Indicators Point To Bullish Market!

Post on: 18 Июль, 2015 No Comment

Market holds onto last weeks gain. Producers

price index coming out, expect volatility.

Bullish market anyone? Perhaps set ROI to

50% instead of 100% Get the latest at

This is A.J. on Monday, September 12th with your

Trading Trainer web log. We are your home of

market insights for the serious option trader.

This web log will cover the events in the market

from today as well as prepare you for watching the

market tomorrow.

The most impressive thing that happened today is

that the market held on to last weeks gain. There

was a high probability of a reversal today. That

did not happen. What did happen is that with all

the big acquisition news coming from tech stocks -

like Oracle acquiring Siebel and EBay acquiring

Skype — and oil again deflating as news of demand

for oil softening is rumbling around, techs shot

up and energy stocks moved down. The NASDAQ and

the small-cap S&P 600 gained. The S&P500 and the

DOW stayed flat. Volume increased on the NASDAQ

exchange. Volume decreased on the NYSE. Also,

today was a no news day. That could contribute to

the explanation on why the blue chip contingent of

the broad market was flat. Tomorrow we get the

producers price index which is bound to either

aggravate or relieve investors fears of inflation.

No matter which way, tomorrow will be a more

volatile day than today.

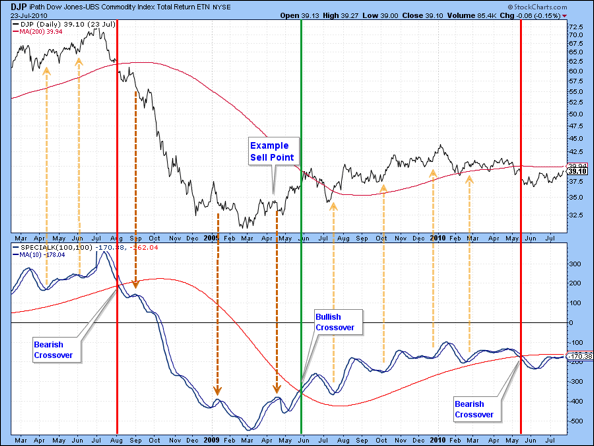

Coming from a technical perspective, lets count

up all the bullish signs the broad market has

given us in the last two weeks. We have all three

indexes trading above their averages. We had

Chaikin Oscillator crossing above its zero with

respect to all three indexes. We had MACD

crossings above its MACD averages with respect to

all three indexes. Today we had moving average

crossings with respect to all three indexes. And

all three indexes followed through on the counting

method to determine a market bottom. So what are

we waiting for? Why arent we calling this a full

on bullish trading bias? The answer is because we

need a strong trend to build. Were trend

followers after all. Two weeks is not enough to

call a trend. So till then, our bias will remain

neutral-bullish — which means tend long but

realize the broad markets arent there to bolster

the underlying stocks. Rather, the stocks are

much more on their own. With that said a

neutral/bullish trading bias usually means setting

your profit expectation to something lower that

when the market is rallying. Perhaps 50% return

on invested capital versus 100% return on invested

capital. Think about it.

My EOG resources October 60 calls closed lower at

$10.50 an option. My current return on my

invested capital is 69%. Ive been in that trade

for 52 days. My Pacificare Health Systems November

75 calls closed lower at $4.60 an option. My

current return on my invested capital is 59% after

being in the trade for 52 days. My Quicksilver

September 40 Puts closed higher at $0.40 an

option. Im in the red with a return on my

invested capital of -75% after being in the trade

for 26 days. I only have till this Friday to do

anything with those. My Tenaris October 105 Calls

closed lower at $11.20 an option. Im in the

black with a return on my invested capital of 42%

after 17 days in the trade. My Alcon November 120

Calls were stopped out today. I sold them early

There is no telling how the market will react to

Click on the below play button to hear

the blog as an audio from A.J. himself!

A.J. Brown is a full time options trader, author,

speaker and consultant. Watch him review stock