Industry Investment Banks

Post on: 3 Май, 2015 No Comment

Contents

For information about how the 2008 financial crisis has affected the investment banking industry, see the 2008 Financial Crisis page

Investment banks help public and private institutions raise capital. Although many investment banks manage money for institutions and wealthy individuals, they are very different from banks that most people are familiar with. Investment banks do not have retail locations where they accept deposits and create accounts for the average consumer.

Instead investment banks cater to companies and institutions, mainly by finding them sources of funding. Their services include arranging equity and debt offerings, providing credit facilities and selling securities to investors. They also advise institutions on a wide range of transactions, notably mergers and acquisitions. The clients of an investment bank benefit from the bank’s access to investors, expertise in valuing assets and experience in executing transactions.

Larger investment banks, such as Goldman Sachs. have their own sales and trading operation which allows them to generate additional revenue from market making and executing trades. Additionally, many investment banks provide asset management and brokerage services.

These services are generally complementary. For example: an acquisition is often financed by a debt or equity offering. Similarly, having a sales & trading operation not only allows the bank to buy and sell securities on behalf of its clients but also to trade in other securities an earn a commission for market making.

Industry Overview

Investment banks are commonly identified as bulge bracket firms such as Morgan Stanley. Merrill Lynch (MER) or Goldman Sachs. However, investment banks vary both in terms of services they offer and the way they are organized.

On the other side of the spectrum, institutions such as Citigroup and Bank of America. commonly identified by their retail operations, have in-house investment banking divisions which compete for business with pure-play firms like Goldman Sachs. Banks in this category are known as Money Center Banks — a term used by institutions that offer a wide range of financial services.

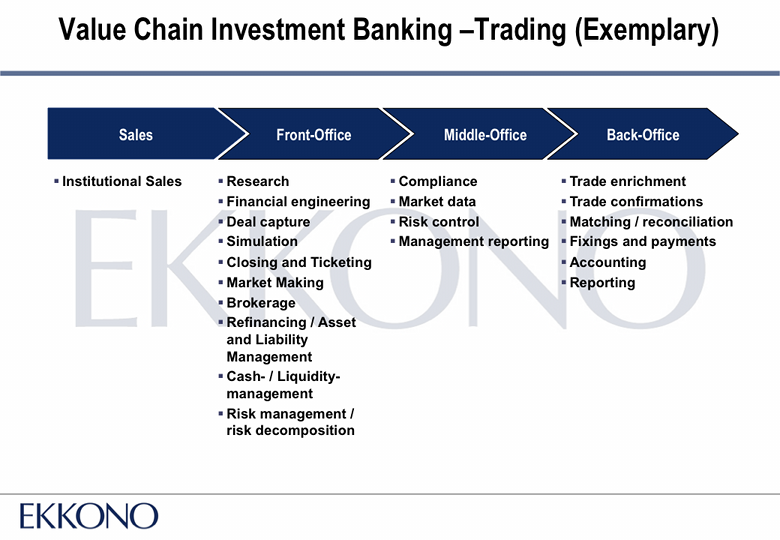

In terms of organization, most bulge bracket investment banks have very similar operating divisions, with minor variations in structure. For example: In some banks Prime Brokerage falls under the Sales & Trading division, in others it falls under asset management. Moreover, many deals are handled by more than one division. For example: In an underwriting deal the investment banking division advises the client and structures the offering, while the Sales & Trading division sells the securities in the stock market.

Investment Banking

The Investment banking division (IBD) helps its clients to raise funds through debt and equity offering. This includes raising funds through an Initial Public Offering (IPO). offering a credit facility with the bank, selling shares to sophisticated investors through private placements. or issuing and selling bonds on behalf of the client. The division functions as an intermediary and earns its revenue by charging a fee. Clients benefit from the bank’s access to investors, expertise in valuing assets and experience in executing these transactions.

Often the bank will buy shares directly from the company and try to sell it at a higher price to investors. This process is known as underwriting. and is riskier than simply advising clients — since the bank assumes the risk of the stock selling for a lower price than it had expected. Underwriting an offering requires the division to work with Sales & Trading to sell shares to the public markets.

The division also earns revenue by advising clients on mergers and acquisitions (M&A). which involves evaluating the target company, negotiation the terms of the agreement and arranging the financing for the deal.

