Indian Dividends

Post on: 16 Март, 2015 No Comment

In India, most of the people seek stock market as an extra source of generating income. There are many professionals who work in multinationals and do investing in stock market just to earn some cash to secure their future. If you invest in stock market you have two options either to invest in such stocks that can provide you good long term capital growth or you can invest in dividend paying stocks. Many people think later is the better option i.e. investing in such stocks that pays them healthy dividends at the end of each quarter. It helps them to build a regular cash flow also.

Most of the companies distributes dividends to shareholders at the end of each quarter so if you a good bunch of 15 to 18 high dividends paying stocks, you can earn few thousands every quarter and this is pretty joyful moment for most of us. Isn’t it?

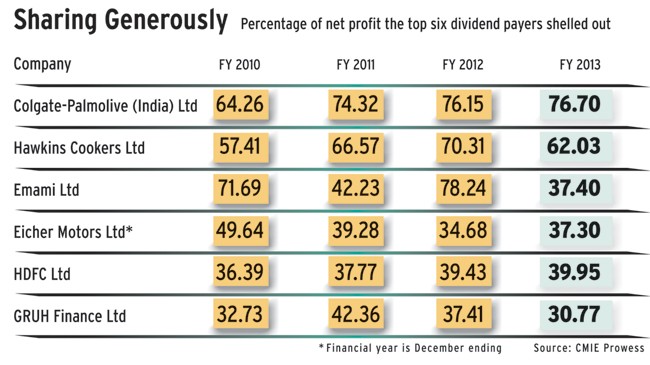

While investing in dividend paying stocks in Indian stock market the most important and difficult task comes while choosing stocks. People usually rush towards such stocks which give them high dividend yield while it’s not the right method as it requires a lot to investigate further besides dividend yield. You can check things like dividend history, dividend growth rate per year, dividend payout you gets, earnings per share, Price to earnings ratio.

If you see a stocks giving high dividend yield, it does not mean always that it’s a wise choice as it might be because of decreasing stock price continuously. Always ensure that dividend stocks you are going to buy offers you great stability and reliability, high growth for future perspective, and it had been paying dividends to its shareholders since quite a long at least for 10 years.

Remember, there are very few companies which are slightly priced higher and it makes no sense if you buy them at higher price just to get some dividends as your overall profit will be null(more price you will be spending to purchase stock will be nullify by the dividend money you will get). So always try to find such dividend paying stocks which are running undervalued. Undervalued stocks are those stocks which run slightly below the intrinsic market price.

Further, if you want to choose stocks that give healthy dividends with high stability and which are best to buy also, you should use dividend screener tool. A common example of this tool can be found here @in.dividendInvestor.com/screener.php .

Similarly if you want to track which of stocks are being ex-dividend so that you can purchase and make money with them also by claiming your dividends, you should have used dividend tracker tool here @ in.dividendInvestor.com/tracker.php .