic value does not diminish or decay over time. It remains stagnant as long as the underlying stock does not move. Options will only be left with their intrinsic value when they expire.

Changes with the Underlying Stock

Intrinsic value changes when the underlying stock moves. Intrinsic value increases as the underlying stock goes more and more in the money and intrinsic value becomes zero when the underlying stock moves out of the money.

Intrinsic Value of Call Options and Put Options

Intrinsic value of call options increases as a stock rises above the strike price of the call options. Intrinsic value of put options increases as the stock falls below the strike price of the put options.