The investment banking division is normally divided into industry coverage and product coverage groups. Industry coverage groups focus on a specific industry such as retail, oil, or technology. Product coverage groups focus on financial products, such as mergers and acquisitions, leveraged finance and equity.

Sales and Trading

Sales and Trading is the division that buys and sells assets and securities in a lot of markets. The division mainly operates in highly liquid markets, such as the New York Stock Exchange or the Chicago Mercantile Exchange. but also does over the counter sales.

Sales and Trading division deals with a wide range of asset classes, including commodities. bonds. stocks. futures and options.

Asset Management

The asset management division manages money for institutions, such as mutual funds, and wealthy individuals. The business is divided into three sub-divisions.

Fund management. This division manages a number of funds, each with a different focus and strategy. For example: the asset management division may have three funds, one focused on private equity investments in emerging markets. another dealing with arbitrage trades, and yet another that buys and holds corporate debt. Clients can choose to place their money with either of these funds. Some banks, such as Bank of New York Mellon. manageexchange-traded funds that are accessible to retail investors. The bank earns revenue by charging a fee for assets under management, and sometimes by charging a commission based on returns.

Private Banking and Wealth Management. The division manages banking activities of extremely wealthy individuals. Apart from providing regular banking services, such as check clearing, the division also advise such individuals on tax strategy and investments. They work closely with other parts of the asset management division to provide a comprehensive service, e.g. work with fund management to invest in different strategies.

Prime Brokerage. The division deals with professional asset managers, such as mutual funds and hedge funds. Their services include executing trades on behalf of these clients, holding custody of their assets, and advising them on potential opportunities. For example: When Berkshire Hathaway (BRK) needs to buy a certain security from public markets, it uses a prime broker to buy and hold the security on its behalf. The division works closely with the Sales and Trading division. Additionally, the prime brokerage can also help its clients (hedge funds) to find investors.

Principal Investing and Proprietary Trading

Investment banks have attempted to increase their return on equity by investing their own capital into certain ventures. The bank invests its own capital by taking a equity or debt stake in corporations with the aim of influencing the management. The motive is very similar to that private equity investors — the bank tries to profit by turning around companies.

The bank can also take short-term positions in the market with its own capital. This is known as proprietary trading, and the bank attempts to earn a profit by correctly predicting market movements. Proprietary trading is very different from normal sales and trading operations — where the banks revenue is primarily dependent on the volume of trade it executes on behalf of its client.

The notion of the bank risking its own capital can be traced back ever since banking was invented. J.P. Morgan, founder of J P Morgan Chase. was an extremely successful investor. However, in recent years, Goldman Sachs has been the leader in this field — in 2007, the bank profited greatly from the proprietary trades that it made against the sub-prime market.

In many cases, the banks allow other investors to invest in such ventures (and charge a management fee). This puts them in direct competitor with hedge funds and private equity firms for both investors and investing opportunities.

Research

Factors that affect bank’s profitability

Reputation and client relation

Investment banks act as a bridge between those who need capital and those who can provide it. In this regard they act as a certification company. Investors who purchase securities buy it under the assumption that that these securities are fairly valued. Similarly, the company that issues these securities depend on the bank to provide them a fair price for these securities.

While the bank can use sell securities for an unfair price and make quick short-term gains, it is unlikely they can sustain such practices in the long run. Moreover, given that their service includes providing advice to institutions, their business depends on the quality of these advices. In other words, banks with a reputation for providing good advice are likely to retain their clients and get more clients in future. Major investment banks, such as Morgan Stanley and Lazard. have built their reputation over decades, making it extremely difficult for new players to gain advantage in the industry.

Certain banks choose to focus on a particular market and build its reputation in that segment. For example, while KBW Inc. is known for its expertise in advising companies in the financial sector. According to research by the Wharton School, there is a correlation between advisory fees and reputation of the bank. [1] Indicating that, everything else being equal, investment banks with a better reputation earn higher revenue from fees.

On the other hand, highly ranked employees of a bank have their own reputation and industry connections — in some instances, overshadowing the reputation of the bank. For example, in Mergers & Acquisitions, names such as Joseph Perella and Bruce Wasserstein stand independent of their firm’s reputation. As a result, there is fierce competition between banks to hire and retain top bankers.

Credit Ratings

The bank earns additional income by borrowing money at low rate and lending or investing it at a higher rate. For example: