Insurance for stock losses Try stop loss orders or put options

Post on: 29 Май, 2015 No Comment

Q: I want to buy individual stocks but I’m afraid of losing tons of money. Can I buy insurance?

A: You’re wise to want to prevent catastrophic losses. After all, if you sell a stock for a 35% loss, you need to find one that goes up 54% just to get your money back. And there aren’t many stocks that go up 54% right away.

Can you buy insurance to protect you from catastrophic stock losses? After all, you can buy catastrophic medical insurance and get insurance to protect your home from fires, high winds and earthquakes. So why not your portfolio?

The answer is yes, but it’s a little different than a standard homeowners insurance policy. You don’t write checks every month. Insurance for your portfolio is more like a trading or hedging strategy.

There are two approaches that might work, one that’s a little less expensive but has risks of its own and another that will cost a bit more.

The first strategy is having a firm policy of cutting losses.

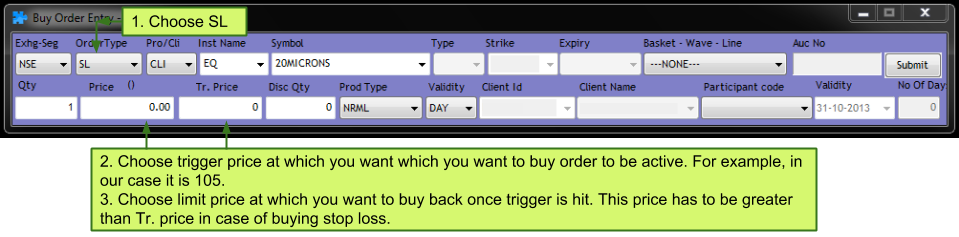

Famous investor, Gerald Loeb, told investors to sell any stock that fell 10% from the price paid. If you follow that rule, most of the time you’ll be able to limit your losses. But this requires you to either set up and maintain stop loss orders or monitor the stocks constantly.

There’s another danger. Let’s say a stock is trading for $10, and you have a sell order in if it goes to $9, which would be a 10% decline. But what if the company discloses its accounting was a total fraud and it’s going bankrupt. The shares would probably drop immediately to nearly $0. Let’s say $0.10.

In this case your sell order doesn’t do you any good. Your sell order converts into a market order when the stock falls below $9. Since the shares never traded hands at $9, and headed down to $0.10, you’d end up selling at $0.10. And even if you had a sell limit order, which lets you define a specific price to sell at, the sell would never have executed. In other words, you’d still own the shares.

That’s where hedging and options come in. The other thing you could have done in this case is to buy a put option for the shares you owned. By paying a fee, or premium, you can force another investor to buy your shares at whatever price you set ahead of time.

So let’s say in this case you owned a put option on the stock for $9. Even after the shares plummeted to $0.10, you would still have the right to sell the shares to the buyer of the option for $9. You, in effect, bought insurance to cap your loss at 10%.

There are drawbacks with put options. First, they cost money. In addition to the premium you pay, you also have to pay a brokerage fee that’s usually higher than a usual market order for a stock.

And like any form of insurance, you’re out the premiums you pay if nothing bad happens. The other drawback is that they expire, so you have to keep buying new put options to replace the ones that expire.

But if you’re willing to put up with those drawbacks, put options can be a great way for investors to protect themselves.

Matt Krantz is a financial markets reporter at USA TODAY. He answers a different reader question every weekday in his Ask Matt column at money.usatoday.com. To submit a question, e-mail Matt at mkrantz@usatoday.com .