Indicator Forex Download Leading and lagging indicators

Post on: 17 Апрель, 2015 No Comment

Leading and lagging indicators

How to Use Leading and lagging indicators in currency trading?

Technical analysis uses charts and indicators to predict the future direction of the market. As a trader, you must master how to read the different charts and how to use various technical Leading and lagging indicators. Technical Leading and lagging indicators are basically of two types: 1) Leading and 2) lags. Understading how to use both leading and lagging indicators can give you the edge as a trader. Some of these indicators are very useful and is considered an important weapon in the hands of skillful and savvy trader.

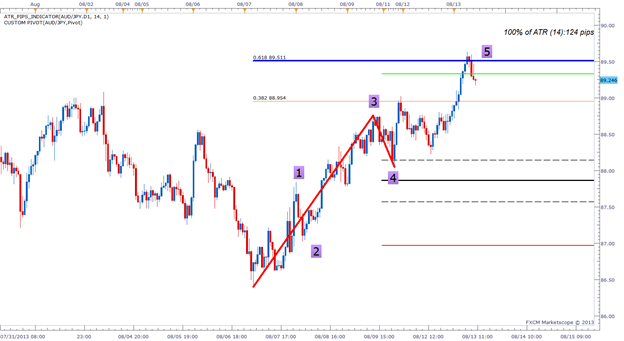

What are leading indicators? As the name suggests, a leading indicator of price action leads the market and gives buy or sell signals ahead of the trend or shift in before the start of a new trend in the market. Leading indicators are considered very important because they give a signal before trading time. One of the most popular leading indicator is the pivot points. There is an entire method of trading called pivot point trading that has been developed over time. Pivot points combined with Fibonacci retracement can be very effective. Pivot points can be calculated for each market. The other popular leading indicators are oscillators as Relative Strength Index (RSI) and Stochastics. However, the problem with most of these leading indicators is that they often give false buy or sell signals. They need confirmation from other indicators.

On the other hand, as the name suggests lagging indicators lag price action. Trailing indicators are often later. Sometime late in the provision of buying or selling signals. Since these indicators are lagging, they tell you about a reversal in trend or starting a new trend that could then be too late for you. Most popular lagging indicators are moving averages. Moving averages are three types: 1) simple, 2) Exponential and 3) number. Another very important lagging indicator is MACD (Moving average convergence divergence). The moving average and MACD widley are used by stock traders, forex traders, futures traders and options traders!

Stochastics is one of the most popular leading indicators used in different markets as stocks, forex, futures, commodities, almost all the options markets. Stochastics are based on complex statistical formula that you should not go. You just need to know that what gives the overbought or oversold market conditions. It is scaled from 0 to 100. When you reach 80, the market is considered overbough and when it touched 20 on the bottom level, the market is thought to be oversold.

Others on the MACD (pronounced Mac ESD) is a lagging indicator that uses three exponential moving averages 12.26 and 9. 12 represent a faster exponential moving average using prices in the last 12 periods. 26 is a slower exponential moving averages. 9 represents the difference between these two things.

So what indicators to use? Professional traders combine leading indicator with lagging indicator to make buy or sell decision. The best combination is a combination of the MACD Stochastics 1 Hourly charts to identify the trend of the day. You must master these waters and lagging indicators if you want to be a successful trader.